Arbitrage

Arbitration is one of the oldest trading strategies. Its popularity, both among traders and investors, is the existence of a small risk. The task is to purchase and simultaneously sell the same or sufficiently similar types of assets.

Two traders kept a constant telephone connection between exchanges in Chicago and New York. When on one of the stock exchanges (for whatever reason) the price rose sharply, for example, sugar, and on the second exchange yet, where sugar was more expensive than it was sold, and bought at the second exchange. After a few seconds / minutes, when information about price changes came to all market participants, prices again equalized. And the traders just fixed profits.

As a result, people occupied robots. Today they are happy to arbitrate price deviations of 0.01% and even 0.001%, while people earned up to 10% on one transaction. Traders of classic stock and commodity markets remain nostalgic about times that will never return.

Reason why arbitration does not work:

- Absence of liquidity on the exchanges

- Problems with the introduction / withdrawal of large amounts on exchanges

- Not understanding of how to technically conduct arbitration, And

- Insufficient infrastructure.

Absence of liquidity on the exchanges:

Impossibility to quickly buy an asset on one of the crypto-instruments, and on the other to sell it with a large volume. Because of this, there are practically no large buyer or seller on the market, let alone funds that move prices in the stock market.

Problems with the introduction / withdrawal of large amounts on exchanges:

The introduction of large amounts on exchanges becomes a problem for the client, the bank and the stock exchange itself. And often drags on for weeks and months. And when it comes to withdrawing money, things get even harder and longer.

For Example: As a result, large players not only can not find liquidity, They also can not quickly dispose of their money, introducing and withdrawing them to various exchanges for arbitrage transactions.

There is no understanding of how to technically conduct arbitration:

As a result of problems with clauses 1 and 2, there are practically no institutional investors on the market. But in large numbers there is an audience, with insufficient financial education.

Insufficient infrastructure:

Most terminals of crypto-exchange exchanges are in the Stone Age, in comparison with technical progress.

For example, the charts of each trading pair can be loaded for a few seconds. And when you click on the "buy" or "sell" button, the transaction may hang for another few seconds. Constantly changing prices on several stock exchanges, they make you instantly make calculations "by eye," often making mistakes.

Various ways Arbitrage Crypto Trader solves these problems

The terminal is imprisoned for work with any size of trade deposit. They can be used by both small traders and large institutional hedge funds. By the way, in the strategies of the majority of the latter, hedging of risks, that is, arbitration, is prescribed.

Due to the low liquidity of the crypto-currency markets, small and medium players can earn money using the platform, the smaller the size of orders, the more benchmark results Arbitrage Crypto Trader.

For small deposits such operations take place within a few hours and even minutes.

Arbitrage Crypto Trader does not require any deep technical or even financial knowledge from the client.

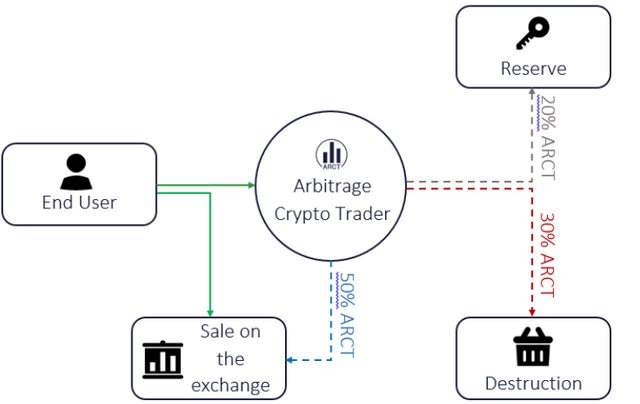

He monitors the markets in 24/7 mode, looks for suitable formations for entering the transaction and waits for the trader to only one-pressing the "enter the deal" button. At the same time, on one exchange, a coin is purchased, for another it is sold.

For premium accounts, which will be used by professional traders, Arbitrage Crypto Trader creates a huge amount of space in the use of various types of orders and strategies.

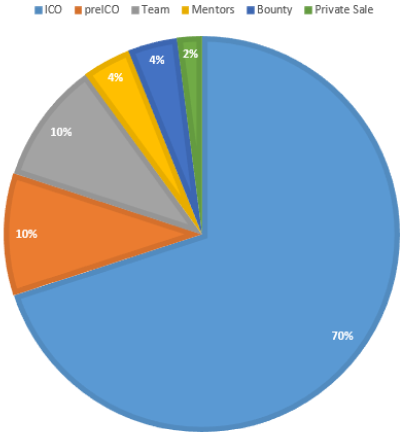

Token Distribution:

Advantage of Arbitrage

- Arbitrage deals is the extremely small amount of risk assumed.

- on one of the exchanges, the rules for input / output of money will change and the standard discrepancy will increase from 1.5% to 3.0%.

Arbitrage Crypto Trader eliminates the huge market inefficiencies historically present in crypto-exchanges.

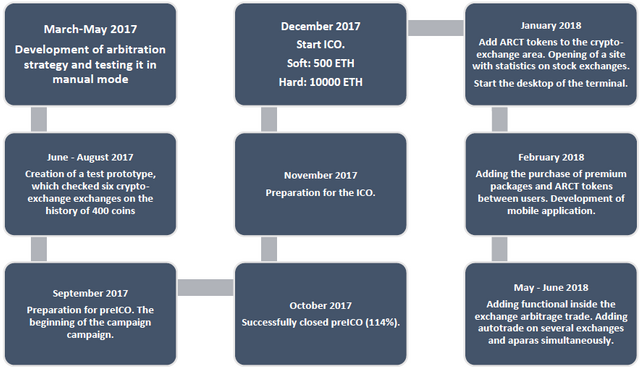

Roadmap

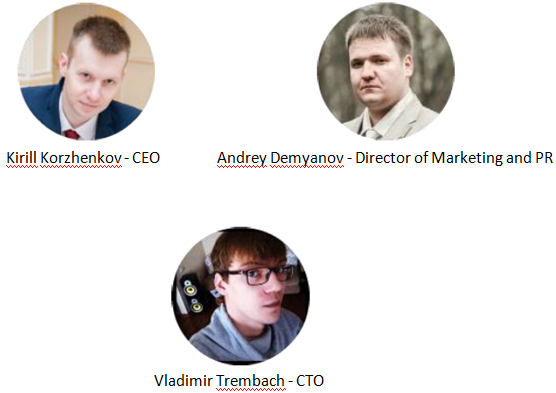

Team

More Information Connect to Arbitrage

Official Website: https://arbitragect.com/

Official FacebookPage: https://www.facebook.com/groups/arbitragect/

Official Twitter: https://twitter.com/arbitrage_ct

Authorized By:

Bitcointalk Username: bright4mech

Bitcointalk Profile link: https://bitcointalk.org/index.php?action=profile;u=1298523

ETH wallet address: 0x6707A43E7c34E560828f2785Eb01A4b1327877C0