OneLedger ICO Overview

OneLedger is not a blockchain itself, let’s get that out of the way first. Probably a good thing because of how many new blockchain projects have sprung up since the beginning of the year. I’m struggling to see how the majority of blockchains will ever gain traction and use in the real world, it’s similar to how many different coding frameworks or linux distros you’ve never heard of exist today.

Now that we have a growing number of blockchain networks, each serves their own purpose and provides unique business use cases between them. However for a business, having to integrate your legacy data and systems or build on one blockchain network is enough of a risk and pain, let alone multiple. So we need a way to communicate among them, enter the OneLedger protocol.

OneLedger intends to provide the much needed bridge between the various blockchain networks and real world businesses. Its protocol for one allows businesses to develop dApps for multiple blockchain networks using only the OneLedger API gateway, similar to Xamarin for mobile apps. Overall this simplifies and minimises the risks associated with developing on public blockchain networks, reducing development time and therefore costs. These benefits extend to the ongoing maintenance side of software as well. Developers can now write a universal dApp that can sit on top of and communicate across multiple chains all in one language. The OneLedger protocol then handles everything else.

This allows for significant modularisation of business processes greatly reducing the risk a business needs to take on to move a specific section of their business to the blockchain while also increasing the ability to maintain and update these modules. If you’ve tried developing dApps at current you know OneLedger is something that’s dearly needed, much the same case if you’re an established business who wants to experiment with blockchain but needs to minimise risk at the same time.

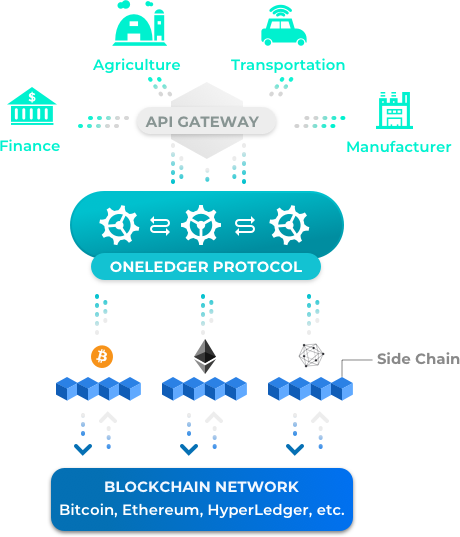

OneLedger protocol view

The above diagram shows how the OneLedger protocol works at a high level. At the top businesses communicate and develop dApps using the supplied API gateway which uses the OneLedger protocol to ensure a universal data exchange with various sidechains each of which are synced to their corresponding main network.

OneLedger aims to build a suite of modularisation tools accessed by their API allowing businesses to leverage blockchain networks with minimal risk and development. Their powerful SDK will enable businesses to quickly develop cross platform dApps with one language. Businesses are able to provide both permissioned and permissionless services which is something the competition (Hyperledger, Quant, Aion) are still either neglecting or yet to integrate. OverLedger will make use of sidechains that are synced to their blockchain network through hashed lock time contracts, the same tech powering the lightning network and atomic swaps. This allows any blockchain that supports this feature to be accessed with the OneLedger procotol. If a network doesn’t support HLTC well then I’m not sure it’s worth your time anyway.

The use of sidechains in OneLedger keeps public bloat out of the way of your business processes and will have no affect on transaction latency or reliability, a common problem with interfacing directly to public networks.

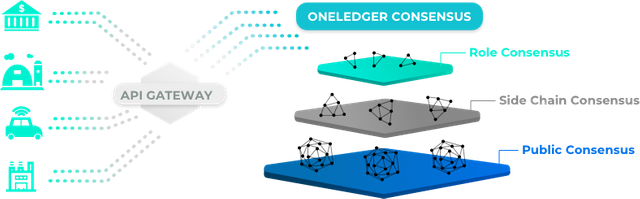

OneLedger consensus structure

In order to maintain consensus between multiple chains simultaneously OneLedger proposes a three tier consensus structure. The first layer will act as the core layer for the business processes and logic implemented in a configurable role based manner. The second and third layers are the sidechain and public chain consensus platforms respectively. The sidechain layer will act as the bridge between the first role based layer of OneLedger and the public network ensuring everything is kept in sync at all times with high throughput, security and low latency.

By simplifying the process of dApp development and blockchain integration while minimising risk and costs OneLedger aims to be the point of contact for businesses when it comes to integrating blockchain into their workflows. The flexible SDK, modular structure and role control allows businesses to move sections of their business to the blockchain as they see fit and without having to modify how the business process operates itself in order to fit to the strict rules of a blockchain network such as Ethereum for example. Add to this the ability for businesses to use their existing IT resources to build rather than having to rely entirely on outsourced talent from the likes of blockchain engineers and Solidity developers.

A strong team is very important when evaluating an ICO, OneLedger seems to have a more than capable team to achieve the projects goal. The OneLedger team comprises people with experience from large credible companies including IBM, Mircosoft, Autodesk and Amazon to name a few. The team also have decent blockchain experience with the CTA founding a blockchain based credit rating system and David Cao the CEO being the chairman of the Canada China Blockchain Professional Association.

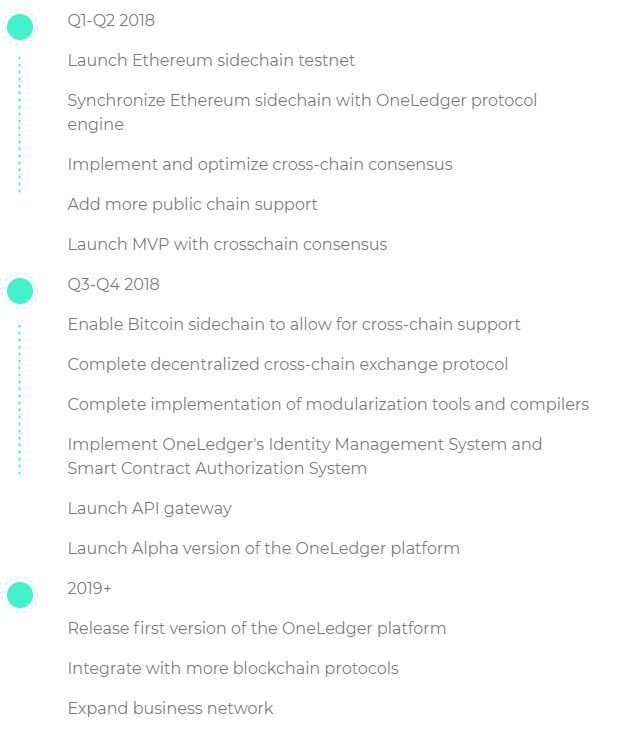

OneLedger roadmap

The roadmap shows that by the end of Q2 2018 ie. June, OneLedger will have launched an Ethereum sidechain testnet, synchronised this with the OneLedger protocol, implemented cross chain consensus and launched an MVP. Quite a tall order considering the ICO itself is scheduled for end of May/ June, although I do believe development is being carried on in the background in the meantime. By the end of 2018 OneLedger aims to launch their API gateway and also the alpha version of the platform. A lot of work is ahead but the timeframe and deliverables seems reasonable.

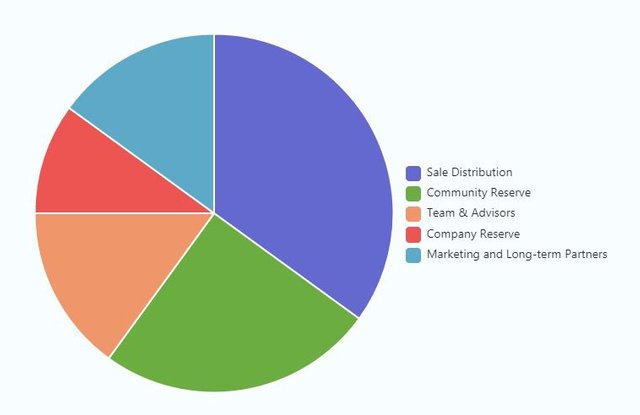

Token distribution: 35% sale, 25% community reserve, 15% team & advisors, 10% company reserve, 15% marketing & long term partners.

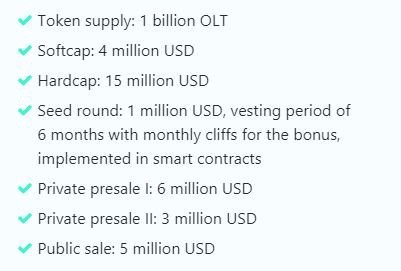

Token metrics are really the deciding factor of whether or not to invest in a project for an ROI. Investment purely on technology basis is another story. OneLedger has favourable token metrics with a very reasonable $15m USD hardcap with the public sale reserving $5m of this, I do hope this small public cap does not mean a max of less than 1eth per whitelist user. The max supply is 1 billion OLT tokens where 35% are available for public sale. The rest of the tokens hold various locked timeframes for a minimum of 6 months all enforced with smart contracts.

Token metrics

The above metrics put OneLedger at a very low initial marketcap of ~$18,200,000, going by the 35% (350,000,000) tokens available for sale with a crowdsale price of $0.052 (Taken from: https://medium.com/@OneLedger/oneledger-token-metrics-update-e3b77ef3b0b0)

If we add the community reserve tokens on for an overestimate of marketcap we still have a very low cap by competitors standards of ~$31,200,000. Token metrics are quite good for a project with this much impact, have to hand it to the team as well for listening to the community and lowering the token price and upping the supply proportionally. Although the market cap remains the same it shows how the team is willing to listen to the community and make changes accordingly, shows the ability to adapt and listen to your market. A vital skill some businesses and projects forget which inevitably leads to their downfall sooner or later.

Overall OneLedger is a promising project and while they do have competition, the market is still hungry for this type of service and is still lacking a polished product businesses can and want to use. This is where OneLedger has the potential to jump in.

Go here https://steemit.com/@a-a-a to get your post resteemed to over 72,000 followers.