eCoinomic.net – another dimension of loans- description

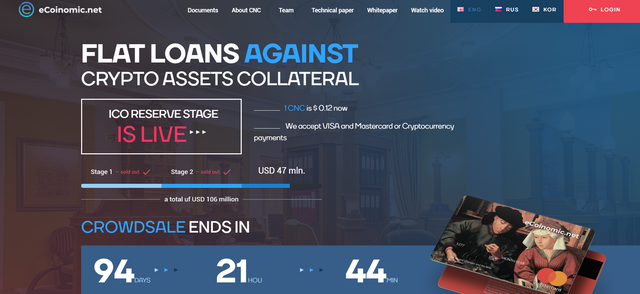

There are certain times in life when we may all need a little help financially, for example being on the low income or encountering a financial setback. Imagine, that you don’t need to worry how to make ends meet. You could take an instant loan with your crypto assets as a collateral and enjoy your life. Let me introduce you the project which opens this doors: eCoinomic.net

For today, the global lending market is estimated at 6 billion dollars. This number shows the approximate worldwide volume of monthly loan requirement and shows how great potential this market has. If we compare it with the total volume of the cryptocurrency market, which is estimated at 300 billion dollars, the difference is really significant. Although, according to the experts opinions 1 trillion of dollars crypto market cap supposed to be hit in 2022.

eCoinomic, the project I am introducing to you know combines both of the described categories (global short-term lending and cryptocurrency market).

Being precisely eCoinomic is a peer-to-peer lending platform created for the cryptocurrency holders. Loans are taken in fiat and collateral assets stays in tokens. Lending part is provided by financial institutions (investment banks, family offices, funds). Borrowing, anyone who poses crypto asset.

The platform itself has been designed to the three categories of borrowers:

- Those who need money but don’t want to lose their crypto investments

- Those who want to get a leverage for dealing for a raise

- Those who want to insure the risk of a fall in the price of the cryptocurrency

Basic offer for the user from eCoinomic looks so:

The user can take a loan up to 10 000 USD with the return term of one month. eCoinomic takes 100 USD of commission, which in case of 10k is just 1%. Much less, than any other available service.

Each platform user can create the own set of services, picking up some positions from the list below:

• Secured and unsecured loans based on fiat money and cryptocurrencies

• Long-term and short-term investments in fiat money and cryptocurrencies

• Hedging the exchange rate risks for crypto assets

• Financial transactions, exchange, collateral management

• Payment for goods and services in digital currency on the online trading platforms

• Fiat money transactions, virtual cards issuance backed by crypto assets

If you would like to learn more about eCoinomic check the links below:

Website: https://www.ecoinomic.net/

Whitepaper: https://ecoinomic.net/docs/whitepaper

Presentation: https://ecoinomic.net/docs/presentation

Social media:

Facebook: https://www.facebook.com/ecoinomic/

Twitter: https://twitter.com/Ecoinomicnet

Telegram: https://t.me/ecoinomicchannel

Disclaimer: this is NOT investment advice. This is purely my opinion, based on facts found on the project website, whitepaper, social media and etc. Please do your own research and decide if it qualifies with your risk profile.

Anna Hare

https://bitcointalk.org/index.php?action=profile;u=1754481

Project sounds interesting, but its not very unique unfortunately. Nevertheless, cross my fingers.