Ichimoku Japan: Chapter 1.1: History Ichimoku

Ichimoku Kinko Hyo is a technical analysis devised in the early Showa era (1930s) by Ichimoku Sanjin (Goichi Hosoda). He was a director of the commercial affairs department of the Miyako Newspaper, currently Tokyo Newspaper who was a talented stock analyst as well as a newspaper reporter. Back then the Miyako Newspaper was very much focused on market analysis than the current Nikkei Newspaper and his column was the most trusted by investors. However, he was not just a market analyst. Started his own analysis and trade since the age of 12, he was a real trader and has been pursuing market analysis for his entire life.

Ichimoku Sanjin set up a private research institute and devoted himself to study and research at the heart of the market. Later his first column was published from Miyako Newspaper in 1935 with the name of “Shinto Tenkan Sen”, but the drawings and calculations were kept secret.

Soon, traders started to ask him to reveal the art of Ichimoku Kinko Hyo and the techniques for correct analysis. In 1950, he taught his technique only to three people with 10-year confidentiality agreement. One of them was a president of a major securities company in Japan (The rest of two are unknown).

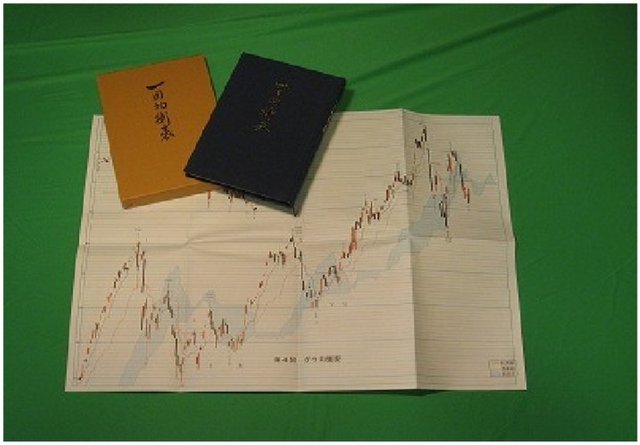

Nearly 20 years later in 1969, seven volumes of the Ichimoku Kinko Hyo were officially published one after another and the knowledge gradually started to be in public, causing a major Ichimoku boom. After being tested for decades, finally it came to the world.

Out of total seven volumes, only four volumes, Ichimoku Kinko Hyo, Ichimoku Kinko Hyo Complete, Ichimoku Kinko Hyo Weekly, and My best Keifu, are currently purchasable in public. The remaining three volumes are placed at National Diet Library in Tokyo which are also accessible but not purchasable.

Ichimoku Kinko Hyo was originally invented in 1935, and at that time, there are still little decent technical analysis in the world. For example, Stochastics was out in the 1950s, and Granville compiled moving average technique in 1960, and the rest technical tools are mainly 70s and 80s. So, Japan’s advanced in the development of such wonderful technical indicators were quite profound. For example, the candlesticks were developed in the Edo period (mid 1700s). And now, these indicators are used and favored among traders all over the world. Ichimoku Kinko Hyo is a technical analysis that has been validated in a long history and has proven its effectiveness in any market.

However, even in Japan, there are not so many books or websites with correct understanding because of wrong interpretations. For example,

“when price breaks out of the Kumo, it’s a signal for the beginning of a trend and therefore, it’s the best buying signal.” Or,”look for a gold cross or dead cross of Kijun sen and Tenkan sen and take trades.” “When Chiko span breaks out the candles, take trades towards the breakout direction,” and on and on.

You would often see those comments made by individual traders, even in some famous broker’s websites. However, I have to say that it’s the very “immature” way of understanding Ichimoku Kinko Hyo because it’s not always the case.

By looking at all the drawings, at first it may seem difficult to understand. However, I think it’s rare to find a technical indicator as simple as Ichimoku Kinko Hyo. When you see the five lines, Kumo, Kijun sen, and other lines moving and interacting, you might think they are profound. Actually Ichimoku Kinko Hyo is profound and deep, but not difficult to understand. Just think of it as a combination of simple things.

After you read this book, you’ll notice that it’s so easy at first glance.

The direct translation of Ichimoku Kinko Hyo would be “a diagram that shows the equilibrium at a glance.” Equilibrium is a state where the power relationship between the selling and buying powers is equally balanced. The price goes up when the buying power is stronger and goes down if the selling power is stronger but the basic idea is that the market moves towards the imbalanced direction. So if you know where the equilibrium point is, you can immediately determine whether the buying power is stronger or weaker, selling power is stronger or weaker in a current market situation. Many people do not understand the concept of “understanding the equilibrium at a glance”. Can you see where the equilibrium point is from the Ichimoku Kinko Hyo?

Ichimoku Kinko Hyo is just one of the many technical indicators in the world, and yet, one of the rare indicators that draws few lines ahead. In fact, the Senko spans 1 and 2 are drawn ahead from present candle stick. What is this for? A certain calculations are done and the values are drawn and shifted 26 days (candles) ahead. However, even if traders look at Ichimoku Kinko Hyo at a glance every day, only few traders understand and interpret its meaning correctly as to why it’s shifted 26 days ahead. Most traders just focus on whether the price goes through or bounces off the Kumo but never think of the true meaning of the shift.

In the original books Kumo is called the “resistance zone” and Goichi Hosoda never calls it as Kumo. So first of all, there seems to be some deviation to the meaning of “Kumo” among traders and the misalignment is growing in various places, misleading the nature of the Ichimoku Kinko Hyo. So in this Ichimoku Basic Master book, I will thoroughly explain the true meaning, probably the most detailed explanation about Ichimoku Kinko on the earth. And I hope after reading this book traders will get more interest in Ichimoku Kinko Hyo and eventually get to read the original Ichimoku books.