Infinite Banking 101: Debtor, Saver, or Wealth Creator

Infinite Banking 101

Understanding how the Infinite Banking Concept (IBC) works should be simple and easy. The three pictures below aim to show you just how easy it is understand how IBC works. At the end of the day, we determine which of thethree type of people we are:

- Debtors

- Savers

- Wealth Creators

Unless you know and practice Infinite Banking, you are either a Debtor or Saver.

According to Nerdwallet, "the average household that’s carrying credit card debt has a balance of $15,983." (Source: https://www.nerdwallet.com/blog/average-credit-card-debt-household/)

The typical Americans finance their lifestyle by taking loans, paying them off, then repeating the process. In this manner, cash flow is constantly leaving the household never to return. It's a monumental transfer of wealth to banks.

Savers do the opposite of Debtors by capitalizing their bank accounts so they can avoid paying interest to the banks.

Unfortunately, what Savers do not realize is that a transfer of wealth is happening with this approach. Notice in the picture above money is saved, then spent, and the process is repeated for life.

The average American will earn $2 million or more during their working years yet have only around $50,000 on average saved for retirement.

This is the reason why even Savers can never get ahead. Although they are avoiding paying interest, they are also eliminating the opportunity to earn interest by spending money deposited in a traditional bank. This is called Opportunity Cost and there is only one way to avoid it.

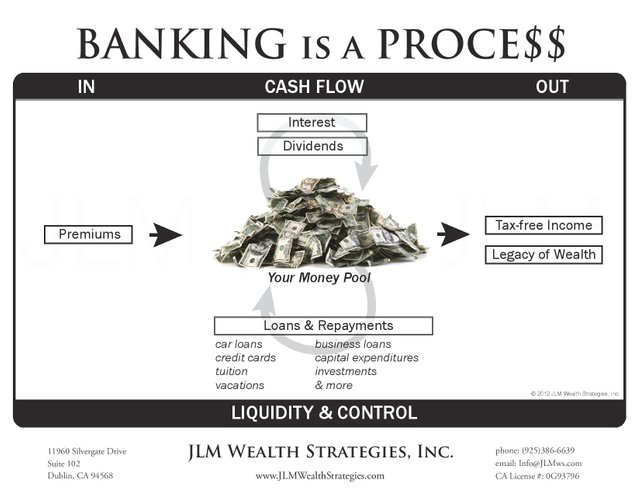

Wealth Creators utilize the Infinite Banking strategy to create a private banking system where they can access money while never interrupting the growth of their money. See above how Opportunity Cost is eliminated. Money is always growing even while you use it some place else.

IBC'ers are able to finance cars, invest in other assets like real estate, pay for college, grow their business, etc. on a tax-free basis all while accumulating a nest egg for retirement that has no stock market risk.

Infinite Banking the only savings plan where there is no downside for using your own money!

At the most basic level, these 3 pictures above along with the picture below capture the essence of Infinite Banking.

Take back control of the banking process and grow your wealth safely and without opportunity cost by implementing Infinite Banking.

To become a Wealth Creator and learn more about the Infinite Banking Concept, watch the videos here: http://www.CashValueBanking.com. You can also ask questions or request a time to connect with me by visiting my calendar at: http://www.vcita.com/v/john.montoya

Even though I had never heard of the IBC that you mention, I still consider myself to be a wealth creator, and not just one or the other.

Creating multiple streams of income is a simple way to ensure your future is in your own hands and not in the hands of the banking system.

Opening up an individual, non-taxable Roth IRA for example is a great way to ensure you will have more than '50,000 dollars' after making 2 million working a lifetime in lieu of the transfer of wealth.

invest now, for a better future, that's what I am gonna continue to do through my 20's 30's and 40's that way when im 50 i will be kicked back at my house in Jamaica, Jamaica smoking a fat joint with my Rastafari friends Mitchiganz and Blackz hahaha

Steem on my friend :)

Multiple streams of income is the way to go! I agree about opening a Roth IRA. It's one of 3 ways to create tax-free income that I blogged about in a previous post: https://steemit.com/ibc/@johnmontoya/3-ways-to-have-tax-free-income-in-retirement.

The challenge with the Roth IRA are the rules and restrictions Congress sets regarding how much can be funded which is not enough in my opinion. From a liquidity standpoint, only contributions into a Roth are accessible before age 59.5 without taxes and penalies.

IBC is a private, non-qualified account. This allows the freedom to do what I want with the money when I want. And it's tax-free regardless of how old I am. No need to wait unti 59.5 to create the lifestyle I want right now. :)

l'll have to check that post of yours out -- seems as though there is quite a bit of useful info. to gather from your page, so I will be following closely along the way.

Definitely going to be looking into IBC since it is even less stringent or 'strict' it seems than a Roth. Thanks so much for the valuable info. I will be using this to the best of my advantage.

Steem on & stay cashin' in!!

You're very welcome. If you find value in my posts, please consider resteeming and sharing on other social media. I appreciate the dialogue!

yes, for sure. you shall see me around... I will definitely consider sharing on other social media sites where I am activily engaging with the community.

Keep up the solid work, your ethic is there , so I will be rewarding you on your journey just as you have shown me.... steem on and stay cashing in, of course :)

Respect from

@conradsuperb