HOMELEND: DECENTRALIZING THE MORTGAGE LENDING INSTITUTION

Mortgage lending industry is an invaluable institution as individuals have gained immensely from it. As shelter is essential to man, the mortgage industry assists individuals with loans to secure comfortable houses and apartments. With mortgage loans, the acquisition of properties such as houses and firms has been made possible. Borrowers pay back the loan with a fair interest within a speculated period of time. Most mortgage lending institutions deduced their interest from income tax making it easy for the borrowers to pay since paying tax is an obligation. The institution is made up of a value chain with three separate stages that are indispensable for the smooth running of the industry. They are; origination (requesting and closing of loans), servicing (obligation governing the loan) and securitization (issuing a financial instrument). Knowing that the mortgage value chain has not been decentralized poses huge challenges. These challenges range from origination problems to securitization difficulties.

What then are these challenges and problems facing the mortgage lending institution?

The challenges and problems that have plagued the lending institution include slow nature of loan procurement, time consumption rate, multiparty system, poor management and the introduction of mortgage-backed securities. Procuring mortgage loans has been a very slow process and time-consuming. This is attributed to the traditional mortgage financial system based on paper documentation. While most of the financial institutions have become digitalized, the mortgage lending institution is still backward with the paper-based system. This makes the intending borrowers pass through a lot of stress to procure mortgage loan.

The involvement of multiparty system has completed the system. The institution introduced a lot of parties varying from the lender, borrower, rating agency, appraiser, and broker. This creates many middlemen, eventually making the borrowers pass a lot of bottlenecks before mortgage loans can be procured. As a result of the involvement of a large number of parties, appropriate documentation of the borrower becomes a lengthy process and they tend to lose trust in the institution.

Also, the introduction of a financial instrument, mortgage-backed securities introduced complexity while trying to expand the lending institution. Mortgage-backed securities (MBS) served as a third party to grant subprime loans. However, lack of proper documentation in the mortgage-backed security led to the institution's financial crisis. The lack of a digitalized and decentralized system has created difficulties in the securitization of mortgage loans. It was a high-risk venture as there was no decentralized blockchain. Some of the mortgage lending institutions have to fold up due to the crises resulting from lack of digitalization of the system. Hence, there is a need to digitalize the mortgage lending institution.

#Homelend, digitalizing Mortgage Lending Institution through the decentralized blockchain

In view of creating a conducive environment for the borrowers and reduce risks, homeland has been developed to solve the issues and problems of mortgage lending. Homelend is a decentralized and distributed platform based on Ethereum blockchain with the aim of digitalizing and reforming the mortgage industry. The platform tackles the challenges associated with mortgage loan procurement.

In Homelend's platform, every information concerning the borrower of mortgage loan is kept in a digitalized way. The paper-based system of documenting the creditworthiness of borrowers is not practiced in the platform. Instead, all the paper documents are transferred to a digital repository based on distributed ledger technology. All assessment done in homelend is more professional and digitalized. The platform makes use of artificial intelligence (AI), machine learning (ML) and social networks to get vital data about the borrower of the mortgage loan.

See Video Below...

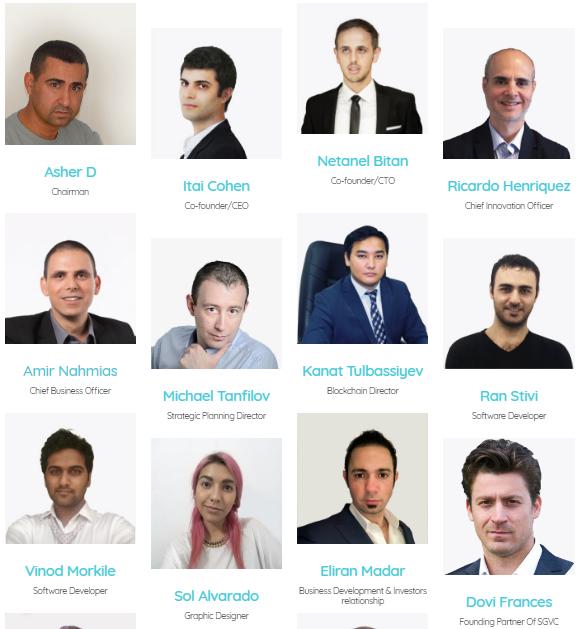

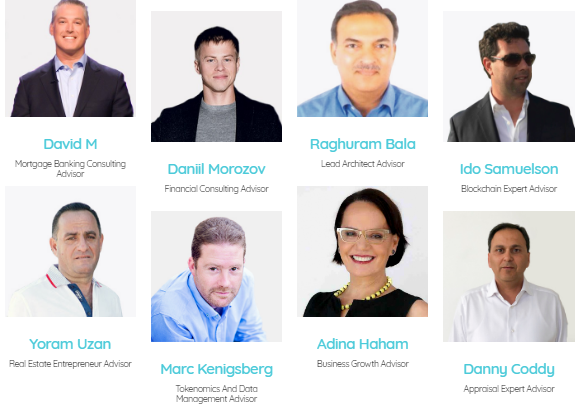

Homelend Team and Advisors

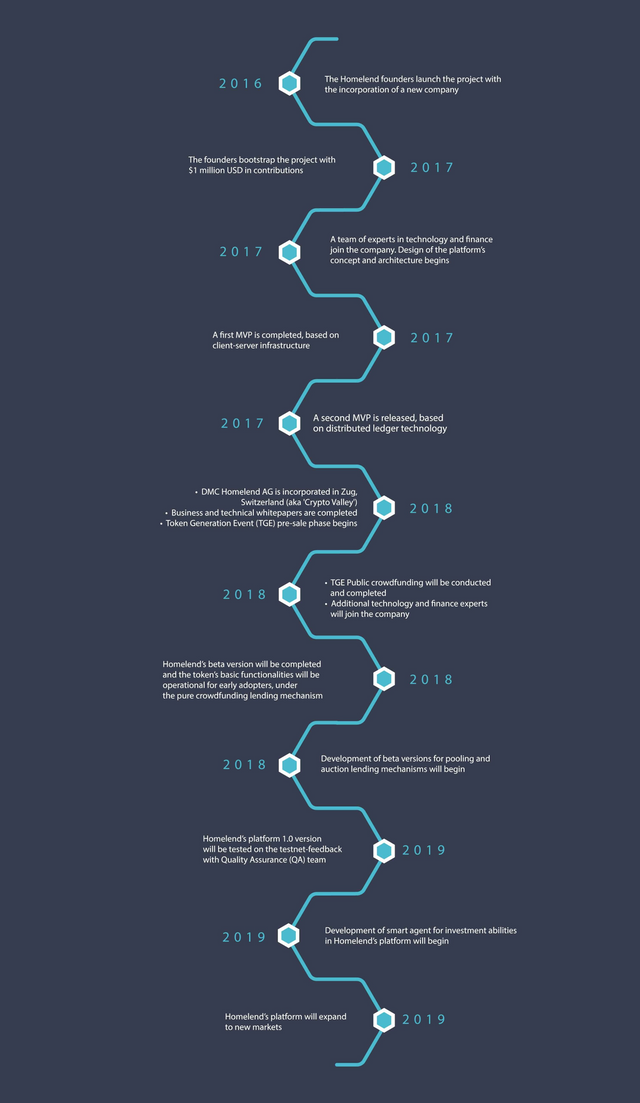

Roadmap

Token Info

Token | HMD

Platform | Ethereum

Price | 1ETH - 1,600 HMD

Softcap | 5M USD

Hardcap | 30MUSD

Total Supply | 250M HMD

Accepting | BTC, ETH, USD

In Conclusion

The value of Homelend to the reformation of the mortgage lending cannot be underestimated. Thus, the mortgage industry should adopt Homelend to create a digitalized, transparent and immutable system for proper management and financial flow of resources.

Useful Links

Website

Telegram

Facebook

Twitter

Linkedin

Medium

Reddit

BitcoinTalk

| Author | Golden |

|---|---|

| Bitcointalk Username | Mymy_ |

| Bitcointalk Link | https://bitcointalk.org/index.php?action=profile;u=2236211 |

Great article, @goldena!

Decentralization of mortgages can have benefits if looked at in a different way. I mean a different way of looking at the situation under the supervision of Mortgage Broker Hull. That's precisely the experience that helped me, and that's why I speak so boldly about it. I'm sure some people with mortgages are struggling right now because of the constant changes in the interest rate course. That's why a broker's help in such cases keeps the risks to a minimum. It's been proven in my experience, so that it might be helpful to you as well. If you are interested, you can find more information about this which will definitely be a valuable resource for you.

Decentralizing the mortgage lending institution offers potential homebuyers greater flexibility and access to a wider range of financial options. This shift allows individuals to explore alternatives beyond traditional banks, resulting in more competitive rates and personalized terms. By utilizing decentralized platforms, the mortgage process becomes more transparent and efficient. For those looking for insights, 21st Mortgage reviews provide valuable feedback on how such lenders are adapting to modern demands. Overall, decentralization is revolutionizing the way mortgages are obtained and managed, empowering consumers.