Day Trade? Swing Trade? HODL? This might help you decide which one you are!

Post by: @CryptoLanger

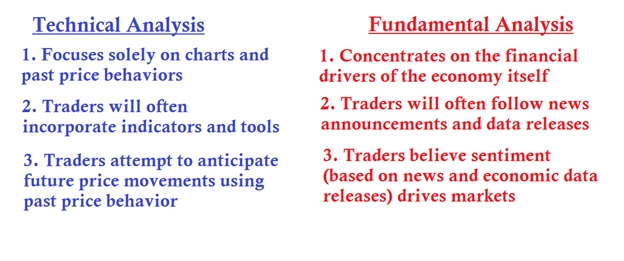

We receive so many questions (mainly due to FOMO from twitter!) on how should you be trading? You hear some people praise HODL while others never hold a coin more then a couple hours at a time. Then there is others who do a bit of both. Ultimately; do what works for you! If you are great at Technical Analysis but also enjoy Fundamental Analysis of a coin (like myself) then do both. Here is a breakdown of different trade strategies that you can implement and decide for yourself. You can be a 100% Day Trader or a 100% long term hands-off investor, or do both!

HODL – Long Term Investments:

HODL is quite simple. Buy the coin, keep the coins in a safe wallet. Just make sure you DYOR to ensure the coin you are buying has long term potential. This, like a stock pick, would be a coin you could go weeks without knowing what the price of the coin was. You also wouldn’t lose sleep if the coin plummeted in price for weeks or months at a time. As a HODL coin, you are investing in the coins future. Not the current price of the coin. The price of the coin shouldn’t matter to you. If you are worried about a 25% dip or the coin staying stagnant for many months on

Dangers of a HODL’er:

- Lethargy during a sideways market

- Disregarding your strategy

- Chasing somebody else’s dream

- Believing somebody else’s FUD

- Using money that you shouldn’t be

- Failing to properly do a self risk analysis before investing

- Feeling like you HAVE to do something or make moves

(That quote was pulled from Twitter, unknown author)

If you can cope with these dangers then this type of investment will do well for you. This is a hands-off, long term method of investing. DYOR, find good coins with bright futures, buy and hold. Don’t worry about the daily percentages

Swing Trading 101:

Swing trading is essentially buying and selling coins (as investments) for quick profits rather then one long term profit in a HODL. This is when you find an opportunity in market dips (or more particularly specific coin dips) and you buy in low before the break out into its upward trend. You then can hold it for a few days to a week to even a month. Hold it until it reaches a peak or close to the next resistance level (or at a profit your satisfied with) and then sell it. Now with this trading you have to be considerate of the pairing your trading with. Example a BTC/TRX pairing; if you are swing trading TRX (buying at a dip it just had and plan on selling it in a week or so when TRX news release comes out as planned). You have to be aware of BTC price fluctuations. If you are holding out for a dip in TRX then your money is currently sitting in BTC. If BTC is in a downward trend you will be losing money while you wait for a further TRX dip. In this situation its best to either a) take a risk and put your money in an upward trending coin or b) shelter in Tether (USDT) until your ready to take your money and switch it to BTC and then right into TRX. This is only an issue if BTC is in a downward trend. If BTC is soaring then its even better to keep it in BTC until you are at your buy level with TRX.

One important note with swing trading is to only swing trade coins you feel have bright futures and wouldn’t mind holding if it continued to drop after you bought in. Don’t buy “Sh!!coins” or you’ll just hold bags not investments.

Swing trading is beneficial if you have a fundamental understanding of technical analysis but it isn’t essential. I would be very comfortable swing trading as long as you have been paying attention to the mood of the market and the previous days/weeks of that coin your trading. If you find a coin that you know is making DEV progress, making announcements and keeping the public engaged on twitter, etc, and you see the coin in the past few months has been in an upward trend but the past week or two its taken a dip. Sometimes dips can simply be big whales cashing out followed by subsequent FUD sellers due to the sudden price dip. If you can pick up on these then that is all you need in swing trades. You just have to DYOR to make sure the price isn’t dipping for a reason. (Example: Bitconnect shutting down).

Day Trading:

Day trading is very dependent on technical analysis. One thing to note is that many of the indicators out there that are used so heavily in the stock market are also available in cryptocurrencies however they aren’t as reliable. To keep it simple; in the stock market there are market makers who will have thousands of “Apple” shares on standby and when the spread between bids and asks in Apple starts getting to far apart they will use those shares to fill the gap; reducing the market volatility.

In Cryptocurrencies there are no market makers. What makes these indicators successful are other traders doing the same things you are. If 1000 people know the support level of a coin then they will make sure they put there buy limit at that support level. This essentially creates a wall to protect from the chances of a further dip. Likewise, in a resistance level many traders will cash out before hand which is why its hard for the price of the coin to continue up past it. However, when bulls do break through that resistance you tend to see a strong upward trend as traders will ride the upward trend as that previous resistance level becomes the new support level.

Now the most common indicators used for cryptocurrencies are Simple Moving Averages (20-50-100-200) MA’s, RSI, and Bollinger Bands. (more advanced users like PhilakoneCrypto and Eric Choe use Fib Retracements, Elliott Wave theory, etc).

A 20-moving average means whatever chart your looking at there will be an average price of the past 20 of that specific measurement of time that will appear on the chart. So, if you’re in hours it will have the past 20-hour average. If its in days it’s a 20-day moving average, and so forth. This helps you recognize if your trading bullish (above the moving average) or bearish (below). Obviously, the higher the MA the more accurate it becomes. A 200-day moving average may be more reliable then a 20 day.

An RSI is an oversold or overbought indicator. An RSI less than 30 means its oversold and an RSI greater than 70 means its overbought. As the name implies its an indicator; an RSI of 20 can still drop. Conversely, an RSI of 80 can still climb. It’s just a tool of probability.

Bollinger bands coincide with the Moving Average. The bands are bracketed around the Moving Average and are there to track volatility. The wider the bands are away from the MA the more volatile the coin. Typically speaking, the more the coin trends toward the top band means the coin is overbought and when it trends close to the lower band its oversold.

One important thing to note is breakouts 90% of the time occur within the bands. It is a major event if there is a breakout outside of the bands. Note a breakout can be a rapid sell off or buy in.

These are the 3 common indicators. The best advice I can give to learn day trading is to research lots of youtube videos.

https://babypips.com can teach you forex trading which is 95% the same as cryptocurrency trading.

Chart Guys, DataDash, BoxMining are all great guys to follow to learn trading material on Youtube.

Note one thing to understand is to get used to trading in satoshi’s as that’s what the charts go by on exchanges. A Satoshi represents one hunred millionth of a bitcoin (the smallest unit of bitcoin currency recorded on the blockchain). This is written as 0.00000001 Satoshi (or sat’s). Now the unit of measurement on all exchanges on the right side of the graph in charts are in sat’s so its important to be able to identify when day trading what the difference in satoshi’s will be in USD. Download a iOS phone Bitcoin calculator that you can type in the price in satoshi and it will convert to usd. You can also do this by typing it in Google.

How to Day Trade aside from knowing technical chart analysis:

Best way to learn is find a pairing (BTC/TRX) and watch it for hours. Don’t put money just watch. Look at all the buys and the sells and watch how big sell walls come into play and recognize all the small purchase orders that keep changing (these are bots that do automated trading).

Find coins with high volume only

Ideally find coins in an upward trend and that are good coins to hold if you get stuck with it

Preplan an enter and exit strategy before entering the market. Set your buy price then right away set your market sell limit. This depends on how much your willing to take a loss on in order to get out safely and be able to use that money to continue day trading (maybe move to a different coin) and eventually you’ll make that loss back and then some.

Preplan an exit (sell). Don’t be greedy. Decide at the beginning based off the recent 15 minutes/half hour/4 hours/8 hours/1 day charts is it hovering between supports and resistance? How many percent is it fluctuating between support and resistance. An idea would be buy and sell for 3-5% profits at a time and do this for countless hours in a row to build compounded interest on these profits each time.

If its in an upward trend ride the wave but be ready to sell as soon as you see a downturn imminent and don’t get caught in a sell off.

DON’T GET CAUGHT IN PUMP AND DUMPS

There are tons of pump and dump groups. These can contain thousands of people with several million $ worth of BTC. The group leaders will announce a coin at a designated time on a specific exchange and at that exact moment the coin will see a massive spike in volume. They sometimes will delay sell offs as long as they can and spread FOMO messages on social media and exchange chat forums so they can get external buyers in on the pump. It sounds exciting but many times you can lose lots of money in the blink of an eye on the dump. There is just too many people trying to dump there shares (at market) at once and it becomes too hard to sell them until usually your very far down in the red.

Candle Stick Charts:

Candle stick charts are used in Cryptocurrency as it factors in human psychology which is ideal in this type of volatile market. The Green candlestick bottom is the OPEN price of that period of time. The Green Candlestick bottom is the CLOSE price of that period of time. Now a Red Bottom means the OPEN price and the Red Top means the CLOSE (as it closed further down then its open price). The wick represents the quick price of buys or sells (depending if its above or below the stick) that occurred but were just quick and unable to maintain any substance. This shows FUD and FOMO in psychology and can show market uncertainty and volatility with large wicks.

https://docs.google.com/document/d/16I21Z3JR9sQReezAeAXiIUsJSihRNt3YiUUKXGWRDow/mobilebasic

(Google Doc Credit goes to @XKavalis - it is his material I am just providing the link!)

The article link posted above is a great tool for learning to trade Crypto. Use it and youtube videos and spend hours watching charts on your exchange of choice and find out which indicators work best for you. Remember you can’t fully rely on indicators they are simply another tool for the tool box. Also learn how to identify resistance and support levels and learn (more specifically, watch) what volume does to price changes in coins. These will help you make trading risk minimal and success rates high.

Lastly, There are bots you can buy called Gunbots. These bots use your exchange API and have access to strategically buy and sell your coins for you 24/7 making you small profits. Prices are around 0.1BTC and although I haven’t used them it’s something I am considering looking into more. They don’t have your private keys, password, and are unable to withdraw coins from your account they simply just make tons of micro trades 24/7 to gain you slow and steady profits. I haven't used gunbots (and am also hesitant to suggest them; but I did just post a steemit article on 3commas.io trading bot which works using an API and I can attest that it is a really convenient tool and you don't pay for it (rather it takes a fee per trade much like each exchange fee). See my steemit blog for more information on 3 commas tool!

Thanks! Be sure to follow on twitter @cryptolanger