The Audacious Acquisition of Anaconda Copper: The Greatest Deal in Wall Street History

Image courtesy of Britannica

The Audacious Acquisition of Anaconda Copper | The Greatest Deal in Wall Street History

In a time when the American business landscape was teeming with audacious moves and questionable tactics, one deal has emerged as the epitome of financial prowess - the acquisition of the Anaconda Copper Mining Company by William Rockefeller Jr. and Henry H. Rogers. This audacious maneuver, chronicled by author Robert L. Heilbroner in "The Worldly Philosophers," showcases the extraordinary lengths to which these businessmen went to gain control of Anaconda, all without spending a single dime of their own money.

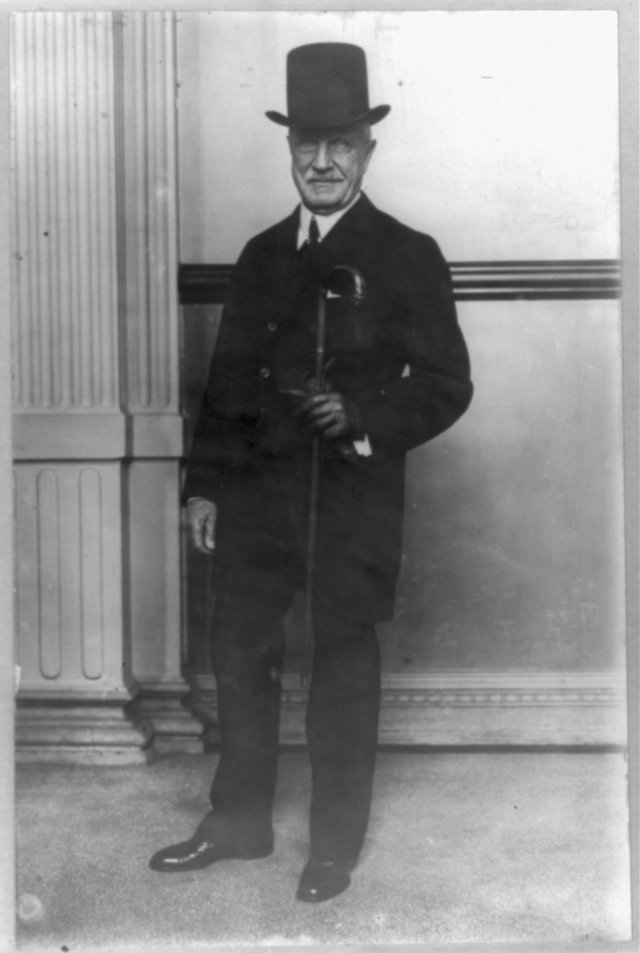

Image courtesy of Wikimedia Commons

The tale unfolds in five simple steps, each more astonishing than the last:

The Initial Purchase: Rockefeller and Rogers presented Marcus Daly, the owner of the Anaconda properties, with a check for a staggering $39 million. The condition was that Daly would deposit the funds in the National City Bank and leave them untouched for an unspecified period.

The Paper Organization: With the wheels set in motion, Rockefeller and Rogers established a paper company known as the Amalgamated Copper Company. They strategically appointed their own clerks as dummy directors to give the appearance of legitimacy. Amalgamated then "purchased" Anaconda, not with cash, but by issuing $75 million in Amalgamated stock, conveniently printed for this purpose.

The Borrowed Funds: Leveraging the $75 million in Amalgamated stock as collateral, Rockefeller and Rogers secured a loan of $39 million from the National City Bank. This loan served to cover the original check given to Marcus Daly.

The Stock Sale: With their borrowed funds in hand, the duo proceeded to sell the $75 million in Amalgamated stock on the open market. Prior to the sale, they cleverly promoted the stock through their brokers, creating a wave of public enthusiasm.

The Profit: The proceeds from the stock sale were used to repay the $39 million loan to the National City Bank, leaving Rockefeller and Rogers with a staggering $36 million in profit.

Heilbroner, the author who chronicled this deal, described it as a "free-for-all" characterized by "staggering dishonesty." The acquisition of Anaconda Copper exemplified the Rockefeller group's ability to capitalize on the fervor of the stock market and engage in questionable practices to expand their business empire.

At the center of this audacious transaction was William Rockefeller Jr., the younger brother of the renowned John D. Rockefeller and a key figure in the Standard Oil empire. As a vice president and director of Standard Oil, Rockefeller Jr. played a pivotal role in managing and growing the Rockefeller business interests, including the Anaconda Copper deal.

The acquisition of Anaconda Copper serves as a cautionary tale, revealing the excesses and abuses that can arise when unbridled ambition meets a rampant stock market. It stands as a testament to the ruthless business climate of the Gilded Age, where the pursuit of wealth and power often overshadowed ethical considerations.

To delve deeper into the fascinating world of William Rockefeller Jr. and the Anaconda Copper acquisition, additional resources are available. Visit the provided links to Wikipedia, The Reformed Broker article, and the PBNation forum thread.

In a time when the boundaries of financial maneuvering are tested, the audacity of the Anaconda Copper acquisition stands as a testament to the indomitable spirit of Wall Street. As we continue to navigate the intricate world of high-stakes deals, may this story serve as a reminder of the importance of ethics, transparency, and accountability in our pursuit of prosperity.

Sources:

- Wikipedia | William Rockefeller Jr.

- The Reformed Broker | Anaconda Copper - The Greatest Deal in Wall Street History?

- PBNation Forum Thread | The Audacious Acquisition of Anaconda Copper

.jpeg)