BTC Technical Analysis

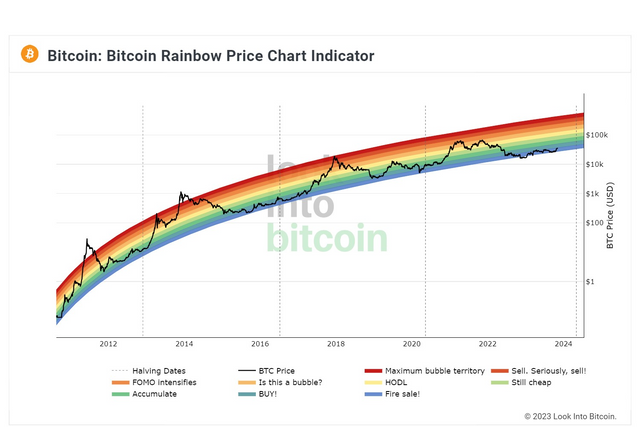

The strong trend in Bitcoin continues. The expectation that Blackrock's Spot EFT application will be approved in the USA keeps the market alive. Historical data shows that Bitcoin is in an exponential uptrend. Therefore, Bitcoin does not need the support of any regulatory agency to rise. The bear market lasted for a long time because liquidity conditions were unsuitable. If crypto did not have cycles and the increase was more evenly distributed over the years, Bitcoin price should have been close to 100k. The yellow band in the chart below shows the expected value of Bitcoin.

Bitcoin price remained strong in 2023. The price has increased by 112% since the beginning of the year. On the other hand, Bitcoin's outlook has strengthened further in recent weeks. In the chart below, we see the price movement of Bitcoin over the last 90 days.

A clear bull flag can be seen in the chart. The price rose rapidly in October, and in the last two weeks, the market is trying to digest this rise. After such rapid rises, the price is expected to retreat slightly, whereas the Bitcoin price is drifting upwards.

The 200-day averages and the weekly RSI confirm the upward medium-term trend. 40k and 47k stand out as possible resistance levels. The weekly RSI is currently above the 70 level, so that we may see a correction in price in a few weeks. This does not change the fact that the medium-term trend is upward.

Thank you for reading.

This is a manual curation from the @tipu Curation Project.

Also your post was promoted on 🧵"X"🧵 by the account josluds

@tipu curate

Upvoted 👌 (Mana: 2/7) Get profit votes with @tipU :)