Worrying Movement in Bitcoin: Will the Decline Continue?

Bitcoin (BTC) fell to its lowest level of the week ahead of the U.S. inflation data and today’s Fed meeting, while U.S. spot Bitcoin exchange-traded funds (ETFs) recorded their first net outflows after 19 trading days.

Bitcoin (BTC) fell to its lowest level of the week ahead of US inflation data and today’s Federal Reserve meeting, while US spot Bitcoin exchange-traded funds (ETFs) recorded their first net outflows after 19 trading days.

According to Cointelegraph Markets Pro, Bitcoin dropped 2.3% in the last 24 hours. BTC, which hit the lowest level of the past week, also caused selling pressure on altcoins. The decline in BTC brought ETH to $3,552, SOL to $154, and DOGE to $0.14.

The tide has turned for spot BTC ETFs

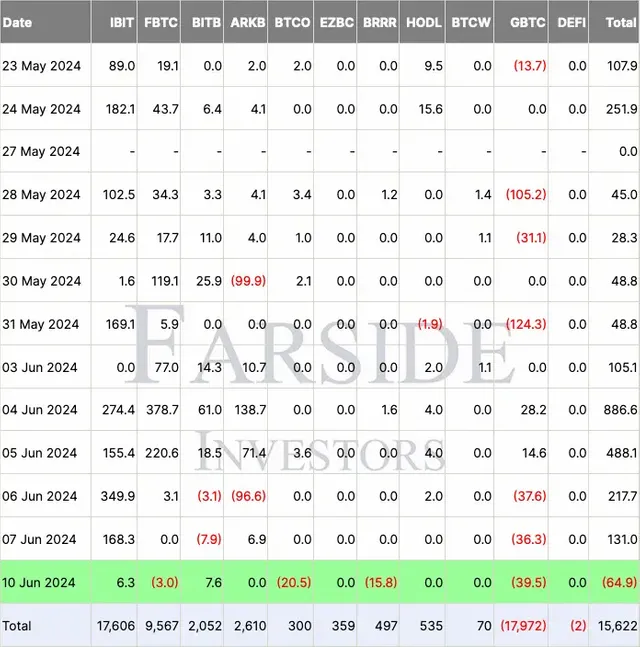

According to Farside Investors, the drop in Bitcoin followed a net outflow of $64.9 million from 11 US spot Bitcoin ETFs on June 10, marking the first net outflow in a month. Leading the outflows was the Grayscale Bitcoin Trust (GBTC) with $39.5 million, followed by the Invesco Galaxy Bitcoin ETF (BTCO) with $20.5 million, and a small outflow of $3 million from the Fidelity Wise Origin Bitcoin Fund (FBTC).

According to a report by Morningstar, analysts predict that inflation will increase by 0.1% following a 0.5% rise in April, bringing the annual rate to 3.4%, while core inflation is expected to rise by 0.3% in May, the same as in April.

The Federal Open Market Committee (FOMC) will begin its two-day meeting on the same day to decide on monetary policy. Investment research firm Zacks predicts that there is no chance of a rate cut by the Fed, and it is expected that the central bank will maintain its target rate of 5.25% to 5.5%, the highest level in 23 years.