The lower entry cost version of the MakerDao Ethereum called DJED is Perfect low entry cost way to mimic ROI seen on MakerDao

In big financial news for Tron Blockchain, Justin Sun, the founder of Tron (TRX), announced on March 29 the launch of Djed, a credit debt facility issuing collateralized loans that appears to be a duplicate of the immensely successful MakerDAO credit debt facility based on the Ethereum Blockchain. Mr. Justin Sun, CEO of Tron, has previously promised TRX community members a decentralized stablecoin be backed by TRX and the BitTorrent Token (BTT). The Djed name means Stability in the Egyptian language.

. JUSTIN SUN, CEO of TRON.

. JUSTIN SUN, CEO of TRON.

source

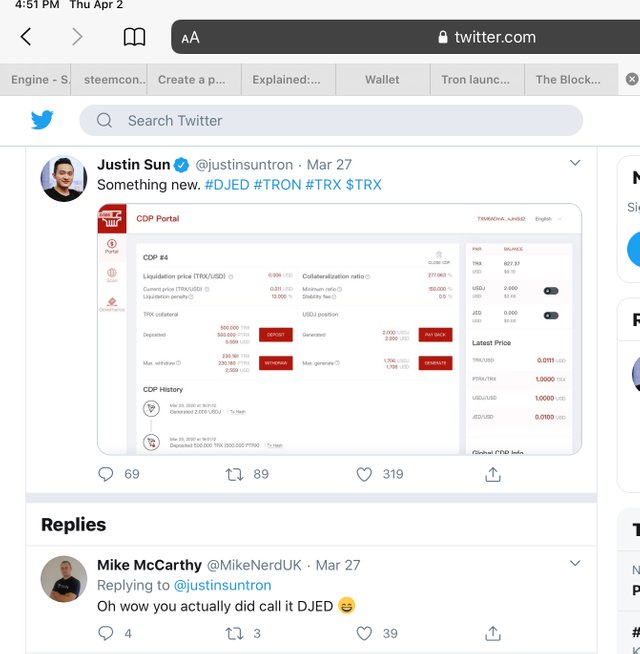

This was also announced by Justin Sun on Twitter;

source

After reading the White Paper and visiting the website I feel that the Djed platform is modeled after the opensource MakerDao platform on the Ethereum blockchain.

So similarities;

The Djed is a credit facility, and a Collateralized debt lending platform,

Djed uses Collateralized Debt Positions (CDP).

Its users need to pay an interest rate called a Stability Fee on their loans, the amount of which is determined through by the Interim Risk Team at Djed.

The whole transaction is trustless using smart contracts.

So basically you deposit a specific cryptocurrency, transform it to a non-fungible version, pledge it as collateral for a loan, and receive a loan in the form of a stable coin.

Now you can exchange that stable coin for dollars and loan it out or use it to buy more cryptocurrency you want to stake!

Differences;

The CDF or credit debt facility does accept Ethereum deposits, it accepts only Tron Token.

There are no gas fees. All the other token names are different to reflect a new ecosystem.

This huge Financial News

This announcement came out not long after right the financial wreck on the MakerDao where many investors lost millions in Ethereum. I wrote about it here link

For those of you who have never heard of the MakerDao I explain more in my article

The MakerDAO is basically a credit facility that issues loans with a certain interest rate called the stability fee against a collateral called Ethereum. The loans are paid to borrowers in Dai. Each Dai is worth one dollar USD. The stability fee or interest rate is raised to reduce selling pressure on the Dai and help keep it pegged to the dollar and vice versa. The DAI stability fee or interest rates for borrowers was 1%, but later the stability fee increased from 1% to 3.5%. As you can see from the below headline, it is the most successful decentralized credit faculty in Decentralized Finance right now.

Why Collateralize your Ethereum?

As an investor your rate of return on Ethereum is variable, for example if the price for Ethereum increased 5% in one month your ROI was 5%. If you owned $100 worth of Ethereum your 5% ROI was worth $5 USD. But what if you owned 10 times as much Ethereum? $1000 worth of Ethereum at a 5% ROI would mean $50 USD. If you had 100 times as much Ethereum your 5% ROI would be worth $500 USD.nSo to make more money, you need to buy more Ethereum. But with collateralization you can buy more Ethereum without having more money. And as you can see by the transactional volume this is very popular.

Event Significance

The true beauty and utility of open source code is that it can be used as the base code for innovations. The Ethereum blockchain is considered the Legacy blockchain for smart contracts. The costs of transacting there include both Ethereum or Ether and Gas. There are other blockchains which use Smart Contracts and nonfungible tokens, similar to the Tokens used on the Ethereum blockchain for decentralized finance and other forms of Commerce. But the Ethereum blockchain is so famous, that the vast majority of decentralized finance runs on the Ethereum blockchain.

But there are two big problems:

- Cost: Ethereum is $180.00 USD

- Scalability; Ethereum frequently reaches its maximum transaction capacity and all transactions slow down and even smart contract function and execution starts malfunctioning, as did early in March and investors lose money.

Now enter Trans credit Facility.

- Low cost Tron is around 0.15 USD or 15 cents

- Tron blockchain has a much higher transactional capacity then Ethereum blockchain.

Opportune time and Publicity*

Justin Sun brought this advanced technology to a blockchain known for high transactional volume decentralized applications for monetary gaming, and for having millions of users. Plus there is a little controversy about copying open source software, which provides free publicity for this new project. You can’t buy that free publicity and all the articles about it specifically stated that it was a copy of the MakerDao, as if copying the most successful Credit Debt Facility in all of Decentralized Finance was a bad thing. Investors who understand how a decentralized credit facility works and who do these transactions on the Ethereum Blockchain, see the advantages of a blockchain with much greater transactional volume. While it is clear that a major share of the MakerDao transactions will stay there or move to other Ethereum based credit debt facilities. If only 1% of this billion dollars a month moves to DJED, that 1% is the equivalent of 10 million dollars USD in monthly transactions. Such volume would be considered a success by most start up standards.

This is a notable occasion because now those investors who can’t afford ETHEREUM at $160.00 USD per Token can still profit from this investment model using Tron tokens at 0.15 $ USD. In some ways this brings DeFi to the masses by making it affordable. Some smart investor with a good grasp of decentralized finance but who was born in a poor country where having $160.00 USD to invest in the MakerDao is simply not possible. But with Tron that same smart but poor investor can succeed.

I think that’s something bigger then Tron-Steemit it’s a global economic opportunity.

That’s the real promise of cryptocurrency.

Stay informed my friends.

Written by Shortsegments, a blogger, who is both a teacher and student studying the blockchain and decentralized finance.

My Avatar, which is called The Hustler

Other Articles I wrote about Decentralized Finance

Blockchain Banking: MakerDao on the Ethereum Blockchain;link

Blockchain Banking or Decentralized Finance explained for regular people.link

A Short Report on DeFi Project dXdYlink

A Short Report: Securitizelink

Places you can buy everyday items with cryptocurrency.link

Other Articles to read about the DJED platform

https://messari.io/article/justin-sun-announces-djed-a-makerdao-lookalike-built-on-tron

https://www.theblockcrypto.com/linked/60246/tron-launches-its-own-makerdao-like-stablecoin-system

Title; The lower entry cost version of the MakerDao Ethereum called DJED is Perfect low entry cost way to mimic ROI seen on MakerDao

Thank you for this explanation. This is very helpful. I also read your two other articles and I understand how great an opportunity to make money. So Tron really makes this money making opportunity available to smaller investors. I also understand what your saying. This opportunity for smart, but poor people to use their brains to make money. This is out of reach or to expensive for most people.

Thanks

!!popcorn

Thank you for your comment on this article and the others. I appreciate you checking out the other ones also. I think it gives a better picture of the situation.

As a businessman, he seized the opportunity. At least try not to copy the source code and instead try to make your own with something new and innovative. ;)

Your right, this was really smart of Justin Sun.

I agree that he was smart to seize the opportunity to create a competitor . Finance is also creating a competitor and it will be interesting to see how that works out. Finance may be a good competitor for MakerDao and Ethereum.

I am very excited about credit facility development and the impact of stock investors moving cash into Ethereum to profit from reinvesting cash derived from CDPs. I would be curious about your opinion of the longterm success of the Tron credit facility Just and the longterm success of the new Binance Smart Chain and the probable development of a credit debt facility there?

Thank you

I have the philosophy not to make a projection. It is not ecosystems that I will embrace personally because we have enough centralization already with the financial system.

It is a question of taste, market, and choice in a world where nothing is permanent.

I liked all this information in one place Thank you for the post.

It is very convient.

Your welcome and thank you for the compliment.

Upvoted and Resteemed. Added to the @offgridlife Curation Trail.

Thank you for your support.

I am very excited about credit facility development and the impact of stock investors moving cash into Ethereum to profit from reinvesting cash derived from CDPs. I would be curious about your opinion of the longterm success of the Tron credit facility Just and the longterm success of the new Binance Smart Chain and the probable development of a credit debt facility there?

Thank you

Yes.... this is great for TRx .... we will see a big move to $100 soon.

So far their volume of transactions looks good.

You can make a lot $$$$ staking (freezing and voting) with your TRX on Tronwallet.me.... like $100 a day passive income.

!giphy great+opportunity

giphy is supported by witness untersatz!

Very clear your article. Compliments!!!

Thank you for your compliment.

Thank you for your incredible post!!!

That's a good post. I like it. Keep it up, buddy.

BE AWARE THIS USER HACKED MY ACCOUNT AND IS VOTING 100% ON HIS REPLIES.

Thank you for the compliment.