Tron Fan Club| UNDERSTANDING CRYPTOCURRENCY MARKET MAKERS - By @solexybaba | 10% payout to the community account

Image edited on Canva

Hello to everyone in this great community known as the Tron Fan Club I bid you all good morning from my country. it is a new day and week. today I have decided to talk about an interesting topic regarding the cryptocurrency market. so today I will be discussing with us all the said topic called a brief study of market maker. I beckon on us all to relax and enjoy the lesson as I begin.

WHAT DO YOU UNDERSTAND BY MARKET-MAKING?

When when we talk about market making, it is then executed by market makers and this happens to do with the provision of liquidity to cryptocurrencies thereby purchasing and selling through making an offer and asking spread through which they get their gains.

And in the time of purchasing the exchanges, a user is needed to pay a particular amount which the price is dictated by the bid price which is the purchase price and also its selling price. and these prices are dictated by the various market makers most especially in cases where we see current coins trooping in the crypto world alongside lesser liquidity.

These market makers usually get their gains from the spread between the purchasing and demanding spread in which they supply a huge amount and then paid for it. the whole idea of the market makers is to come up with a means of liquidity for various cryptocurrencies by making certain market orders which we all know to be the supplying and demanding orders by the market makers.

The market makers are known to be experts and professionals in asset liquidation and also dictate the prices of a certain asset and also manage the activity of the said asset. by purchasing and selling these assets, they tend to determine the price of various assets thereby providing liquidity of these assets through the selling and buying aspect. so the process of providing liquidity regarding an asset through certain processes such as buying and selling is tagged market-making, and the individual responsible for this liquidation of a certain asset through the buying and selling process is known as the market makers.

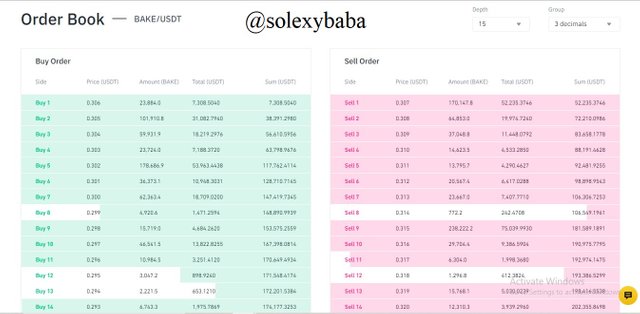

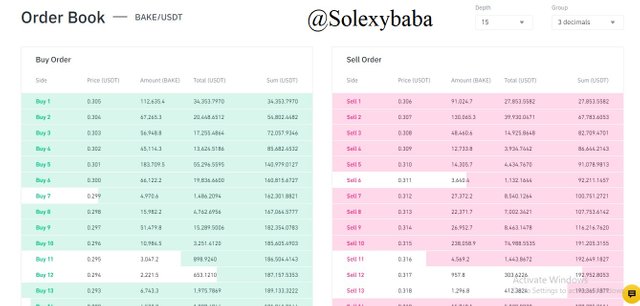

As seen in the above image, the activities of liquidation in the market through the buying and selling of crypto-asset by the market is a market-making process.

WHAT IS THE STUDY BEHIND THE MARKET MAKERS?

The idea of all market makers is to liquidate an asset when needed or to provide certain liquidity to cryptocurrencies and also make an equilibrium constant regarding the purchasing and selling price, the reason is to keep an asset in a position where its value will not depreciate. so the rise of these assets is their top priority, also other investors to some extent are equally involved in this practice of keeping an asset value intact by maintaining and making gains through this aspect, thus his priority is to see that the asset attain a certain level of growth.

We should bear in my that certain exchanges platform consults good market makers and expertise in market making, so as for the market makers to make available liquidity regarding an asset and also determine the value of the said asset which in turn relies on the market maker's influence on the said asset, then the asset price will notice an uptrend in price value. so with this, the market makers will then dive into the market in other to make liquidity available to an asset with the mindset of getting other fewer individuals that are stubborn in the market through the buying and selling process regarding an asset and this is termed as spread and make gains.

ARE THERE BENEFITS OF THE MARKET MAKER IDEA

Yes, I vividly can tell that there are certain benefits to the market-making idea, and some benefits are listed below.

MAKE LIQUIDITY OF ASSET AVAILABLE - Without the market makers there would not be a balance between the supply and demand of assets in the market, so the market makers help to keep the equilibrium constant, without having the sell order exceeding the buy order of an asset and vice versa.

MARKET TREND PREDICTION - With the activities performed by the market makers in the crypto market, it can give little traders an edge in the market by predicting the next movement in the market, and then one can as well determine the perfect order point to place either a buy order or a sell order. so on noticing the activities of the market and when accurately followed, one is sure to make gains in the market.

CONTROLLING ASSET PRICE - The market makers can control price value regarding certain assets in the market. on noticing a fall in price value of certain assets, market makers can as well top up the buying and selling price in other to increase the price value of the said assets, and then little investors will come trading at that particular price, and then we can notice an increase in that asset price value.

- ESCAPE LOSS - With the market makers' movement in the market one can get an idea of what they are trying to do regarding a particular cryptocurrency, that is, when we notice a sudden rise in price value extraordinarily then it simply asks us to stay afar from that market because the market makers do this on purpose in other to trap small investors in the market that are ignorant and tend to dive into the market at that particular time. after a while we then notice a huge retracement in the market, this is the period where the market makers are cashing out profits they have gotten from their preys which are the ignorant small traders who saw the uptrend and dashed into it.

So on seeing such activity one is advised to stay off the market in other not to fall a victim to the market makers in the crypto market.

WHAT ARE THE DEMERITS OF THE MARKET MAKERS' IDEA?

LESS LIQUIDITY OF ASSET - Often time the market makers provide liquidity to certain currencies to maintain the supply and demand of these assets but a situation where we notice an asset having a little level of trading activities, is a result of the said market makers behavior regarding the asset and as such we then notice a huge dump of these assets because of their low value in price.

TO MAKE GAINS - Often the market makers prey on the little investors just to make gains in the market through the sell and buy spread (bid and ask). then tend to pump money in the market to make gains on little individuals who are just making peanuts in the market and that is so bad.

MISUSE OF POWER IN PRICE CONTROL - Knowing fully well that they have the power to dictate the price value of assets in the market they tend to make a coin rise by investing a huge amount of money in it and later on when they feel satisfied, they dump the coin in that manner the coin has then lost its value. so they control asset value when they know that it is to their advantage and nothing more.

CONCLUSION

Understanding the activities of the market makers in the crypto trading market is essential, as though it will guide you to know when to enter the market and when to exit the market so as you do not make losses but rather make gains. so as a trader it is expected that you understand the movement and trend which the market is being controlled to take by the market makers in other to be on the safer side.

Thank you all for going through my content today. see you next time.

Twitter shared

Check out Israel Solomon (@IsraelS49407699): https://twitter.com/IsraelS49407699?t=RTP_fQx3aD_RyRHRcLZ8BA&s=07

Thank you for giving me so much beautiful information. I learned a lot. Please always go ahead.

Thank you for your kind words. We go again. Greetings!

Note: You must enter the tag #fintech among the first 4 tags for your post to be reviewed.

Thank you so much @kouba01 for stopping by

Market makers are doing a significant contribution to the Cryptocurrency field. However, they are very rich as compared to other Traders. Because they have the power to Move some Markets as per their willingness. Sometimes it is good for providing liquidity. But sometimes it really hurts some small Traders due to their unexpected manipulations.

The market makers are rich and as such they dictate what happens in the market and one use the activity of the market makers to determine what is happening in the market and then predict the next trend. Thank you for visiting.

You are most welcome brother. Thanks again for your detailed response to my comment.

Dear I learned a lot your post. Thanks for sharing.

Thank you so much for stopping by sir. Greetings!

Beautiful article

Thank bro

Thank you so much brother for visiting

Wonderful post about crypto market and market making. You have written about this topic beautifully. Thanks for sharing

It is indeed my pleasure, thank you for stopping by