Understanding PancakeSwap - How To Provide Liquidity, Farm To Earn Passive Income During This Bear Market

Hello everyone, I hope you're all doing well? It's no longer news that we're in a bear market; even Bitcoin, the mother of all cryptocurrencies, is bleeding. The LUNA story has also had an impact on the price of other tokens, as individuals are losing faith in crypto and selling off in significant amounts.

DeFi is one of the crypto concepts that has been generating significant profits for its users; many people in the crypto world have gained significantly from supplying their crypto assets to liquidity pools. During this bear market, many users chose to hodl their tokens rather than sell them at a loss. The truth is that you can never lose in crypto unless you decide to sell; while you're still holding the asset, there's still hope. Instead of keeping the asset in your wallet, let it generate passive income for you. You may be asking how; in this post, I'll teach you how to create passive income from your asset by providing liquidity and farming on PancakeSwap.

PancakeSwap is a decentralized exchange built on the binance smart chain blockchain, this platform allows users to exchange BEP-20 tokens without any middleman, the platform uses an automated market maker (AMM) which is run by smart contracts.

What Can You Do On PancakeSwap

Firstly, you can swap BEP-20 tokens, users can decide to provide liquidity to exchange pools, and earn the some fees in returns. Additionally, the liquidity pool tokens can be staked to earn Cake, this is the native token of PancakeSwap, the Cake can as well be staked to earn other tokens on the platform. You can see how lucrative the platform is.

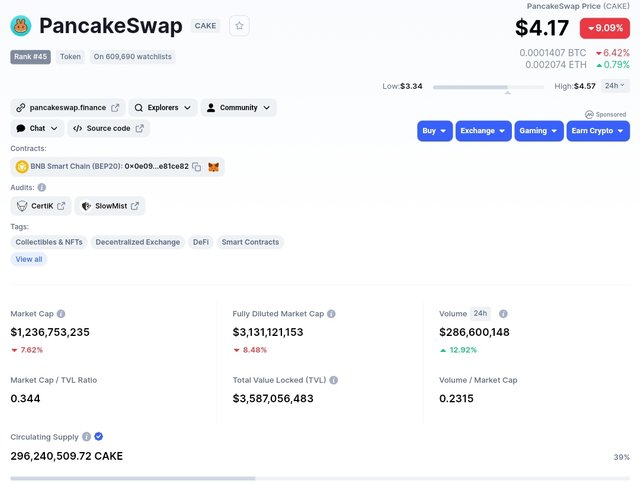

Cake is the native token of PancakeSwap, the token is currently trading at $4.17 with a market capitalization of $1,235,093,659, currently ranked #45 and a total trading volume of $286,324,919 in the last 24 hours.

The token as risen to $44.18, it all time high in 2021 and the lowest low was $0.0002318 in 2020.

Providing Liquidity On PancakeSwap

Providing liquidity simple means adding or supplying your tokens to the pool, and you earn some passive income paid at a certain APY or APR depending on the token you supplied. Instead of leaving your token in your wallet, you can easily add it to the liquidity pool and earn some income in return. I'll show the process of adding liquidity on PancakeSwap.

To provide liquidity to the pool you'll be need two different tokens, and it will be 50% by 50% for each tokens.

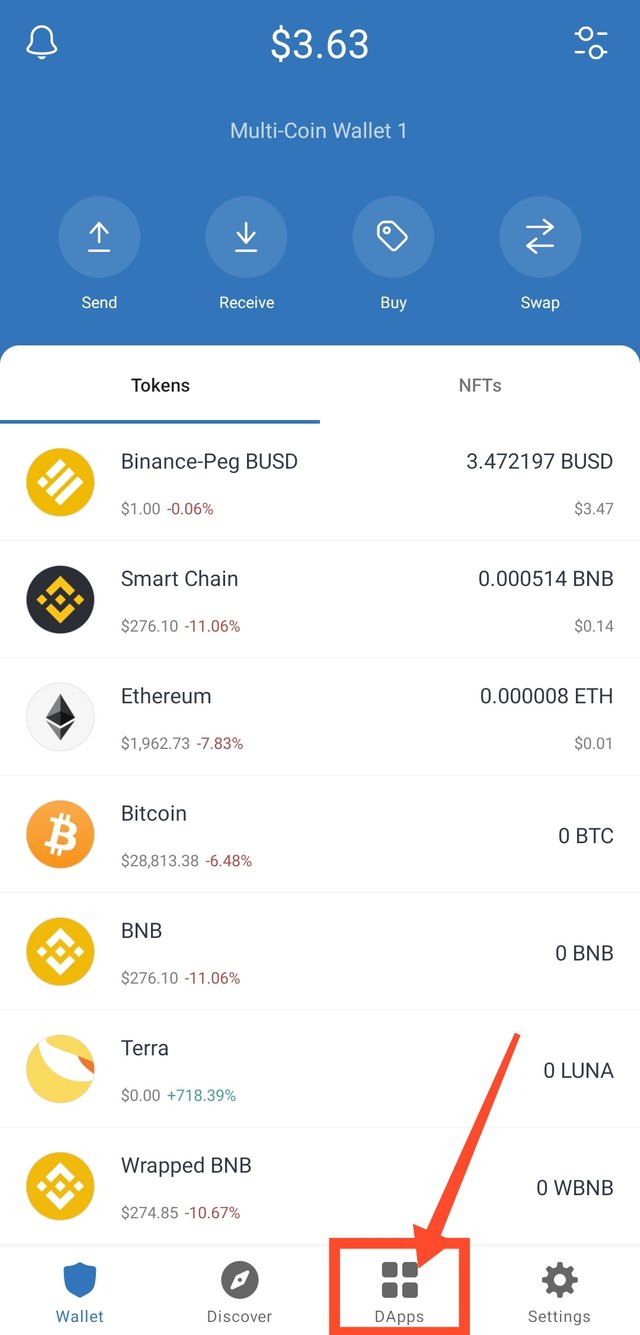

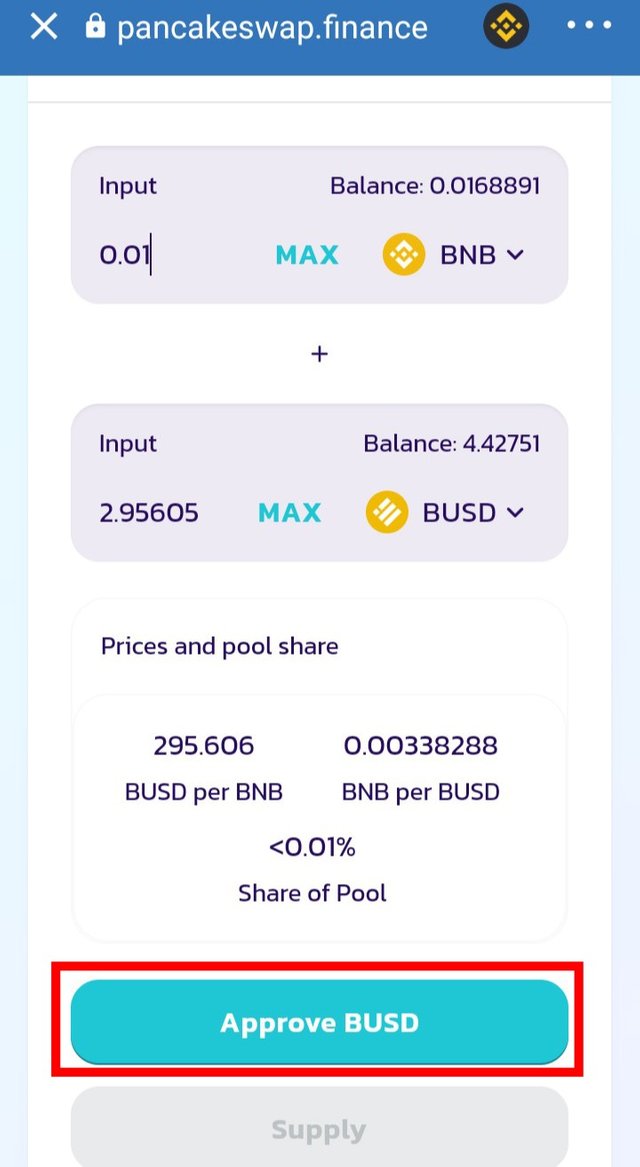

For instance, I decided to add BNB and BUSD to the pool. I'll be using the Trust wallet mobile app.

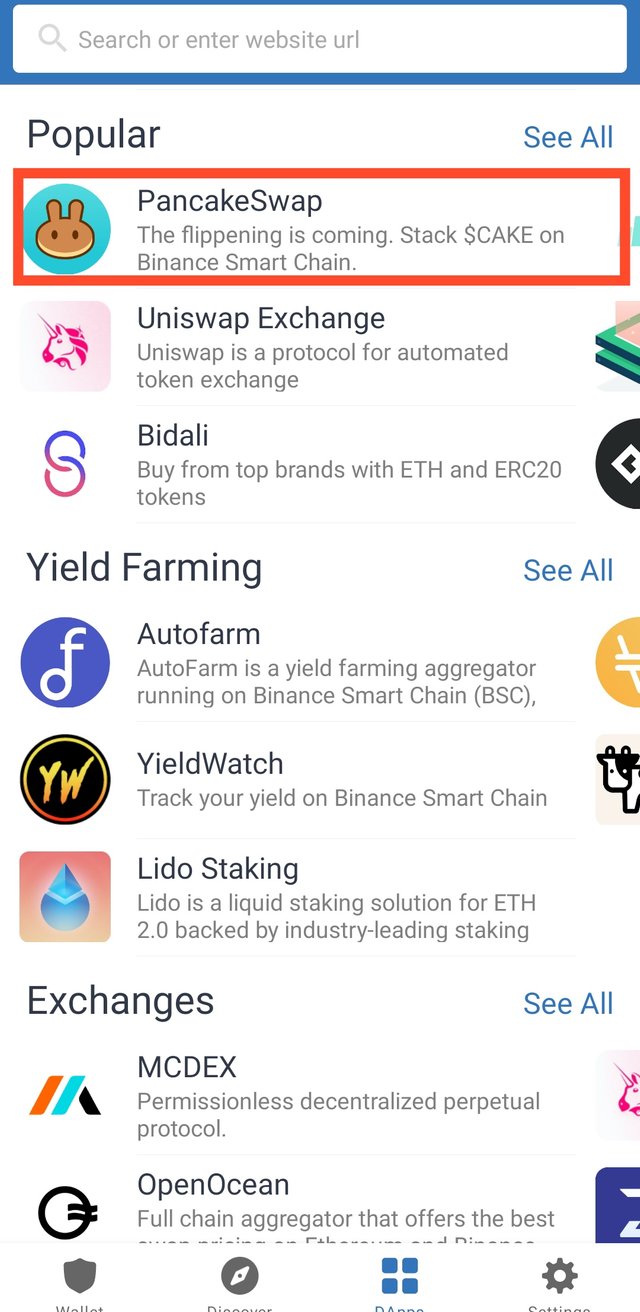

Open the Trust wallet app, and navigate to the Dapp section, go-to PancakeSwap

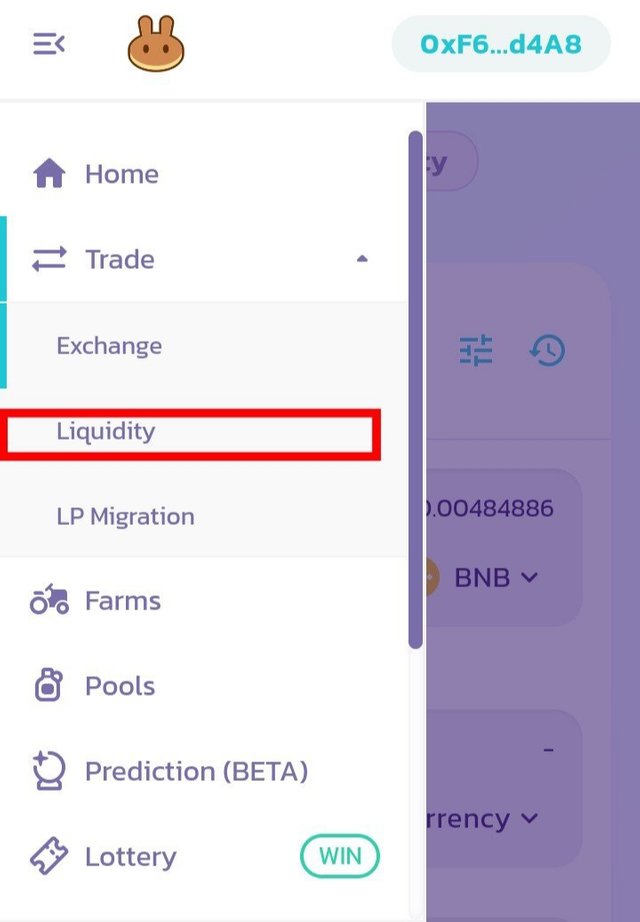

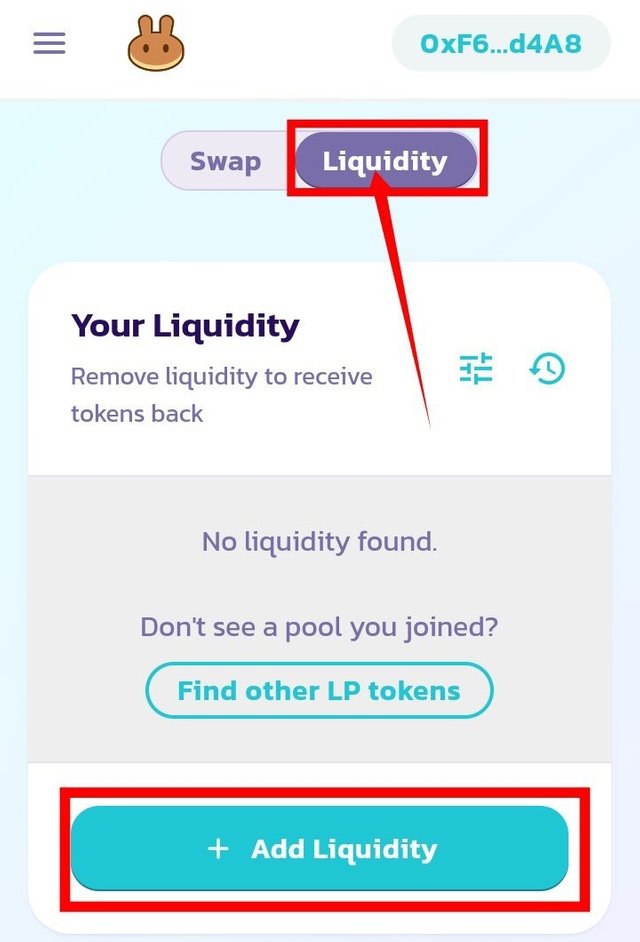

On the homepage, select Liquidity and click on Add Liquidity

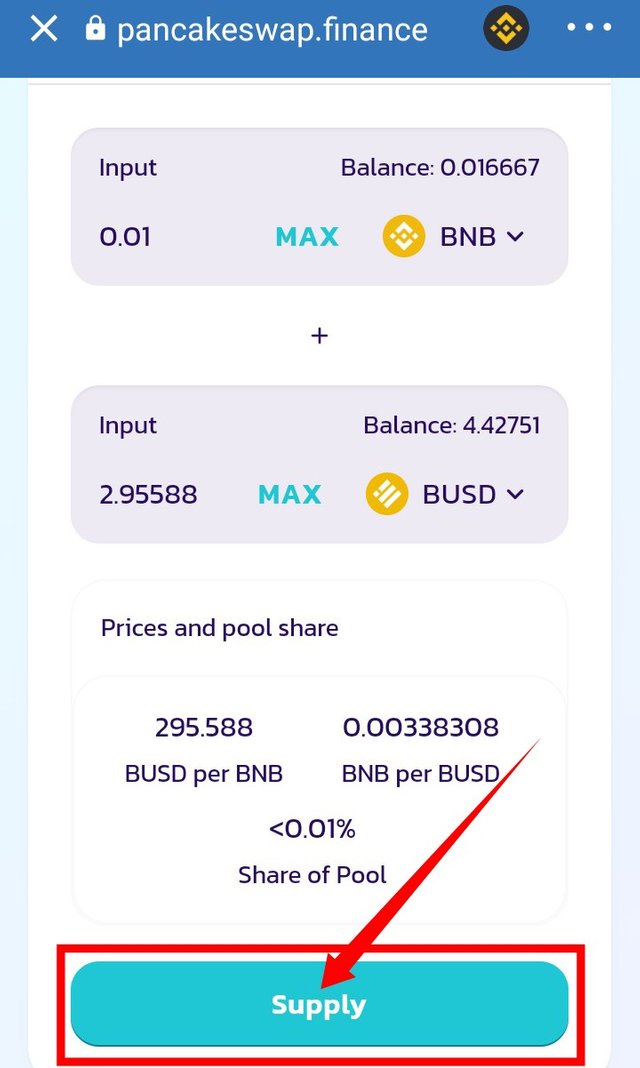

Since I've decided to supply BNB and BUSD, I select the two tokens and enter the amount, click on Approve BUSD and finally click Supply

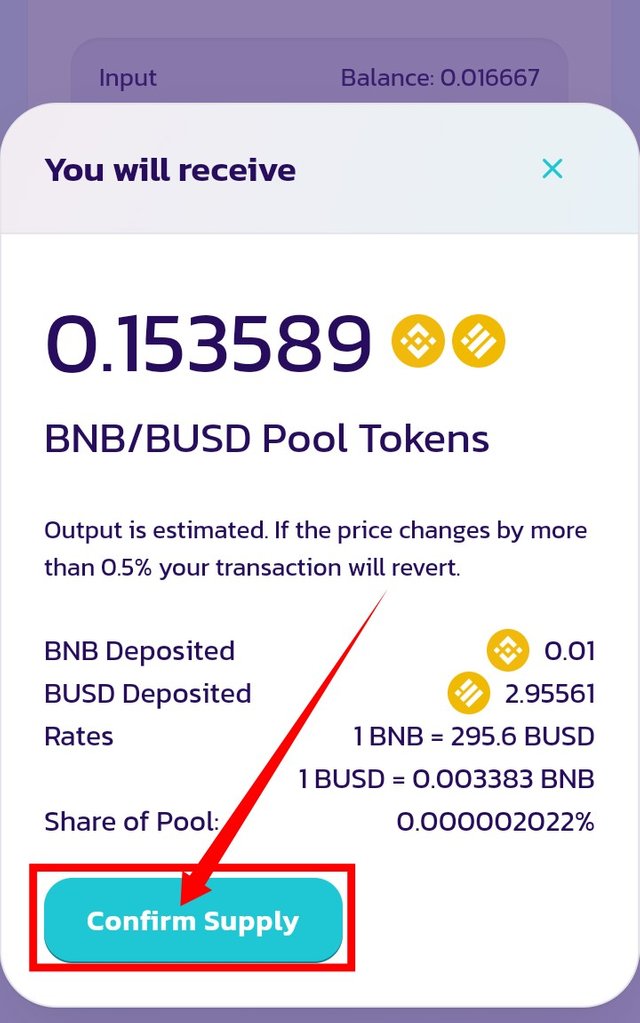

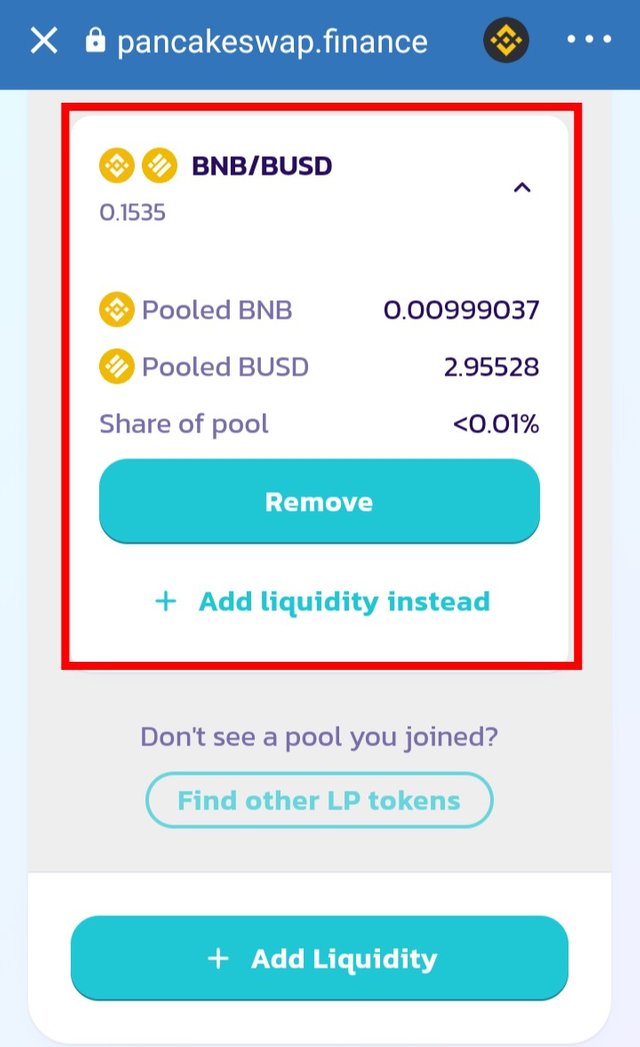

The next step is to confirm the transaction, click on Confirm Supply and there you go, I've successfully supplied my tokens (BNB-BUSD) to the liquidity pool on PancakeSwap.

Farming On PancakeSwap

Farming is another lucrative feature of PancakeSwap, here users can lock their Liquidity pool tokens (LP) and earn passive income also depending of the farm APY.

You must first provide tokens to the liquidity pool in order to farm on PancakeSwap. The liquidity token (LP) will then be stake in the farm section, and you will earn passive income from the trading fee of the token borrower. Since I've BNB-BUSD LP, I'll explain the process of farming on PancakeSwap.

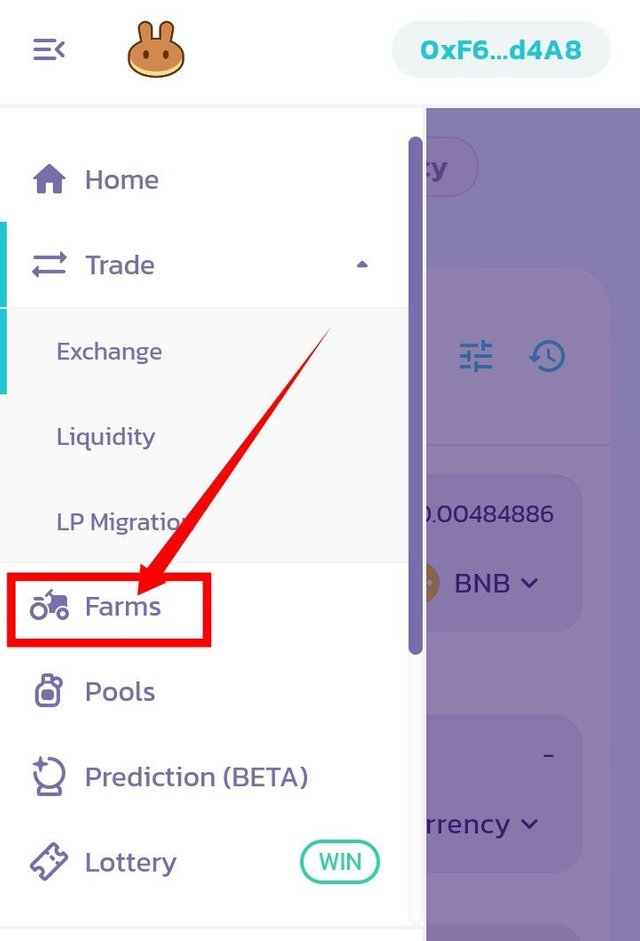

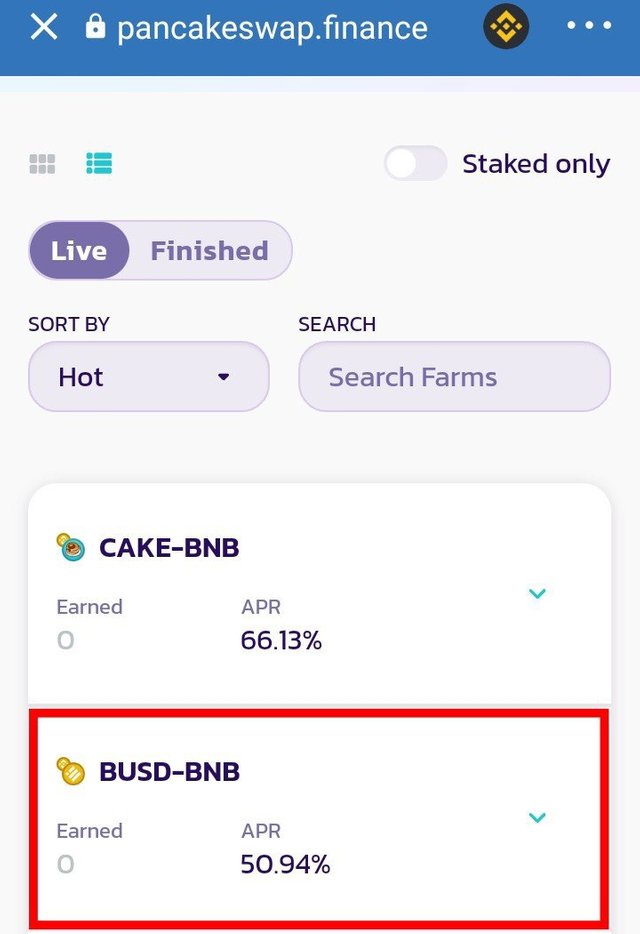

On the homepage, navigate to the Farm section, click on it and find the BNB-BUSD, the interest at APR will be displayed.

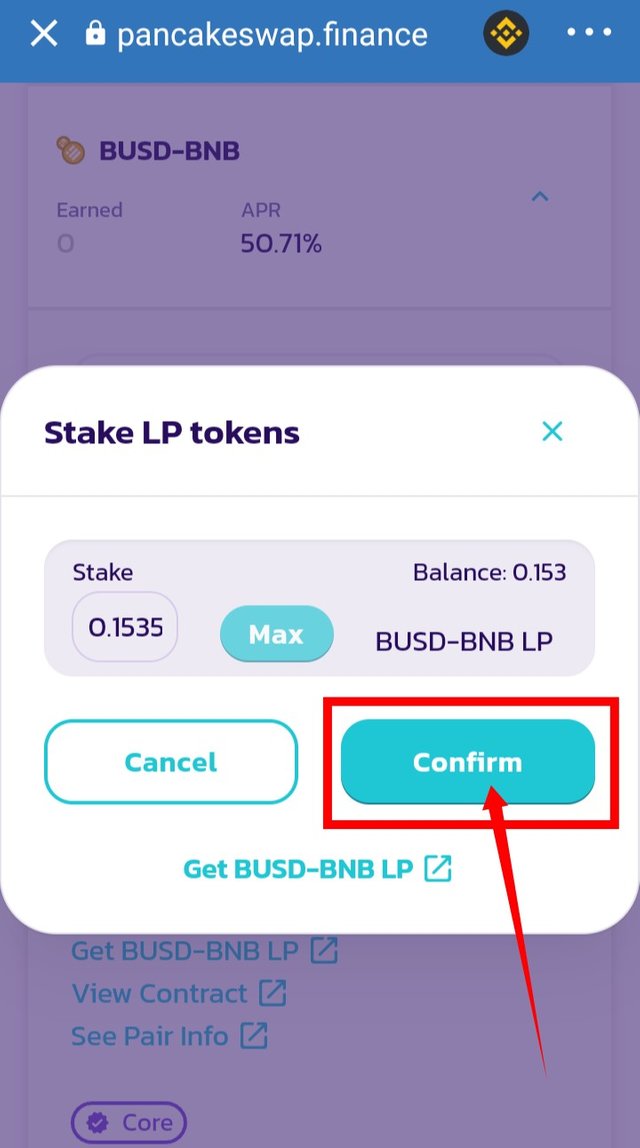

Now the next step is to enable farm, just click on Enable, on the next page click on Stake LP

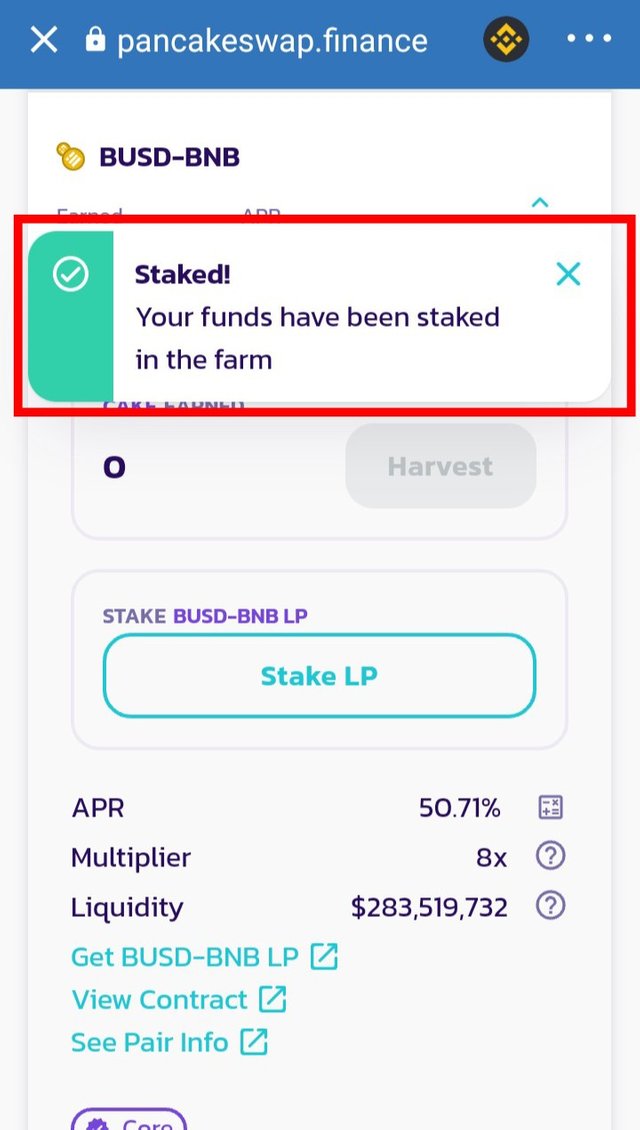

Finally enter the amount of the LP token you want to stake, click on Confirm to approve the transaction. You'll be notified that your funds has been staked.

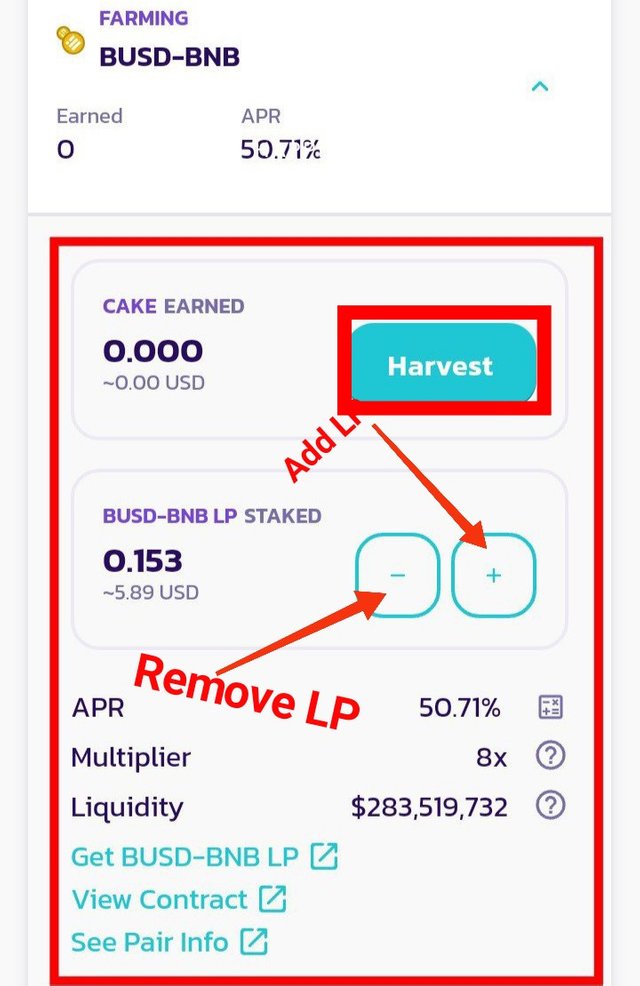

You can decide to add more LP token, Remove the LP token or harvest the rewards. To add LP click on the plus (+) sign, to remove click on the minus (-) sign while Harvest simple means to claim your rewards.

The crypto market is currently in a downtrend, with everyone attempting to maintain their position. In the Crypto ecosystem, there are numerous options for users to maximize their gains or hodling by employing. With the use of DeFi, an acronym for Decentralized financial system, users can easily use one of DeFi's features, such as providing liquidity and farming. These features are available to everybody, regardless of geography or political gender. PancakeSwap is a top Decentralized exchange in the crypto space, providing users with the chance to supply their crypto tokens to the liquidity pool, and earn on the farm section by locking the Liquidity token.

So what are you waiting for? Go to the PancakeSwap liquidity pool section, supply your BEP-20 tokens to the pool, and also use the LP on the Farm some tokens.

In Summary:-

I've discussed about PancakeSwap, a decentralized exchange on binance smart chain, I've as well provide liquidity to the pool, and use the liquidity tokens to farm cake on the platform.

Thank you!

This is an important tutorial content. You have written about this topic beautifully. Thanks

Hello, I'm happy you've found my article interesting and educating thank you for visiting

Note: You must enter the tag #fintech among the first 4 tags for your post to be reviewed.

Pancakeswap a great cryptocurrency tool/website. I used this a while back.

Yeah, it's a great website to swap BEP-20 tokens

A very important content. Thank you for sharing

Thank you my gee for visiting, hope you are doing great?

Omo I no dey do great my gee.

Beautiful post, you've done great mah gee

Thank you my man for visiting my blog, I'm happy you came through, hope you're doing great?

Nice one. Please which coin do we claim/harvest after farming? Is it Cake?

Yes, you claim cake... But bare in mind you must have some BNB (BSC)

Ok