Ethereum Transaction speed, cost and capacity problems solved without ETH 2.0?

Ethereum

...is the second largest cryptocurrency by market cap, and famous throughout the world as being the birthplace of Smart Contracts, the computer code constructs which underlie the biggest thing in cryptocurrency today Decentralized Finance.

Source

#seo-keywords-ethereum-decentralized-finance-second-layer-solutions.

.

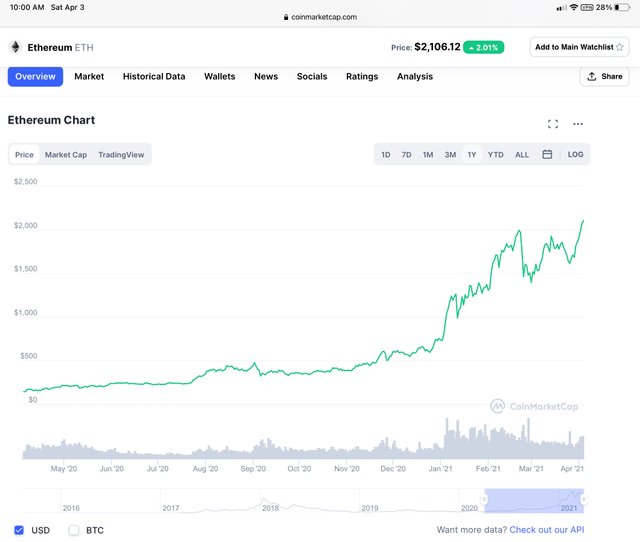

Ethereum recently broke out to $2,160.00 a 20x in a year.

Ethereum’s Chart looks beautiful...

Ethereum problems

Most traders know about Ethereum being a victim of its own success.

Ethereum has the lion’s share of DeFi platforms on it’s blockchain.

But Ethereum has issues with transaction speed, transaction cost and current structure is near transactional capacity.

#seo-keywords-ethereum-decentralized-finance-second-layer-solutions.

.

The Layer One Solution: ETH 2.0

The Famous ETH 2.0, the Ethereum blockchain with Consensus from Proof of Stake, is a departure from the current Proof of Work method of consensus. But it’s currently estimated to be 12-18 months away.

But there is short term help on the way, the second layer solutions.

#seo-keywords-ethereum-decentralized-finance-second-layer-solutions.

.

.

Ethereum Second Layer Solutions

We are familiar with side chains from our experience here with Hive-Engine, and I have written previously about Bitcoin’s famous Sidechain The Lightening Network, which solves Bitcoins issues of low transaction speed, high transaction cost and limited transaction capacity.

The concept is to create a software construct where the transactions can be diverted4 to and where price, speed and capacity are improved. Then transactions diverted to the second layer are brought back to the first layer for settlement, or recording on the blockchains ledger.

Ethereum unlike Bitcoin doesn’t have one second layer solution, it has several, and while you may have not heard of them, they are real, functional and solving real world Ethereum problems.

#seo-keywords-ethereum-decentralized-finance-second-layer-solutions.

A List of Ethereum second layer projects

Connext

xDai Chain

POA Network

Optimism

Synthetix

Fuel

zkSynv

Argent

Loopring

StarkEx

#seo-keywords-ethereum-decentralized-finance-second-layer-solutions.

That’s a long list, are some of them even working?

Yes.

Optimism

Notable projects: Uniswap, Compound,

zkSync

Notable projects: Curve, Gitcoin, Balancer, Gitcoin and Golem.

#seo-keywords-ethereum-decentralized-finance-second-layer-solutions..

What does this mean?

It’s means many things, but the main one is that Ethereum isn’t dying. The So Called Ethereum Killers are going to kill Ethereum. They are perhaps more accurately described as Ethereum Alternatives.

#seo-keywords-ethereum-decentralized-finance-second-layer-solutions.

DeFi is very big.

Today on Bankless Podcast they announced DeFi has 44 Billion in total Value Locked, which means 44 billion dollars US are locked in DeFi Smart Contracts.

#seo-keywords-ethereum-decentralized-finance-second-layer-solutions.

The success of one doesn’t equal failure of another..

I feel the idea that one Blockchain’s success is the other Blockchain’s death is a fallacy.

The truth, I feel, is that the space is big enough for multiple Ethereum-like Networks with Ethereum like components, that can be duplicated and assembled into platforms like Uniswap, Pancake Swap and Cubfinance.

Just like there’s enough room in this space for both a successful Uniswap, a successful PanCakeSwap and now a successful CubFinance.

Certainly like we saw with PanCakeSwap there is some movement of investors from one Network like Ethereum to another like Binance Smart Chain.

But the other big component, I believe is as DeFi grows some of its growth is fueled by new or first time investors coming into both the old and new spaces. We certainly have seen that with CubFinance when many community members entered DeFi for the first time.

#seo-keywords-ethereum-decentralized-finance-second-layer-solutions.

Last Words

Ethereum is here to stay, so is Binance Smart Chain, and we can expect other Ethereum Alternatives to develop in the future. In fact some of Ethereum’s Second Layer solutions will ultimately become separate Blockchain developments beyond or separate from Ethereum. The future of DeFi is very bright, but more importantly very big.

Penned by my hand. @shortsegments

Shortsegments is a writer focused on cryptocurrency, the blockchain, non-fungible digital tokens or NFTs, and decentralized finance, where finance meets technology.

#seo-keywords-ethereum-decentralized-finance-second-layer-solutions.

Definetely ethereum is here to stay no matter what the ethereum killer might want to try out on. But Ethereum needs to work on the huge gas fee also

Yes indeed your right. The second layer solutions provide some relief, but the market/investors have decided that the fees need to be lower.

I'm sure these alternative means will drive ethereum blockchain to attract more investors.

Sidechain have helped reduce ethereum transaction fee but not totally convenient for some users as transactions fee are little bit high.

We await more improved means of making transaction with lower gas fee.

Thanks for sharing.

Your welcome, and I agree that competition is always good to reduce the price of goods and services, like transaction fees, and competition drives innovation, which can help companies reduce the cost of its goods and services.