Experiencing the PancakeSwap Environment

Nowadays, I have DeFi (Decentralized Finance) applications on my agenda. Due to my banking background, the subject attracts my attention intellectually, and I want to take advantage of investment opportunities in this field. Those who follow my blog will remember that I wrote about Nutbox Pnut and Cub Finance before. And today, I will write about PancakeSwap, which is more widely used.

PancakeSwap is the largest DeFi app in the Binance ecosystem, currently ranked 25th among all cryptocurrencies with a market capitalization of $ 6.4 billion. The biggest in the DeFi world is UniSwap, which is part of the Ethereum ecosystem. I spent all the time I had left writing recently to get to know the DeFi world. Therefore, I will start by giving some theoretical information.

As can be seen from their names, the applications I mentioned above allow cryptocurrencies to be exchanged. The main sources of income are 2.5 per thousand to 3 per thousand commissions they receive during the exchange. The main problem they solve is that investors can access sufficient liquidity in cryptocurrency trading. So what does it mean to reach sufficient liquidity?

If a financial product has a buyer and seller who can buy/sell a sufficient amount at any time, we can say that liquidity can be reached in that financial product. It is not always possible to provide this situation with natural supply and demand in the market. That's why people or software called market makers are needed. In the field of securities, for example, banks take on this task. Uniswap and Pancakeswap provide liquidity conditions for the cryptos they list through algorithms that work as automated market makers.

Market-making is a business that requires a large amount of capital. Swap applications have solved this problem by creating liquidity pools. Investors invest in these liquidity pools and earn crypto money from the application in return. The value of the cryptocurrency of the application can be protected thanks to commissions received from swap transactions.

So why do investors like me want to fund liquidity pools? Because investments in liquidity pools provide APR up to 500%.

Now that I've explained the theoretical part of the matter, I can now tell how I realized the investment.

The Ethereum ecosystem has a cryptocurrency wallet called Metamask. I installed Metamask, a browser plugin, and converted it into a Binance Coin(BnB) wallet with a few minor settings changes. Then I purchased BNB on Binance.com and sent it to my Metamask BNB wallet and paired my wallet at https://pancakeswap.finance/ with Metamask using the 'connect' button. So my BNBs have become available in the PancakeSwap system.

On the Pancake menu, there are two main investment alternatives: Farms and Pools.

I want to start with pools. The logic of these financial instruments is based on staking a single cryptocurrency. The cryptocurrencies among the options are not well-known, but I can say that almost all of them are listed by Binance and have a story. In this option, APRs are around 100%. Payments are made through Cake, the cryptocurrency of the PancakeSwap world. The most important risk taken in pools is the decrease in the value of the crypto money you invested in. Returns are not stable, but as far as I have observed, large fluctuations do not occur. Payments are made constantly. It is possible to add the money you earn to the principal money or withdraw it by converting it to BNB. Addition to the principal, money is carried out over the 'compound' option. The transaction that needs to be done to invest in pools is to convert the BNB in our wallet to the relevant cryptocurrency through the Trade menu, activate the relevant pool, and deposit the cryptocurrency that pools.

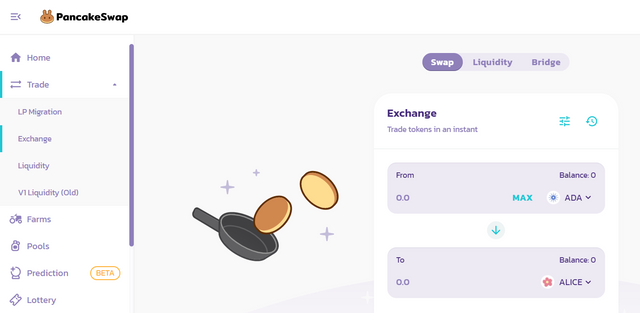

In the 'farms' option, we fund the liquidity pool of a cryptocurrency pair. One of the pairs is mostly BNB, and the other is a less familiar cryptocurrency. Using the 'Exchange' tab under the 'Trade' menu, we buy the cryptocurrency for half of the BNB in your account. Then, we buy the currency formed by combining the relevant cryptocurrency pair through the 'liquidity' tab under the 'trade' menu and adding liquidity to the pool. Finally, we 'enable' the relevant liquidity pool in the 'farms' menu and invest with the liquidity we just created.

The liquidity pool currency, which contains an equal monetary amount of assets from the relevant cryptocurrency pair, is actually a separate financial asset. Therefore, its value may increase or decrease according to supply and demand. We can track the value of the liquidity pools we invest in on the site https://howmuchismylp.com/. We see the cakes we won on the PancakeSwap site.

When we invest in liquidity pools, we take an important risk called 'temporary loss' and the price decrease risk of the relevant crypto coins. The system is based on the assumption that the %0,25 commission that Pancakeswap receives for exchange will cover the possible pricing risks arising from the transactions in the relevant pool. However, during some extraordinary price movements, the liquidity in the pool can be damaged, which can cause the money of everyone who has invested in the pool to melt permanently.

I want to talk a little bit about the transaction fees paid while using the system. While operating in the Pancakeswap system, processing fees are paid at many stages, but these fees are usually around 20-30 cents. As a market leader, Uniswap demands high commissions on transactions due to the nature of the Ethereum blockchain, and the Uniswap system does not allow small experimental investments. Low transaction fees and the completion of transactions in a couple of seconds are the main reasons for PancakeSwap's popularity.

Once we have stepped into the PancakeSwap world, it can be useful to track the assets we invest in with the logic of portfolio management. Portfolio tracking and transitions between investment alternatives would be the subject of another article :)

Thanks for reading.

Sources:

Pancake GIF

Cover Image

Yield Farming - Binance Academy

Defi - Investopedia