The crypto market is saturated with existing utility — A new layer-2 DEX could usher fresh interest into decentralised finance

At the start of 2020, the cryptourrency market saw a promising movement upward. The little market surge offered some kind of relief and hope because the last big market bear of 2018 has crushed most cryptocurrencies.

In 2017, the crypto market saw a bull-run that took the market capitalisation to its record heights. That market surge was a result of massive influx of early adopters who had realized the massive potential of blockchain technology. Currently, the penetration of cryptocurrencies are saturated through early adopters and there is now a requirement for fresh interest.

Despite the serious volatility of the crypto market, the opportunities that the market offers are huge and extremely tempting. However, one of the major challenges is that the cryptocurrency market remains heavily unregulated and particularly unfriendly to the ordinary person. Vast majority of the world's population often engage in investments casually and mostly require some level of guidance — a feature that's currently very rare within the crypto market. Cryptocurrency is fast becoming a mode of investment for people as they are choosing to align their finance with crypto. Individuals and corporations have sort to invest their fortunes in varieties of cryptocurrency assets, migrating from the traditional investment to decentralized finance. Cryptocurrency is offering a decentralised finance (DeFi) where people are sole custodians of their assets and investments.

Crypto exchanges and DeFi movement

As a core of the crypto world, exchanges are not only infrastructures for exchange of digital assets, they have become pivotal elements in the DeFi trend. Exchanges have offered a medium of entrance and also provided various features to aid the onboarding of new people to the crypto ride. They have transformed from the typical platforms where you bring a coin or token and exchange it for another or an interface where you trade assets for daily profit to a composite platform with series of infrastructures tailored to help you manage your finance and investment digitally.

The peculiar problems in the way of true decentralisation through exchanges

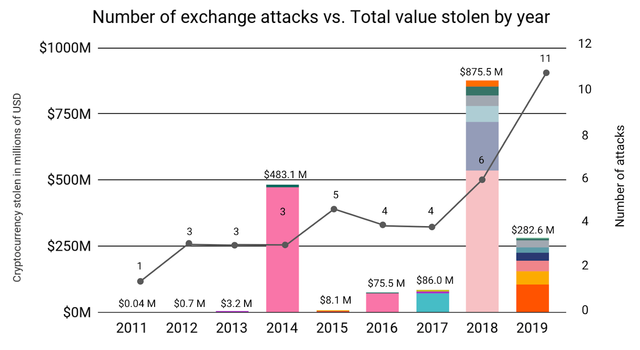

Blockchain technology is lauded for it's innovative concept of decentralisation. An escape from the precarious ship of centralisation. However, while exchanges have provided gateways for people to experience decentralisation, the market segment has particularly been dominated by centralised exchanges. Not only is this ironic considering that the operation of centralised exchanges make the platforms the custodians of the user's assets, but also because for the past decade, centralised exchanges have become easy targets for hackers to steal user funds.

Centralised exchanges have been compromised more times than can be counted. This is a particular problem that needs solution in order for the new DeFi movement to have proper footing. This brings the attention to decentralised exchanges; popularly called DEX. The design of decentralized exchanges makes it almost impossible for user assets to be stolen. This is because users are the real custodians of their assets and addresses containing assets needs to be loaded on the exchange everytime a user wants to perform a trade. Research has indicated that the target for crypto hacks are crypto exchanges and not wallet addresses.

A new Layer-2 DEX (Injective Protocol) can usher fresh interest that supports decentralized finance

A fresh wave of decentralized exchanges is been pioneered by Injective Protocol. Injective Protocol will provide the services of cryptocurrency exchanges and also be the new face of decentralized finance DeFi. The exchange is a layer 2 derivative protocol that aims to target the peculiar aspects of the exchanges that make it too challenging and undesirable for the ordinary individual such as security, convenience and guidance. The project is particularly designed to provide a wide range of services for user which will encourage them to trust the opportunities that they will stand to benefit through decentralised finance.

Convenience, Security & Guidance

Security

The general media often tends to focus on the weaknesses within the cryptocurrency market. The number of exchanges and trading platforms that get compromised through hack attacks have contributed immensely in discouraging adoption by the common person. Crypto exchange breaches over time has made people skeptical about the security of their assets. In fact, a shocking $1.1 billion worth of cryptocurrency assets was stolen in only the first half of 2018 alone. Another notable 7 hacks happened in 2019 which affected even Binance — the largest exchange by adjusted volume. Bitcoin worth of $40 million was stolen from Binance during the breach. The list of these breaches is endless. However one thing is common with these hacks — the exchanges that suffer them are centralised.

Although the damage that was done cant be reversed, Injective Protocol is developing a multi-layered decentralised exchange which offers safety measures which will win the interest of the overall market. The DEX by Injective protocol will provide a better degree of protection against theft and attacks which will encourage persons who have interest in investing in the crypto market but are afraid to lose assets to hacks are willing to utilise and trade more.

While the crypto market is seeing more adoption each day, exchanges are also embracing more secured protocols and algorithms geared toward attaining the required level of security for the properties of their users. Also most of new exchanges are fast moving towards legalization and incorporation with different regulations and derivatives. Injective protocol is building a premium product that's cored on solving the safety dilemma faced by cryptocurrency traders.

Convenience

The security of funds and user assets is not the only hindrance to mass adoption of cryptocurrency and digital assets. Vast portion of existing crypto exchanges offers a really crude trading experience compared to what traditional e-brokerage platforms offer for stock trading. A newbie crypto trader would have to go through huge stress before he finally get set up with the right pairs of assets to trade. The fiat conversion is often the problem for new market entrants. The long process is barely necessary to induce fiat ready for trading against a cryptocurrency. It creates an excessive amount of inconvenience to draw in casual traders and investors who happen to be the most important number of the population. Hence, Injective protocol is integrating both fiat and crypto pairs in one platform. The times of getting to hop between different exchanges to trade are over.

Service

While many businesses and financial enterprises have adopted customer-centric operations, the exchange segment of the crypto market became increasingly raw in comparison.

Most major exchanges take their customers with levity. And because the crypto community has adjusted to a lack of good customer support services, most exchanges don't have a designed framework on customer satisfaction. However, Injective Protocol is cored on building brand loyalty and needs to supply a more consumer oriented exchange services by valuing customer support.

Injective Protocol and the market

Injective Protocol is particularly targeting mass adoption by developing an a layer 2 decentralised platform that provide the services of decentralised exchange (DEX) and a decentralised finance (DeFi). The project team understand that the most effective way to motivate people to trade cryptocurrencies is to create a platform that actually reward the users.

Partnerships and Endorsements

The success of every new startup, businesses or developing enterprise is dependent on partnerships. Collaboration with innovative and important organisations within the crypto market is usually aimed to provide services and required exposure that will drive the new company forward. And Injective Protocol is not an exception — Injective Protocol has signed many of such partnerships with the big names within the crypto world so early on in the development of the project.

Project Strength

Injective Protocol layer 2 decentralised protocol is unique because it isn't created to created to compete against the existing trading platforms; instead, the project will work in harmony and improve on the existing offerings and usher in new wave of interest in DeFi.

Wrap Up

The stale state of crypto market is due to the saturation of existing utility. However, a fresh wave of interest in a compelling market segment can provide the needed catalyst in stimulating the market. Currently decentralized finance (DeFi) is the new face of cryptocurrency as both existing market users and prospective members are all interested in becoming the proprietors and custodians of their personal finance. People are becoming more aware of the benefits and ready to embrace decentralisation. Injective protocol is designed to be at the core of the new wave that would propel the crypto markets back to its record heights.

Hola, es muy interesante este artículo. No sé mucho, es más, solo se de criptomonedas, que es una forma de pago digital, pero no se más nada al respecto. De hecho es un tema bastante complejo y eso también hace que tanto personas naturales como comerciantes incursionemos en este nuevo modo de intercambio comercial, sobre todo cuando se trata de invertir. Pero según lo que leí estás explicando que el riesgo viene dado es porque está centralizado el lugar donde guardan las criptomonedas? Así como un banco digital? Entonces si estuviera descentralizado habría menos riesgo? Descentralizado sería como uno guardar el dinero en su casa, en vez de un banco? ¿Cuáles criptomonedas están descentralizadas y cuáles no?

nice article and I just follow you and read it your first paragraph nice

Thanks buddy.... You can check my blog and enjoy many more of my contents.

I read this article. I also agree that decentralized finance is really a new face of cryptocurrency .

I'm glad I read it. I hope u enjoyed it

Cryptos are the best in the world today because of it's security and convenience in trading

The convenience alone is unmatchable.