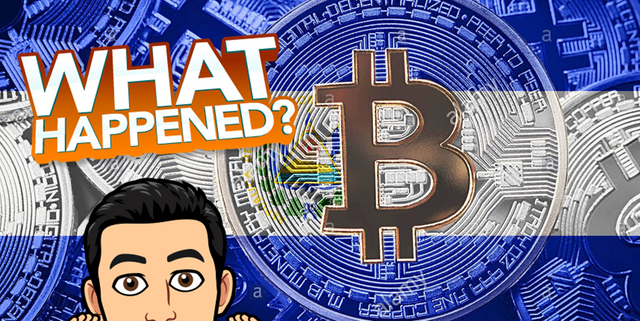

El Salvador, the crypto threat that must be stopped by Karupanocitizen

I do not usually write about political issues because I respect the ideological position of each person, and I hate polemics on issues in which it is almost impossible to achieve consensus, so this will not be the case either, however, as many of you will know, before During and after Nayib Bukele, president of El Salvador, proposed and then got the approval of the Bitcoin Law, many events have occurred, which I believe could forever change the balance of world financial power, all because of cryptocurrencies.

I would like you to join me in this critical analysis of the current situation in El Salvador and review where the problem that the Salvadoran people currently face originates from and why that experience has such a profound impact within the cryptographic environment.

A progressive president

Before going fully into the analysis of the underlying issue, it is important to place ourselves in the context of who Nayib Bukelele is and what motivated him to promote a law to impose Bitcoin as legal tender in El Salvador. Born into a family of Palestinian origin, Bukele based his political platform on the younger generations of the country, his proposal for change was based on seeking the modernization of the economic structure of El Salvador.

At the age of 37, Bukele was elected as the youngest president in America, his political banner has always been the fight against corruption, in all its forms, he has been accused by his detractors of authoritarian and disrespectful of government institutions.

Despite having declared his admiration for the development and progress of countries such as Canada, Germany, the United Kingdom, and even the United States, when questioned about the way he handled politics in his country, he asked for respect and made it clear that he would not be carried away by external pressures. He wants to be a progressive president and do things his way.

Dependence on the dollar, the evil of El Salvador

Until September 7, 2021, the only legal currency in El Salvador was the US dollar, according to calculations by its finance offices, 25% of the country's income comes from money remittances sent by the almost 3 million Salvadorans in the United States of America (its current population is just over 6,500,000)

Despite the agricultural, industrial, and service development experienced by the Caribbean country, the truth is that its economy depends on trade relations with countries such as Panama, Mexico and mainly with the United States, in all cases in a situation of inferiority concerning the rest, hence a change is required that allows it not only to break its commercial dependence but to further diversify its economy and attract foreign investment and collaboration.

The fear of crypto

Since the idea of the Salvadoran president was known, many have been the voices that have spoken against the non-application of the Bitcoin Law, but none with such insistence and weight, like that of the International Monetary Fund and the World Bank. In addition to such important financial entities, opponents of the media argue the unconstitutionality of the Bitcoin Law, the lack of clarity in the prevention of money or asset laundering, the tax burden that costs in infrastructure and operation will entail, but above all the political and economic instability of the country, a great wave of fear generated by a single word: Bitcoin.

Speaking in financial terms, fear is logical, anchoring the country's trade relations to a monetary exchange pattern with the volatility of Bitcoin is an extremely risky bet, but we must also take into account that we continue to depend on a foreign currency, whose monetary policy escaping from Salvadoran control is not an option for a country seeking financial independence.

A "decentralized" opinion

In my opinion, Buekele's bet is quite risky and I think it could have been avoided by creating stable coins backed not only with bitcoins but also with other cryptocurrencies, taking as a reference the investment models created by the De Fi, this would have transferred the losses and also profits, due to the fluctuations of cryptocurrencies, to the Salvadoran government and at least it would have created in society the feeling of economic stability that is so much needed, to create a climate of social tranquility. In addition, the use of smart contracts would have guaranteed the transparency and self-regulation of the value of said stablecoin, also generating confidence in foreign investors, especially those who understand and trust the blockchain environment.

It must also be borne in mind that there is no small thing that is played with the bet of El Salvador, if the adoption of Bitcoin ends up being a success for Bukele, it would be sending a clear message to the peoples of the world that depend on the dollar, to break that dependence, which would probably cause a loss in the value of that currency, a deterioration of the North American economy and would also promote the generalization in the use of cryptocurrencies. In this scenario, the big losers would be the current global centralized financial systems, with the dollar as its reference currency, while the current crypto market would be strengthened.

I would like to know your opinion regarding such an interesting topic, do you think the great world financial interests may have inflated the offer of BTC to pressure its decline in value? Do you consider Bukele's strategy to be right or wrong? Is your opinion on the reasons that motivate the current protests of some sectors of the people of El Salvador? I hope to read you in the comment box.

We keep reading!

Greetings @karupanocitizen, from my humble point of view the decision of the president of El Salvador on the implementation of BTC as legal menda was good, only that it should have accompanied by other measures to prevent the volatility of the cryptocurrency market can affect the economy of El Salvador. although for me cryptocurrencies will go up beyond that suffer low product of the instability of the market itself.

I agree with you my friend @carlir that introducing crypto as an investment mechanism by the government of El Salvador is a wise move, although a bit risky, we live it ourselves as members of this ecosystem, but not what I do not share with Bukelele It is the way BTC was introduced into the Salvadoran market.

Obviously the government seeks to generate income through the upward movement of the BTC, but the citizens of the country would not have to assume that risk, in addition, it must be a headache to be constantly adjusting prices due to the fluctuations of the BTC

Hello friend @karupanocitizen

When you say "I believe they could forever change the balance of global financial power", from my perspective the balance you mention has already started to shift, there are indications that the new protocols running on the blockchain aim to achieve greater privacy, scalability and fungibility of cryptocurrencies, an element that will no doubt attract more countries and also the private sector. Everything new generates resistance, but after a certain amount of time everything goes back to normal as a result of something intrinsic in us, such as evolution and adaptability.

Best of luck.

Greetings my friend @lupafilotaxia, there are indeed signs that the power correlation is moving, in fact many financial institutions (investment groups) already include cryptographic projects in their investment portfolio, however the distance between capital is still a lot financial that is handled through the global banking network and that moves on crypto exchanges.

I believe that El Salvador represents the first real experience of access to the cryptographic world of an entire society, not just a part of it, this if it goes well could motivate other peoples to see cryptocurrencies as a real exchange commodity and not a fiction digital without any importance and if so, the most affected, in terms of loss of value, could be the United States currency.

Have a beautiful day, friend!

I feel Bukele's strategy is right because it will increase the numbers of Bitcoin holders in El Salvador and also it will help those in El Salvador who are ignorant about crypto to have a broad knowledge on it.so @karupanocitizen this is my view on that thanks alot for sharing your ideas

Thank you very much friend @obiwoke for sharing your valuable opinion, I agree with the fact that El Salvador is taking a positive step by promoting the use of cryptocurrencies as means of payment, however I think it is being very risky in terms of its implementation, I consider that it should study measures that allow to take advantage of the upward movement of the BTC while facilitating the adoption of a stable currency for the country.