The importance of Liquidity in Exchanges

Hello Project Hope community, today I want to talk about one of the important points in all projects that are represented by a Decentralized Exchange, such as Liquidity.

Before delving into the subject, I would like to make a small differentiation between what is a decentralized Exchange and a centralized one. And the main difference is that behind the centralized (like Binance, Huobi, Poloniex, etc) is that there is someone who is the one who determines the policies by which that company is going to be managed, because finally they end up being that, and the commissions that are charged in these for each transaction go to this main team in the form of profitability.

In the case of decentralized exchanges, they are basically managed with smart contracts, and there are no intermediaries, no owner or anything like that, and the commissions that the protocol charges for each transaction are distributed among all those who provide liquidity in that system.

And this is where this important term comes in, in both cases (centralized and decentralized) they need liquidity, that is to say, that there is enough capital in the Exchange so that at the moment that an order is executed, either for buying or selling, there is enough solvency for it to be carried out.

That is why it is important that in these decentralized projects, the funds that are added as liquidity can be kept there for as long as possible; in a way, this is one of the great problems faced by decentralized exchanges. But, finding ways for investors to keep their funds in the protocol by seeing gains, implies a degree of trust that needs to be created.

That is why in the projects that one creates, and wants to invest, you should know that by adding liquidity we are directly supporting the project and it is logical to see this as a way to give it stability.

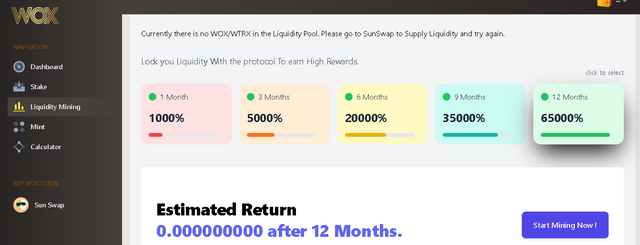

There are projects that offer a higher profitability the longer you decide to keep your liquidity in the protocol. I have recently added liquidity in WOXDEFI, and I have chosen to keep my capital invested there for as long as possible, in this case, for 12 months, since it is the one that offers the highest profitability, and because I am particularly going for the long term with the project.

Note: this is not financial advice, it is an informative post. Before making any investment be sure to do your research.

I authorize the use of this banner to everyone who wants to do it.

Twitter | Instagram | Discord | Youtube | Telegram: @josevas217

|  |  |

|---|

Hello @josevas217, I think the most difficult part is that the project inspires enough confidence in the investors so that they keep the funds there, for a long period of time.

Some projects that we have trusted since their inception somehow do not develop as expected and this is what generates distrust in investors and mass withdrawals occur that significantly affect the projects.

Yes, this is a problem. I have also had some bad experiences in this regard. The DeFi environment is often complicated.

Hello @josevas217.

The truth is that there are many projects that fail to maintain liquidity, maintaining the interest of investors, with the aim that the pool remains full of resources supporting the sale of small investors and the growth of the amount of token, a complicated issue but some projects get it with the implementation of burning.

I think that only the.burning, in the.actualidsd is no longer sufic

Greetings @ josevas217

A very precise and clear publication that explains perfectly to leave no doubt about centralized and decentralized projects , no doubt that placing capital for a long time shows that there is confidence in the project , and invites to do the same to future investors .

Thank you very much for sharing such an interesting publication

All this is so new that it is not possible to be sure that any project will be successful. The reality is that few survive.

I only bump into that post of yours @josevas217

I must admit that even after reading it, I'm still unsure how some DEFI (like WOXFi) are collected liquidity into generating profits. For me, often it does look like this liquidity is just "sitting" there.

One could think, that that liquidity will be used to allow people to trade on the exchange. And that part of fees will be used to buy-back native tokens (minted by liquidity providers). But Im not sure if this is the case.

Cheers, Piotr

@josevas217 Excellent explanation! Very short and easy to understand. If I am discussing crypto the next time with a friend I will definetly refer to this article! :)

Thank you very much for your support

@tipu curate 2

Upvoted 👌 (Mana: 4/6) Get profit votes with @tipU :)

Putting your money in pools can definitely work in peoples favor and it can also help keep the price in a relatively stable position. Too much movement with low liquidity can make price changes very volatile.

@josevas217 this article really touched hidden areas on exchanges so you did a great job explaining this topic

Thank You.