What is Spot Trading?

Spot Trading

The most common method of trading cryptocurrencies

Ways to make money from the digital currency market are very diverse.

#Cryptocurrency trading has become one of the most common ways to gain wealth from the cryptocurrency market.

There are many ways to trade in this market, the most common of which is spot trading.

This type of trading is usually opposed to futures trading. In this article, I explain this trading concept.

What is Spot Trading?

Spot trading

is a transaction in which the traded goods are exchanged between the buyer and the seller at the time of the transaction.For example, in a bitcoin spot transaction at the time of trading, the bitcoin is transferred from the seller to the buyer. This type of transaction can be considered as the opposite of futures trading.

In futures transactions, the traded goods will be exchanged between the buyer and the seller in the future and on the date specified in the contract.

What is Spot Price?

In some texts, this term is usually used to describe the price of an asset.

For example, the Spot price of Bitcoin is $18,380.

You probably guess the meaning of this phrase.

Bitcoin Spot Price means that if someone wants to buy this currency right now, they have to pay $18,380.

The spot price is set by each Bitcoin trader or any other asset and is constantly changing.

The concept of Order Book in Spot Market

An order book is a list of purchase and sale orders of an asset offered by each individual in that exchange or market.

To illustrate this concept in financial markets, consider that people who intend to buy bitcoin place their purchase order in an exchange office.

At the time of ordering, each of them announces their bid price and the amount of BTC they intend to buy.

On the other side of the market, there are people who want to sell their bitcoins.

These people are bitcoin buyers and sellers.

The exchange shows all the sales orders of individuals in a list. List of buyers and list of sellers.

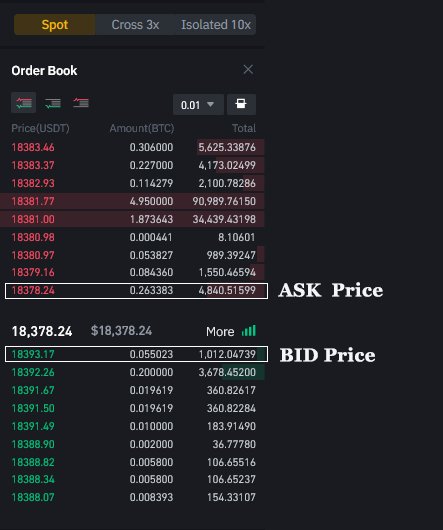

Such a list is called an order book. The image below shows the Bitcoin Order Book at Binance Exchange.

The concept of Ask and Bid and the power of liquidity

After knowing the book order in Spot Market, learning the two concepts of Ask and Bid is not a difficult task.

Ask and Bid refer to two specific prices in the Order Book.

Bid price refers to the highest price that a buyer is willing to pay to buy an asset.

Ask price refers to the lowest price at which the seller has sold his asset.

In the order book, the Bid price is the price shown at the beginning of the buyer order list, and in an Order Book, the Ask price is the price at the beginning of the seller order list.

The image below shows these two concepts in Binance Exchange.

If the difference between the highest price in the sellers sector and the lowest price in the buyers sector is low, there is more liquidity in that market.For example, Bitcoin has a very high liquidity in the #Binance exchange, because the difference between the bid price of buyers and sellers is very low.

Types of trading orders

In this section, I will refer to the types of trading orders in Spot markets.

There are different types of buying or selling orders in financial markets.

If you have worked with exchanges such as Binance, you may have encountered the options offered by Binance at the time of trading when buying and selling a digital asset. In this section, I explain these orders:

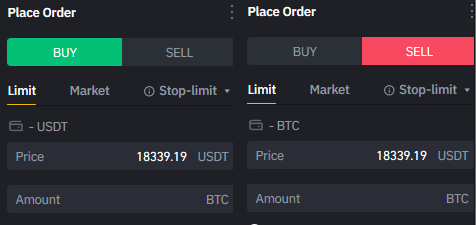

Limit Order

Ordering limit or ordering with a fixed price is one of the simplest types of buying and selling orders. You can see this order in the image below.

Suppose we want to buy 1 bitcoin for $18,300.

When ordering with this method, two parameters must be specified.

Price and purchase amount.

Enter the purchase price in the Price field and the purchase amount in the Amount field.

Finally, by clicking the Buy or Sell button, your order will enter the Order Book.

Market Order

In this type of order to buy and sell a digital asset, we determine only the amount of buy or sell and allow Binance to sell or buy our asset at the price of the last transaction in the market.

Stop limit

This type of order is divided into two subcategories. Stop Limit Order provides more parameters to the trader than the previous two orders.

Stop Limit Order is the same as Limit Order, with the difference that there is a prerequisite for activating this order.

For example, the price of Bitcoin is $18,300, and your goal is to buy it when the price crosses the $18,500 resistance.

This condition is called Stop.

To register this order, three components are required: purchase price or limit, purchase amount and condition for making a purchase or Stop.

Binance will finally place your order according to the price you have registered in the Limit.

But this order will be placed in the Order Book if the Stop price condition is met. In fact, after the Stop condition is satisfied, this order will become a Limit Order.

OCO Order

This order stands for One Cancel the Other.

This order is a combination of Limit Order and Stop limit Order.

When one of the two conditions is met, the other order will be canceled.

In this order, four components are determined by the trader.

In the Amount section, the order amount is entered, for example, 1 bitcoin.

In the Price section, a price is entered that is entered in the Order Book and as soon as the price of Bitcoin reaches this set price, the order is placed.

The Limit section is also the price at which the trader intends to purchase this asset, but this order has a Stop or precondition.

The price entered in the Limit will enter the Order Book only if the condition of Stop is activated, otherwise this order will not enter the order book.

Let me end the discussion of orders with an example.

Assume that Bitcoin is currently priced at $18,300. According to your analysis, $18,500 is a resistance and $17,900 is a support for Bitcoin.

According to your trading strategy, if Bitcoin breaks $18,500, you will buy it, or if the price of Bitcoin reaches $17,900, you will buy it because it is a support point for Bitcoin.

If you buy bitcoins in two different places, you need an OCO order.

In the Price field, enter $17,900, because the price of Bitcoin is currently in the range of $18,300, your order will enter the order book at the same time, and if Bitcoin reaches $17,900 , Your order will be done.

In the Stop field, enter the entry condition for the other mode, which in this example is $18,500.

In other words, you are telling Bainance that if the price of Bitcoin breaks $ 18,500, enter my order in the order book, but at what price? Enter this price in the Limit field, for example $18,520. When Bitcoin breaks $18,500, your purchase order will enter the order book for $ 18,520.

Note: The sales order will be the same as above and there is no difference.

I hope the content is useful and I hear your comments.

With Respect, Hossein Rad

The world of trading is occupied with so many terms that requires explanation and before a person becomes a good trader, there has to be an understanding in order for a smooth running to happen.

I agree with you.

Most of the mistakes were due to lack of awareness.

This is a pretty good explanation for those who are just integrating into the world of trade and investment, there are many people who have the capital to invest but do not have the complete knowledge to be able to do it efficiently, this publication is going to help them a lot to know how they should proceed.

@roronao07

Thanks for your comment👍