The Down of Fiat Currencies? Golden Age of Silver and Gold (Posts of the Week)

Two comprehensive posts about the gold and silver price forecasts some leading analysts and gurus made recently. Do you imagine threefold or fivefold silver or gold prices? Three-digit silver and 5,000 dollars for an ounce of gold?

Precious metals are moving in a strong bull market in last weeks. Analysts and investors seem to be more and more optimistic. Are metals surging, or is the value of fiat currencies, especially the USA dollar deteriorating, in reality?

This is my weekly post recommendation for you with a few new publications. I started a project on my financial web page, Ageless Finance, publishing now “charts of the day” and list posts for my readers. Some are larger, comprehensive posts about personal finance and investing themes. If you are interested in the topics, lists, or the charts, just click on the image.

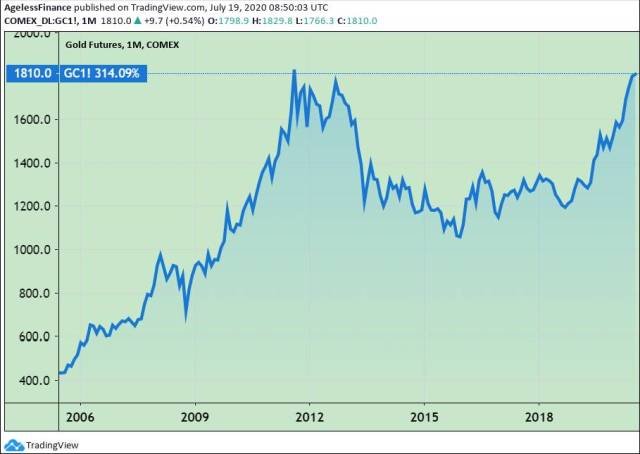

11 Top Gold Price Forecasts of Smart Money–How High Can It Go?

Gold price surged over 1,900 USD this week, very close to its all-time-high in 2011 ($1,920, approximately.) Seemingly, the higher the price of gold goes, the more optimistic analysts and investors we see.

- Gold price forecasts jumped these weeks with the gold price.

- The highest ones reach thousands of dollars.

- “Smart Money” is predicting higher gold prices and may buy gold.

- But, analysts are betting seldom against the trend.

Click the picture to view the full post:

Top 9 Silver Price Forecasts for 2020 and 2021–Is Something Colossal Happening?

This week, the silver price broke out, quickly crossing the twenty-dollar level which was the one-year-high. It topped at $23.40, a price not seen for seven years. Silver has converted from an underperforming precious metal into an outperforming one in days. Year-to-year, it rose 37 percent, while gold only 31 percent.

- Silver price forecasts are optimistic as the metal hits a seven-year-high.

- In the short and middle term, $30-$50 estimates exist.

- In the long term, some analysts are predicting triple-digit values.

- This is not unrealistic given the inflation since previous peaks.

- What do silver price estimates tell us?

Click the picture to view the full post:

The 3 Biggest Challenges in Personal Finance Today

I recommended this post also last time, but it seems very important today. Because of the pandemic, three things are becoming very important in personal finance.

- The worst problem for some people will be how to get enough active or passive income.

- Savers will struggle to keep the value of their investments.

- The situation of indebted individuals, states and companies is mostly deteriorating in the crisis.

- Ageless Finance will focus more on active and passive income sources.

Click the picture to view the full post:

Follow me!

You can also follow me on Twitter, Telegram, Facebook, Minds, Steem, and Hive.

My Previous Chart and Post Recommendations:

How to Dictate Your Posts? Which Are the 3 Biggest Challenges in Personal Finance Today?

13 Brilliant Free Apps for Bloggers, Investors and Freelancers, DIY Fake News Generator

29 Zoom Alternatives, 4 Main Ways to Buy Gold, Surprisingly Stable Real Estate Prices

7 Reasons Not to Gamble, Robinhood and The Woods of the Contrarian, 17 Quarantine Ideas Useful Forever

17 Fake Passive Income Ideas Explained, FANG+ Stocks and Gold Price Explosion

11 + 1 Grave Investment Errors, Brazil in the Abyss, People Need Online Work

11 Countries in Trouble, Busting the Myth of the Dividend Aristocrats

Facebook Is Earning on You, Pre-Corona Stock Prices, Financial Repression

Oil Crash, Streaming in Quarantine, Best Investment in 2020

(Photos: Pixabay.com)

Hello @deathcross

Every time I read one of your publications, I think about it. You clarify some things, or give hints, and leave other doubts. Especially about what one is doing to protect oneself when the real hard times come.

I don't know what to expect from so many bad predictions. Because the fact that silver and gold goes up benefits those who have it but it is not for everyone. At least those of us who don't have it, I think it's more like devaluing fiat currencies... I'm not really very literate in these matters. But your posts are very interesting

Some people think gold and silver (also stocks) are surging. Others think, all diluted fiat currencies are declining. Bud inflation is still moderate.

Protection against inflation and currency-devaluation: "real assets".

Thanks for your nice comment. 😎

Hi @deathcross

It's brought to my attention that you refer to "real assets". Within the investment plan or as a way to protect oneself from the crisis, don't you think that crypto currencies are a good shelter?

I ask because I know the economy is your area, and I would like to know what you think.

Sure, freeing you from responsibility, it's just out of curiosity.

I know I don't know anything. Nothing is sure. As I wrote to another friend below:

I'm watching cryptocurrencies since 2013, and the progress seems to be slow. Crypto-space often lags behind fintech apps. But I hope some catalyst appears which gives a new push, more momentum. Like Ethereum 2.0 or some new business model.

@tipu curate

Upvoted 👌 (Mana: 4/20) Trade Steem <-> BTC from your Steem wallet :)

Thank you very much.

Gold and silver were actually the used for transaction during the ancient period before the use of cash and it really great that these two commodities are widely used by humans and till date we still have people investing in them but we're now in the Era of cryptos in which cryptos will surely be used for transactions around the world.

Thanks for sharing this great post with love from @hardaeborla and I hope you have a great day ahead 💖💕❤️

Thank you.

I don't think anything is certain in this world. They may discover a new technology that makes bitcoin redundant. They may discover a golden asteroid that contains more gold than there is on Earth in total. The solution: Diversify...👑

Hi @deathcross

Thanks for the info about silver. I am interested in silver or gold back crypto. What’s your opinion ?

I also enjoyed the dictation article from a few weeks ago. I am using Siri dictation for text messages and next I will try dictating a post.

@shortsegments

If you really want to know what's about to happen with Gold and Silver, you should consider clicking on one of my Posts...

July 26, 2020... 15.6 Hollywood Time...

Hi, as I wrote in my disclaimer: I'm long in silver, platinum, junior gold miners. Many factors speak in favor of precious metals (and other real assets like stocks and real estate). But I'm prepared also for a steep correction in shorter term if deflation appears.

In fact, it doesn't matter if inflation or deflation happens. Only people must think inflation is a danger. Ant the reality is the negative real interest rate in most countries.

TINA - there is no alternative than real assets.

I think in the longer term I should change silver and platinum ETFs for miners stocks.

My Posts are usually over-looked and mine are the most Valuable...

July 26, 2020... 15.6 Hollywood Time...

Thanks.

I wasn't kidding about my Posts...

July 28, 2020... 3.2 Hollywood Time...