Bright Era of Commodities? Interesting moves in European Stocks, Lumber Price, Turkish Lira, Zoom

Commodities may surge with more money printing and inflation, a weaker dollar, but also with economic recovery. Many exciting raw materials exist, not only the usual crude oil or gold. Why are European stock underperforming, and which 35 Zoom alternatives did we found?

I’m more and more engaged in commodity market investments. Because of the huge money printing of central banks, the economic growth expected next year, and the electric car revolution. All these can raise prices. Unlike equities, many commodity market investments aren’t really expensive yet, especially when past inflation is also taken into account. Lumber is an interesting commodity, even after this year’s price explosion.

But stocks are also essential from today’s portfolio. The question is better: which country, region, and especially which sector to choose after so many price increases. Europe seems undervalued. Or, is it only the usual value-growth discrepancy?

Many Zoom Alternatives

Video chat software is a very competitive market. If you want to know more alternatives to the common Skype, Zoom, Whatsapp, Messenger services, take a look at the 36-item list linked below.

This is my post recommendation for you with a few new publications on my financial web page, Ageless Finance. Shorter and longer, comprehensive articles about investing themes. With many charts and lists. If you are interested in more details, click on the images.

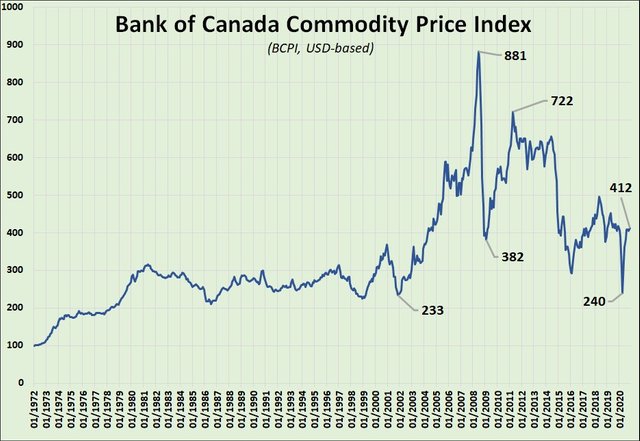

8 Compelling Reasons to Watch Commodity Investments

Perhaps, people should buy more gold and other raw materials. (And, also cryptocurrencies.) Some economists are predicting the collapse of the dollar and other fiat money types. In the first place, because of the exponential acceleration of money printing, or the “endless quantitative easing” we experience this year.

- Commodity investments may enter a bull market soon.

- Money printing, government rescue packages, inflationary risks, and economic recovery are the main reasons.

- Fiat currencies may depreciate, the dollar already moves in a falling trend.

- Where are commodities in the super-cycle?

Click the picture to view the full post:

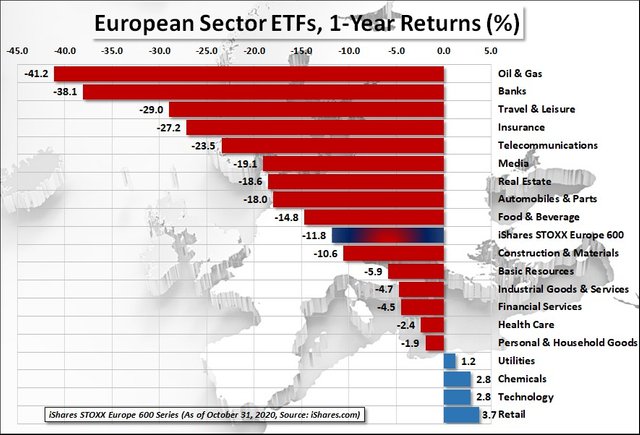

Time to Buy European Stocks Instead of US Ones?

Some analysts say we should buy European stocks now rather than overpriced American ones. Because European indices are underperforming for many years already. European stocks are undervalued, or, at least, less overvalued.

- The Stoxx 600 index nearly stagnated in the last ten years.

- There is always some crisis on the continent giving reason not to buy European shares.

- But there are huge differences between the different countries and sectors.

- You can include this continent in your portfolio.

Click the picture to view the full post:

35 Zoom Alternatives and the Zoom Stock Price Explosion (Updated for 2021)

The story of the Zoom application is a story of success. But the video-chat or video-meeting market is huge and very competitive.

- Zoom alternatives are plenty. We found 35 (click for the list).

- Zoom stock price surged more than 600 percent this year.

- The last two quarterly reports were better than expected. The outlook is bright.

- But the competition is also very strong.

Click the picture to view the full post:

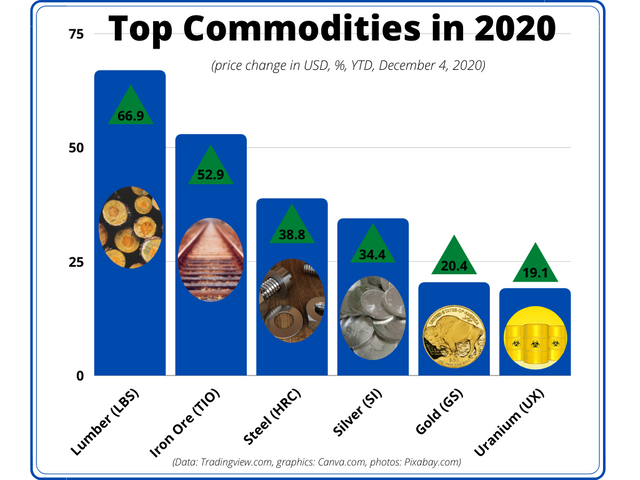

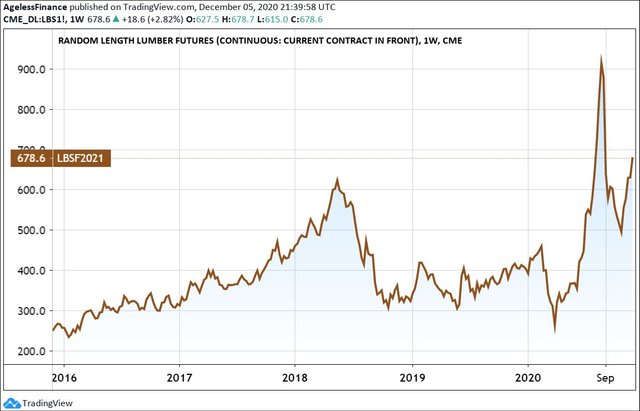

Lumber Price Exploded–Look at the Very Best Commodity Investments in 2020

The markets of less frequently traded materials are very volatile but offer high returns. A good example is lumber, the top commodity in the year 2020 on American commodity exchanges, so far.

- The lumber price surged approximately 70 percent this year.

- The supply declined, lumber mills cut back on their production.

- New home sales in the US stayed surprisingly high, DIY projects also curbed demand.

- What if even more people move to the suburbs? Much more demand for lumber?

Click the picture to view the full post:

The Rebirth of the Turkish Lira And Turkish Stocks (a Tale from the Crypt)

The Turkish lira and the Turkish stocks have miraculously reborn in the last couple of weeks. On the bottom, in early November, traders gave 10.2 liras for a euro and 8.5 for a dollar. These were new all-time lows for the Turkish currency.

- The Turkish lira and the Turkish stock market fell to record lows a couple of weeks ago.

- The economic situation of the country seemed almost hopeless.

- But the president changed his mind and promised a new economic policy to investors.

- Turkish assets skyrocketed, stocks jumped 35 percent.

- But many investors stay cautious.

Click the picture to view the full post:

Follow me!

You can follow me on Twitter, Telegram, Facebook, Steem, Hive, and Mastodon.

My Previous Post and Chart Recommendations:

The Big Tech Winter, Greedy on Energy Stocks at the Bottom, Real Highs of Platinum, Historical Lows of Crude

My Best Posts: Part-Time Jobs, the Real Price of Gold and Silver, the Longer-Term S&P 500 Sectors Performance

Extreme Crypto Transaction Fees, Natural Gas Price Explosion, Traps in Blogging SEO–Posts of the Week

The Down of Fiat Currencies? Golden Age of Silver and Gold

How to Dictate Your Posts? Which Are the 3 Biggest Challenges in Personal Finance Today?

Disclaimer:

I’m not a certified financial advisor nor a certified financial analyst, accountant, nor lawyer. The contents on my site and in my posts are for informational and entertainment purposes and reflecting my collection of data, ideas, opinions. Please, make your proper research or consult your advisors before making any investment or financial or legal decisions. I may have positions in the investment assets mentioned in this post.

I am really surprised to hear and see that zoom has 35 alternatives that much

I think Google, Facebook, Microsoft, Amazon, Apple are the most dangerous ones in this competition fight

Maybe more.

Thank you for reading.