Using bitcoin as collateral in the banking system

In the traditional banking system, it is quite easy and straightforward to borrow money from collateral such as stocks, real estate, or bonds.

This allows wealthy business owners, companies, and individual customers the ability to hold assets forever, without having to sell them when they need to use a small portion of their assets. They simply mortgage their assets with banks, and they get loans at low-interest rates, and often such loans avoid being taxed by government agencies.

Currently, the cryptocurrency ecosystem has built up a complex set of contracts and derivatives that can use bitcoin as collateral.

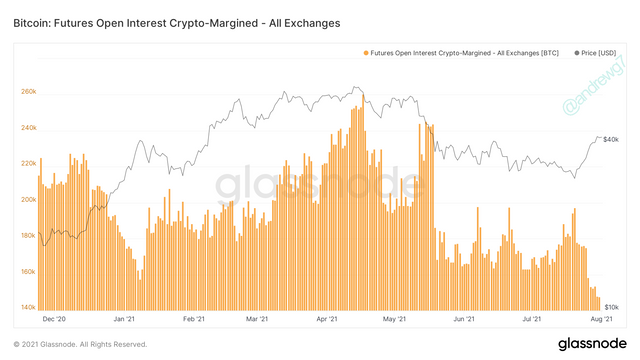

Below is an open interest for futures and options contracts using bitcoin as collateral.

As you can see, as the price of bitcoin goes up, the volume of bitcoin used as collateral also increases, peaking in April 2021.

The integration of bitcoin into the traditional banking system will create a new way for companies to approach a new capital, less inflationary source of capital relative to the dollar. This is similar to what Michael Saylor did with MicroStrategy, they will become more popular.

Instead of merging companies, buying and selling stocks, and then increasing the stock price, companies will tend to accumulate bitcoin as a high-value asset that has the ability to against inflation and add them to the balance sheet.

With the dollar, additional units are created through lending, whereas in bitcoin there will be only 21,000,000 and this cannot be changed. Therefore, holders of large amounts of bitcoin have the maximum collateral to borrow at low-interest rates, with little risk, to get more profit without having to sell their entire assets.

I firmly believe this will happen on a massive scale, and MicroStrategy is at the forefront.