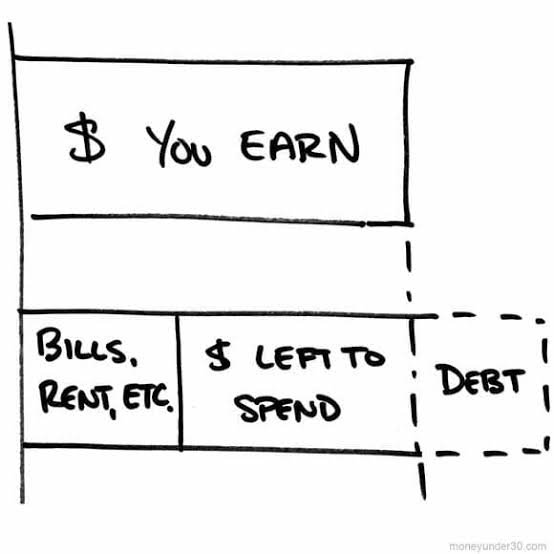

Balance your earning and spending.

When most of us hear the random financial advice of paying ourselves first, the very first thing that comes to mind is taking a percentage of the money we earn and go do some shopping or get ourselves an expensive wine but that is not the literal meaning of that word instead what it means is that for every earning that we make, we need to set aside a certain percentage that we will save up somewhere and for every of our earnings, that percentage has to be a fixed one either it is going to be a 10% at the end of every month or if it is going to be a 20% that will be based mainly on individual preference.

In the case of doing something good with your finance, it has never been about the amount been earned instead it has always been about the amount saved and the amount used for something good. If you continue to spend as much as you earn then be sure that you are in for some serious trouble when the next pay check does not surface.

Even if we are faced with the opportunity of hitting a million dollars today, it is only a few persons that will be able to utilize that money appropriately, so many people will spend the money lavishly without even paying off their debts. It takes a serious money management knowledge to increase obtained money and take advantage of opportunities that could guarantee serious money increase.

Keeping track of finances can never be an over mentioned point, keeping record of every single money gotten and every single money spent will save our financial life from a lot of disaster. It is a careless financial mistake to continue to earn and spend without even realizing where the money is going into. The continual delay of keeping track of expenses is going to stop us from reaching any set goal financially, it is in our best interest that we sort out the financial records immediately and then we can figure out where our money is going into and what we can do to get better.

Classify your expenses.

For every money earned there must be a process of spending going on, that way the economic situation is going to be just balanced but the choice on where the spending should go to matters a lot as well.

The first category is your needs, these are basic things that are important for your survival, when filling out this category you have to be completely sincere with yourself here and only include those things which your daily survival lies upon.

The next category happens to be your wants, we all have wants but we know deep down in our hearts that are unnecessary and we have the ability to survive without them, so in this category you have to learn how to reduce it to the nearest minimum.

Another category is the aspect of savings, it is advisable to save first for rainy seasons and set up emergency funds when they will be necessary and after that begin to save for investment opportunities that may present themselves or those that you look to personally go after.

Greetings dear friend, there is no doubt that maintaining a balance between our remunerations and our expenses is something that will allow us to be more financially efficient, generally people tend to spend more than they earn, maintaining many debts.

Thank you for this excellent article

Only a very few people actually monitor their expenses but only if we realize how very important it is for us to monitor our expenses, then we will do it even more.

Excellent recommendations, the title of your publication caught my attention and that's why I came here. Balancing income and expenses is excellent to be able to manage ourselves very well. Thank you for sharing.

Financial Markets Analyst.

@lenonmc21