Unleashing the Power of Active Investing: Challenging the Passive Paradigm

Welcome to my latest blog post. No surprises here: I'm all about active investing, the real deal, and really not a fan of passive investing. But there's a catch to this view – you have to know what you're doing. Seriously, why should someone who actively manages their money end up making less than a passive investor? It just doesn't add up, does it?

Let me break it down for you. An active investor should be raking in more money, unless we're talking about a total shock in the system like a stock market crash or, of course, when the active investor has no clue what they're doing. Makes sense, right?

Now, brace yourselves for a mind-blowing tale from 2017. We all know Warren Buffet, the legendary guru. Well, he actually won a bet against those fancy hedge funds, claiming that good ol' index investing (the passive one) would outshine the returns of a cherry-picked group of hedge funds (yep, active folks) over a decade. Boom!

Buffet points the finger at those sneaky fees. Let's talk numbers: these hedge funds have the audacity to charge a sweet 2% of all incoming investments and grab a cheeky 20% of the profits (after accounting for the so-called waterfall strategy – losses from previous years are first in line to be compensated before any profits can be declared). Talk about a hustle!

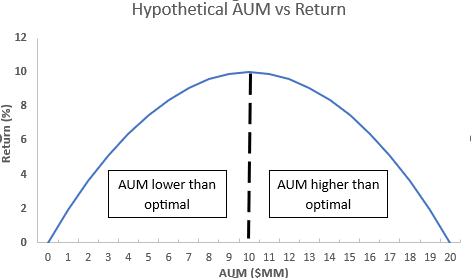

Now, here's where I come in with my two cents. I've been in the trading game for nearly a decade, and I reckon those fees aren't the sole culprits behind the hedge funds' defeat. Nah, it's all about the size, my friends. You see, every hedge fund strategy has its sweet spot in terms of monetary size for execution. Go too small, and you can't fully exploit those juicy arbitrage opportunities. Go too big, and you become an inefficient mess, devouring your potential returns like a ravenous monster.

Why doesn't the hedge fund industry with all its smart folks not know this? You bet they do but the concept of optimal firm/AUM (assets under management) is not consistent with the operating model of a hedge fund whose only goal to continue to grow its AUM (of course it can't do that by consistently loosing money, so it has to continue to figure how to make profits just as it fulfills its growth agenda). Think about it. If you are a hedge fund manager, do you tell all future investors that you won't take their money because you've reached optimum size for your strategy? Of course not! Only a hedge fund led by Mother Theresa will do that! And that my friends lies the fundamental weakness of the hedge fund model and why Warren Buffet won this bet.

What is the solution? I really believe that it is better to have an AUM lower than optimal than to have one that is higher than optimal. The reason is that inefficiency is significantly detrimental to returns especially when you consider a higher monetary base. This is why it seems newer hedge funds tend to perform better than older more established hedge funds even after accounting for risk. This is because the newer hedge funds are still growing and more likely to be on the lower end of the optimal point on the AUM curve compared to older more established hedge funds that will be on the higher end AUM. If you assume the returns vs. AUM curve as quadratic, the best hedge funds for your money should lie on the left of the curve (see figure below).

Now, how do you find hedge funds on the left side of the AUM curve for their given strategy? There is no easy answer, but the best answer is you start your own hedge fund yourself. Think about it, if you start a hedge fund (account to be more precise) with $10,000 for example, you are more than guaranteed to be on the left side of the curve for a very very long time so much so that you don't have to worry about being on the right side for any practical length of time for the fund/account. This is why individual traders outperform hedge funds and why I invite Warren Buffet to make the same bet with a cherry picked set of individual traders. Hint: He won't because, this time, Buffet will be guaranteed to loose!

So, folks, there you have it. Active investing versus passive investing – a showdown for the ages. But let's remember, size does matter in this game. Find that optimal hedge fund size (or better still, grow one yourself), and you'll unlock the true potential of your investment strategy.

Happy investing, and remember, continue learning!

AI + Finance

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.