The Rich Are Fleeing Illinois According To IRS

Abuse people and they will leave. This is a stark reality that some states are starting to face.

The "tax the rich" mantra is in full force and has been for some time. This is a convenient way to cover the fact that governments all over the place are facing shortfalls.

In the past, this was a more effective strategy than it is today. With people making money in non-traditional ways means they are mobile. This is especially true for the wealthy.

When we lives in a manufacturing society, business owners were tied to a physical piece of real estate. Thus, picking up and moving, unless at retirement, was not very easy.

Contrast that with how people make money these days. With so much taking place online along with improved communication systems, the ability to relocate is much easier.

This is exactly what the State of Illinois is facing. For years, the state was known for excessive spending. This led to an equally high tax rate, especially at the higher end of the spectrum. In that state, along with elsewhere, it became fashionable to attack the rich. Politicians hammered this point home for decades.

Now, people are taking their money and leaving.

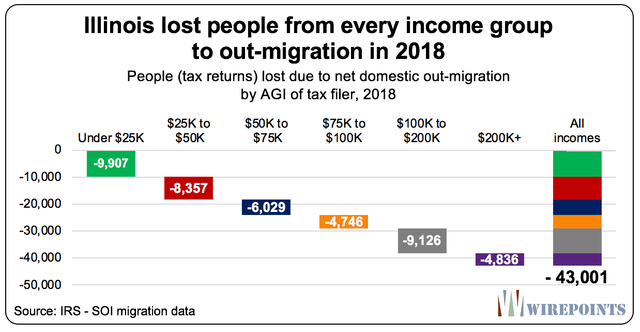

According to the IRS, Illinois lost over 43,000 taxpayers who migrated out.

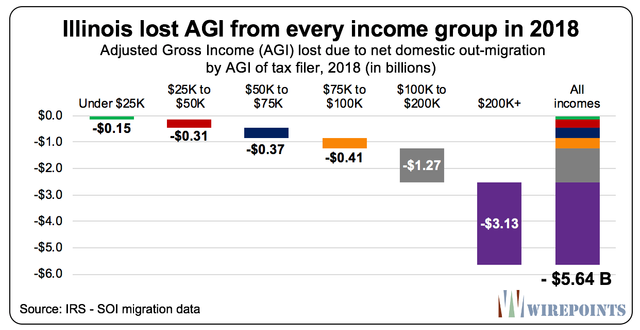

The taxable income that left amounts to $5.64 billion.

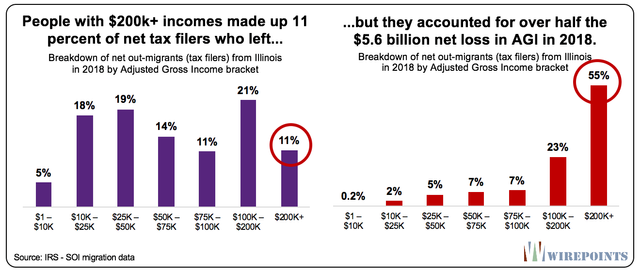

One of the biggest challenges for the state is the fact that the $200K+ income earners accounted for 11% of the people departing yet accounted for 55% of the income lost.

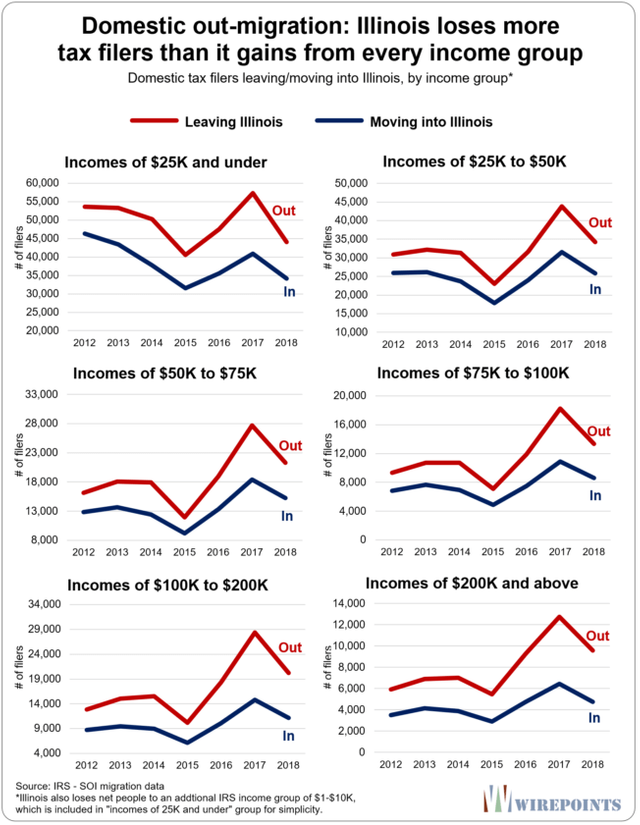

The above information is based upon tax filing year 2018. This is not a new situation though. Since 2012, the migration out took place in all income groups. Nevertheless, the upper end earners have consistently left the state, making things worse because they took the massive incomes with them.

Illinois is not the only state to experience this. IRS records also show similar occurrences in New York, New Jersey, California, and Massachusetts. States with high tax rates are going to find this not only continues, but likely accelerates. With an aging population, it is likely a lot of retirees are going to move as the economic circumstances affect them.

On the flip side, states such as Arizona, Texas, and Florida are seeing net increases in migration. With people being less tied to a geographic area, migration is now a viable financial technique employed.

The question is how long until politicians realize what is taking place. Their inherent need to demonize the upper income earners is coming back to haunt them. How are they going to reconcile with these groups after attacking them for so long? If the trend continues, the massive shortfalls in spending are going to be harder to close since more income is going to be leaving these states.

If you found this article informative, please give an upvote and resteem.

Posted via Steemleo

Illinois is turning into Europe.......High income taxes, high sales tax, high property tax, rain tax, tolls, and shitty weather. Stay out of Florida

Posted via Steemleo

Congratulations @taskmaster4450le! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

EXACTLY why they are pushing so hard for world governance. Then there will be no place to flee outrageous taxation and anyone not in bed with the political elites will be a peasant.