SPInvest: The Opportunity By The Numbers

I decided to play a bit with the numbers in an effort to show the exponential potential of the SPInvest token. Please keep in mind that, unlike many tokens, this is an asset-backed project. The STEEM that comes in from the purchase of tokens is powered up. This feeds the repository to put the SP to work, thus growing the incomes of the club, offering more value over time.

We can look at this from two perspectives. The first is as a passive opportunity. Someone could buy the token and just let it grow in value. The second is where one can take a more active role.

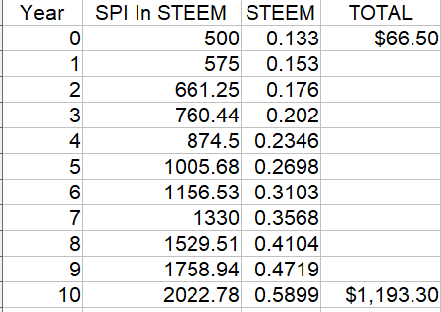

For the example here, I am going to use a starting point of 500 STEEM. The club mentions a targeted 20% return annually: something that I will cut down to 15%.

Here is what it all looks like.

Here we see the enormous potential of this opportunity.

To clarify, the price of STEEM was arrived at using a 15% annual growth rate. So this begs the question, does anyone thing the price of STEEM, in a decade, at 59 cents is overly optimistic or unreasonable?

I think it is safe to say that most of us have our sites set on much higher and believe STEEM is sure to eclipse that by a significant amount.

As these numbers attest, 500 SP, worth roughly $66.50 will see almost an 18x return over the next decade. Who wouldn't want numbers like that?

If we agree that the price of STEEM used in this example is a bit on the conservative side, then the only other variable is the return that SPInvest can generate. Can this project really do 15% annually for a decade?

To start, it is best to keep in mind that the project has returned more than that after only 6 months. I think, first year, it will eclipse 40% from the start of the project.

Nevertheless, what is the sustainability over time?

This is where the second way to get involved is important. SPInvest offers the anyone the opportunity to be active. Thus, we each can influence the return by active participation.

What are some of these activities?

For some, this is writing articles that are posted under the SPInvest and the sub accounts. These accounts receive upvotes, another activity, that provide reward payouts. This, naturally, helps the overall return.

Well also see club member delegating SE tokens which are used to curate, at present, LEO and NEOXAG. Once again, by curating, we see those tokens amassed which are believed to hold good long-term value.

The latest addition is the ability to designate SPInvest (really @spi-payments) as the beneficiary on votes. This allows for the rewards to go to SPInvest while the author gets SPI tokens. This STEEM is powered up and put into the leasing pool which provides a good return each month for the club.

Certainly, one could make the case that he or she could do most of what SPInvest is doing. That is true. The difference is that each aspect would have to be done by the individuals. Is one going to lease out SP, curate LEO and NEO, write posts, and then go around an upvote accounts that get a decent amount of SP on each post?

If one can even do this, will it continue and expand as more subcategories are added to the project. It is not far-fetched to consider the idea of SPInvest doing something similar with some SMT projects. There is nothing saying that the project has to stop with only a few tokens that are curated and focused upon.

Ultimately, as more people are involved, there is a larger pool of opportunities which to actively increase the return this project will yield.

Therefore, I do not see the 15% annual growth rate, which is below the 20% target, used in these numbers as being too outlandish. Hell, the amount of BTC that is owned by the club might make up a fair portion of this if it does moon like some of the optimists claim.

Either way, this is where I see the SPInvest opportunity and the numbers to back it up. Anyone is free to play around with them however he or she feels. Ultimately, the conclusion is the same, there is a potential for an enormous return over time.

Here is something to ponder: how does all this look if the price of STEEM gets back to $2 or $3?

At $3, under this scenario, we are looking at close to a 100x.

With numbers like that, it is too tempting to not have 500 or 1,000 SPI tokens. A mooning of STEEM could be enhanced by all the other activity taking place around SPInvest.

If you found this article informative, please give an upvote and resteem.

I am trying to get to 500 spi.

Thank you for the post.

Had to resteem this, excellent read up.

The numbers don't lie and i feel stupid for not having thought and done a post like this myself. Great information and all your numbers are bang on.

We'll soon hit 100,000 issued and then we are players

FYI - Our SE buy wall is 80% bought out.

The buy wall is with 1 spi as 1 Steem correct? So when it is sold a new buywall with a higher price will be available correct?

Posted via neoxian.city | The City of Neoxian

I just did a quick calculation:

Based upon the earnings report for this week, I divided the 489 STEEM by the 79,715 in the account. This comes to .006 return for the week which is 31.89% annually.

Keep in mind this is only based upon the earnings and does not include any appreciation in the value of the assets that are held.

https://steemleo.com/spinvest/@spinvest/steempower-investments-weekly-earnings-report-25

For the same reason you rounded down to 15%, i round down 20%. I always say 20% as i think we'll always earn at least this amount and if i starting throwing out 25-30% predictions, it could backfire on me, lol.

When worked out weekly, we float in the 27-34% range so this week is one of our better weeks :)

The numbers get crazier when you do 20%.

That is my point, the return, even at 15% is mind-blowing.

Congratulations @taskmaster4450le! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!

Monstrous growth potential with this project and exactly why I got in on the ground level.

Posted using Partiko iOS

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.