The Headlines Still Look At Cryptocurrency As Financial

Yesterday, I put together a post detailing the difference between Bitcoin and the Alt-Coins. Essentially, I concluded that Bitcoin is a financial mechanism while the Alt-Coins are technological. While the later has the financial aspect to it, overall, the success is going to be determined by the technological development.

As we move towards Web 3.0, these blockchains are going to be the foundation of decentralized platforms in many different areas of life. We already see numerous projects that seek to achieve this end.

Bitcoin, on the other hand, has a lot of development yet it is not really moving in that direction. Instead, the development that is taking place is in an effort to make it a more efficient financial system.

This is becoming an important variable as we see what people are projecting and forecasting.

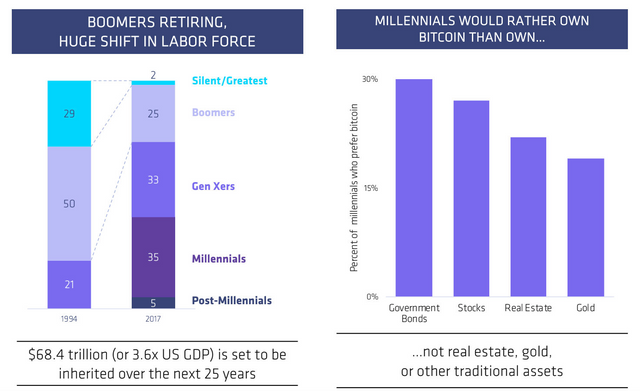

There is a lot of talk about how Millennials are set to inherit a large sum of money of the next couple decades. The figure that the Baby Boomers are set to pass on is over $68 trillion. This bodes well for cryptocurrency since this group, according to surveys, is more likely to want to hold Bitcoin as opposed to real estate, stocks or bonds.

The institutional asset manager Grayscale also points to the huge shift in wealth as a potential boon for BTC.

The firm says it’s impossible to tell just how much capital may flow into Bitcoin, but managing director Michael Sonnenshein says he believes there’s no doubt the leading cryptocurrency is resonating with a millennial audience.

A separate study from Charles Schwab found Millennials are choosing to buy Grayscale’s Bitcoin-backed trust (GBTC), over Netflix, Disney, Microsoft and Warren Buffett’s Berkshire Hathaway.

While this is all likely true, this still looks at cryptocurrency as financial. This is where the analysts are making the mistake.

The Millennials are a technologically advanced generation. They grew up using technology more than any previous one. The idea of learning about technology is foreign to them since it is just something that was the norm. It is this outlook that is going to radically alter the viewpoint about money.

Millennials tend to drift to those applications they want to use. They are not bound by pressure or influence of others. So while Facebook is the Generation X (and late Baby Boomers), Millennials went to Instagram and Snapchat.

I foresee the same thing happening with cryptocurrency. As they come upon applications they like, with currencies that are applicable, that is what they are going to use. They do not care about mainstream or centralized. It is the utility that matters to them.

Of course, with the numbers they have, whatever they decide as a group becomes the mainstream. Right now, since it is the largest game in town, everyone presumes it will be Bitcoin. This might not be the case.

The Maximalist case was also delivered a blow by one of the biggest Bitcoin advocates out there. Andreas Antonopoulos is well regarded for his books and talks about Bitcoin. Over the past 6 or 7 years, he traveled the world being an advocate of Bitcoin and how the present system is simply not sustainable in light of this alternative that is being presented.

Yet, he is open about the fact he is not a maximalist. His view is there will be many different currencies that people use. In an interview, he stated there will be thousands with a small handful dominating most of the transactions.

“And within those, I expect we’ll see a classic power-law distribution where one, two or three systems will dominate more than 50 percent of the value. Maybe not a lot more than 50 and the leader may only have about 40 percent but the tail is so long that the next three combines don’t even have 20.”

Antonopoulos further asserted that there would also be the emergence of 1000s of different tokens with different degrees of utility. Some of them could be a social affinity and association-centric, in a sense that there could be tokens dedicated to sports teams, pop stars, etc.

https://eng.ambcrypto.com/bitcoin-advocate-claims-future-will-see-emergence-of-thousands-of-cryptos/

I actually disagree with Antopoulos a bit on this. He has a very strong technological background which allows him to see past maximalism. However, I don't think he ventured out into many of the different projects and how segmented things will be.

It is akin to hundreds of thousands of different villages all over the world. Each is its own self-contained system with a lot to offer the members of its community. Some will naturally be rather large with others being a lot smaller. Tokens are going to represent many different things, having differing values. For example, we will likely see hundreds of trillions in real estate that is tokenized.

As for the tail, I do agree with his sentiment yet I think his percentages are a bit high. I see Bitcoin settling in at around 10% of the total.

Bitcoin might end up being the only token that is viewed from a financial perspective. The rest are going to depend upon the utility and how well it does in attracting users. The financial aspect will be secondary as compared to what the application or platform offers. This will be, ultimately, what I believe drives the Millennials.

We are going to be in a world where creating a token is easier than putting together a website. Today, we know a handful of websites dominate the Internet traffic. Of course, we also know how the Internet became centralized and "siloed" over the past two decades.

Web 3.0 is going to see a shift away from the centralized paradigm. With decentralization occurring naturally, this means that the user base will be spread out. People are going to opt for what they like without being locked into any one platform like they are now with Facebook and Google.

This means token distribution is going to spread to everyone. Since the likes of 7 billion people varies greatly, we are going to see a ton of diversity in the currencies used. Technology is also going to allow for instant conversion to whatever token is required, meaning it is of little importance what currency is in one's wallet.

Therefore, the most successful blockchains are going to be those with projects that appeal to people and provide some value to them. Of course, value is a relative term which is the kicker. It is basically up to individuals to decide what they like.

We also will see the advancement of automation mean that currency is automatically generated using computers. As more people enjoy the automated wealth creation, they too will be using currencies that will be outside the "norm". Ultimately, I do not see the my hub that ties into a local mesh network using Bitcoin. Keep in mind a product like that could have millions of users around the world making it a widely held token.

A lot is going to change over the next 20 years. In my view, the two main drivers of this are technology and the change in demographics. These are the two most important variables to monitor since they are going to have the greatest impact.

The odds of everything, including the financial system being upended due to them is great. We are already seeing the beginning of this start to unfold.

In the end, I believe our monetary system will reflect this.

If you found this article informative, please give an upvote and resteem.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

There is much to think about in this post, @taskmaster4450! Some key take-aways that I pulled from this are about the generations growing up now. A) They are using technology naturally (not spending time learning it as we had to). B) they are set to inherit huge sums from the Boomers. C) They are far more likely to invest in tokens than things like real estate. These collectively seem to indicate that the way things will play out in the future is ripe for cryptocurrency to be much more mainstream. While Bitcoin will always be the leader, the thousands of other coins that form the "tail" have huge potential value. (Sorry, I'm over-simplifying what you've stated here!)

That's exiting to think about. It's exhausting to try to guess what will and won't do well and worrisome to consider the amount of risk involved in investing. My take-away is that the risk is in not dabbling at all - of being fearful of the highs and lows to the extent that you don't build a diversified portfolio of crypto.