"Kill The Middleman"

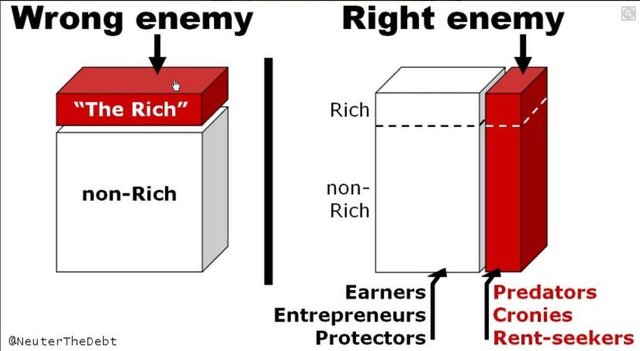

Few ever took the time to consider what the rent seekers in society extract and how much they cost humanity.

To start, let us define rent seeking. According to Wikipedia

In public choice theory as well as in economics, rent-seeking means seeking to increase one's share of existing wealth without creating new wealth.

These essentially are people who truly do not create wealth. Instead, they extract it. The idea of moving money around is a prime example. Banks get paid a large sum of money, in total, for providing this "service". In the day of electronic funds transfers, we can see how little this is really providing.

Wikipedia goes on to explain:

Rent-seeking results in reduced economic efficiency through misallocation of resources, reduced wealth-creation, lost government revenue, heightened income inequality,[1] and potential national decline.

Do any of these results look familiar? They are things that are talked about regularly. Yet few point to the rent seekers as the problem. It is fairly obvious why this is. The rent seekers have amassed so much power, they control most everything, including the media.

If the problem is the rent seekers, then the solution is something that eliminates them from the equation.

This is exactly what blockchain, coupled with decentralized currencies, does. The goal of blockchain is to eliminate the middle man. Whether it is a money transfer system or Facebook, billions are extracted from the hands of individuals and placed in the coffers of a few companies. As we saw, over the last few decades, this has resulted in exactly what the definition of Wikipedia describes.

Here we also see the answer of what real world benefit does blockchain and cryptocurrency provide? The answer is simple: they eliminate the middle men from the political and economic environment.

Think for a second how many businesses truly are nothing more than "pass-through" institutions. Their purpose is simply to move one thing from point A to B. Ultimately, they do not add much to the equation yet do take a cut.

Even in commerce, we see the same thing happened. Amazon destroyed the physical retail world. It is, however, still a platform that is a middle man. On the commerce side of things, Amazon basically brings buyers and sellers together. For this service, it takes a cut.

We, of course, felt this completely natural. The challenge with this is the fact that power keeps growing as time passes. The power structure is not flattening out but becoming more vertically integrated.

Decentralized blockchains seeks to do the exact opposite. Those who are building upon these databases with the mindset of creating DAOs are also reversing the present structure. Even if an entity takes a cut, it is usually done simply to cover fees.

A prime example is the LeoShop. This entity was set up to enable individuals to sell their digital assets. Eventually, the idea is to expand the offerings that can be placed on there.

The big question is who owns this? The LeoShop is part of Steemleo. Hence, the answer to who owns it is nobody. Steemleo is represented by the LEO token yet it is not a security token. Having the token does not provide the rights to any of the assets or the profits. Tokens are utility in nature with stake affecting one's ability to interact.

Individual token holders are benefited by the fees charge through a token burn. This means that everyone in that community who is holding LEO is positively affected.

In the long run, I foresee this business structure expanding rapidly. The existing structure will not stand up when hundreds of millions of people realize there is a different way of doing things. When people can start with a social media application and end up owning digital assets that can be freely traded on an open exchange, they will realize the new model of wealth building.

Without the middle men, there is a lot more to "prime the pump". When entities are pulling 5%-50% while not providing much in the way of wealth creation, then the entire economic system is slowed.

This all changes with a blockchain like Steem. Anything that is developed and placed upon Steem can be structured in a similar fashion. Tokenization pushes the power out, meaning more people have an vested interest in what is going on. They also have a way of exercising that power. For now, options are limited but there will come a time when platforms will collapse simply because those who amassed a great deal went too far in asserting their will.

When people have options, they are no longer obligated to put up with bullying or tyranny. Look at the Steem front ends. For those who are blogging, at the end of the day, does it really matter which one is used. They all post to Steem. Thus, if one tribe/group is upsetting, there are plenty of other options.

Rent seekers look to keep accumulating power. Since they are not creators, they do not put their accumulation to work producing more innovation. Instead, they look to purchase assets as a mean of consolidating their power. The vertical integration process ends up with the exact situation we are presently confronted with.

Fortunately, we are developing alternatives. Technology is providing people with the ability to do a lot more. We can sit at a laptop and produce a multi-million dollar business. Through the use of tokenization, we are seeing the ability of the masses to profit from the idea. Through their interaction, kicking off the network effect, we see the possibility of enormous wealth generated for billions of people.

It might be difficult to see that in the early stages. If this is the case, I urge everyone to take a look at the money and wealth the rent seekers presently have. By targeting that, we will see the power shift very rapidly.

If you found this article informative, please give an upvote and resteem.

Posted via Steemleo

What a great way of looking at things once again.

I am big on basic economics in the context of family fiancés, marketing and entrepreneurship. I haven’t considered the concept of rent seekers since college.

I do love how blockchain has the mechanism to bring entrepreneurship even to creating and maintaining a currency. All it takes is an organized group of smart constructive folks to create something good for a group of people who need it. Taking our own stake without middlemen is so empowering and holds a huge upside.

With the flow of information via the internet and blockchain, we can communicate, educate and help each other choose which institutions to alienate and which ones to rally behind based on our goals.

Great editorial again old friend.

Posted using Partiko iOS

There will always be a middleman. In every system. Or at least fees.

What if I could pay the rent for my house through delegating steem...

Consider a model where I would weekly power up steem and then delegate that to the person who has the rights to my house, until a certain amount of steem has been accumulated by that person.

The moment that I would then stop the delegation because the payment was fulfilled, I would not only have a house, but also a massive amount of steem power... quite a different model indeed.

Or consider the idea of housing being DAOs. The higher the stake, the more options people have as to where to live. The only fees extracted are to cover expenses pertaining to maintenance and repairs.

One could opt of where to live and for how long based upon the stake. Payments made, in the DAOs token, that are in excess of expenses are then burned, helping all in the ecosystem.

Posted via Steemleo

That would also be a very interesting and very different way to approach housing indeed.

You have given me a lot to think about in this post!

Posted via Steemleo

This post is really good! Going to reference it in future discussions.

Hey! So sorry to ask this.

I'm new to this platform. Do you mind explaining to me what rent seekers are and also what are steem abusers ?

Hi @taskmaster4450!

Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

Your UA account score is currently 6.168 which ranks you at #267 across all Steem accounts.

Your rank has dropped 1 places in the last three days (old rank 266).

In our last Algorithmic Curation Round, consisting of 91 contributions, your post is ranked at #2. Congratulations!

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.