So Where Are The Equity Markets Headed...Just Monitor The FAANG Stocks???

FANG is the acronym for four high-performing technology stocks of Facebook, Amazon, Netflix and Google. The term was coined by CNBC's Mad Money host Jim Cramer and used first an episode of Mad Money back on February of 2013. The acronym was later changed to FAANG to include Apple.

The S&P 500 index is the bell weather of the equity markets and suppose to represent the broader market. However, the index is heavily influenced by technology stocks. Technology stocks in the S&P 500 account for 22% of the index's weighting, more than any other major stock sector. So when the S&P 500 gained 31% in 2019, Apple, accounted for 4.9% of that gain, while Microsoft accounted for 4.6% of that gain.

Another way to looked at the influence of technology stocks on the S&P 500 is through market caps. The S&P 500 is weighted by market cap, with a market value of about $25 trillion. However, Apple, Microsoft, Amazon and Alphabet belong to the $ trillion market cap club. So, four tops represent about 16% of the entire market value of the S&P 500.

The tech stocks were weighed down by the broader market. The Dow Jones Industrial Average lost more than 1,900 points over two days, while the S&P 500 shed about 6% and posted its worst day since February 2018 on Monday. The Nasdaq fell into negative territory for the year.

Shares of the so-called FANG stocks, including Facebook, Amazon, Netflix, and Google parent company Alphabet, shed a combined $177 billion in market capitalization in just two days as coronavirus fears slammed global markets.

Each of the technology giants pared losses on Monday and Tuesday when global stocks fell for two days in a row. On Tuesday, Alphabet shed the most in market capitalization, losing roughly $24 billion in value on a 2.5% fall. Netflix was the smallest loser, erasing about $4 billion after falling 2.4%.

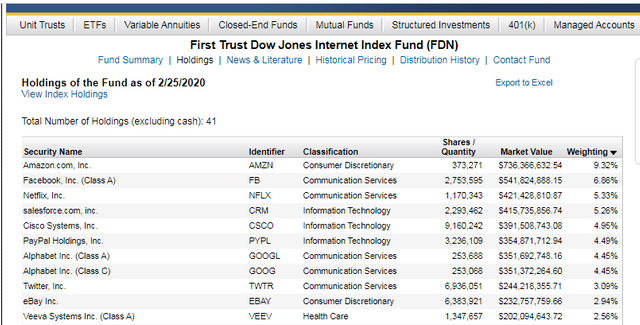

One of the best ways to monitor the FAANG stocks collectively is through the Dow Jones Internet Composite Index which is a float-adjusted market capitalization weighted index designed to represent the largest and most actively traded stocks of U.S. companies in the Internet industry. The exchange-traded fund, FDN, seeks investment results that correspond to the Dow Jones Internet Composite Index. Top 10 holding include...you guessed it the FANG stocks.

So if the FDN is tanking, then I pretty much know the entire Market is tanking and vice versa. Thus, FDN serves as a great proxy / index for the Equity Markets. So where is FDN heading next, the chart suggests we are due for a broader market rally?

This post is my personal opinion. I’m not a financial advisor, this isn't financial advice. Do your own research before making investment decisions.

Posted via Steemleo

I tend to agree with your assessment. The market is going to rebound from this. I do not feel this will be a major collapse. The fear is great right now but things will rebound quickly if the coronvirus passes with less deaths than expected.

Posted via Steemleo

We should consolidate at these levels for a bit, then potentially move higher.

Posted via Steemleo

We're seeing more asset correlations in times of fear.

Yes, investors are running in the US dollar, Yen and Franc.

Posted via Steemleo