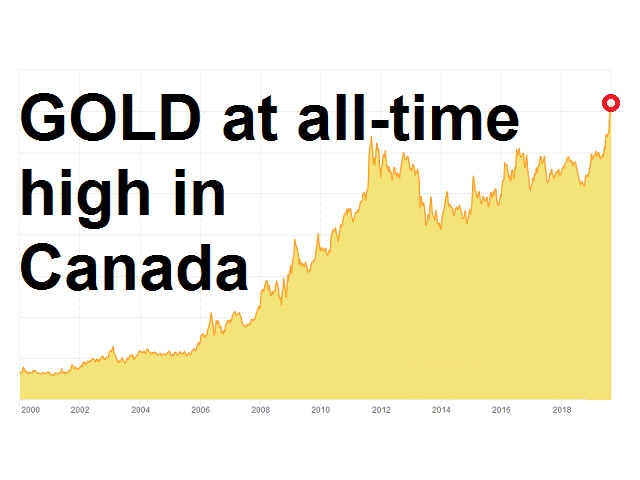

Gold hit $1700 USD and $2300 in Canada! What's next?

Stocks, bonds, and oil had their worst day since October 2008, with much more pain still to be felt, but gold held strong above 1650 today - one of the only things that didn't collapse! Even cryptos felt the pinch, but gold and silver both held their ground, even making new intraday highs!

So, what's next for gold and silver prices?

Well, let's ask someone who has been paying attention to the charts (and fundamentals) for a long time, and who has been sharing analysis with an excellent track record for at least a decade.

Let's ask... Me.

In 2008, at 800 CAD, I was telling people on YouTube to hold physical gold (and silver). I begged people all through 2009 and 2010 to investigate these metals as a potential store of value for their savings.

After the price spike in 2011-3, critics (including my family) gloated that gold's price had fallen and claimed I had been wrong. But it didn't fall far - they would have still been 'up' if they had listened to me. And since then, it has done nothing but climb.

I correctly called the exact gold bottom in early 2016.

In early 2018, I accurately predicted that gold and silver prices were about to break out.

And in August 2019, I forecast that gold was about to blast off to $2500 CAD. It hasn't looked back since.

Okay, so I know what I'm talking about. Here's what I see coming.

After completing the run up to 2500 CAD or more, likely within months or even weeks, there should be a brief consolidation. Either a price correction or a sideways pause, before further resumption of the bull run. This move will take gold to ~3000 CAD and 2000+ USD.

Additionally, and this is less of a sure thing of course, is the chance that a complete revaluation is coming soon. Many fiat currencies are in crisis (and for good reason), and the USDollar hegemony may be crumbling. If the crash is nasty enough (either organically or by design) then a new solution will be offered by the banks and governments of the world - safety through financial servitude. A cashless society control grid which the technocrat elites have been salivating over for generations now. In such a world, gold and silver have value. What that value translates to in today's dollar terms, is really hard to quantify. It's better to think in terms of purchasing power. Gold and silver bullion will always have value to humans - just as they always have. They are useful and they're scarce, and to humans, that gives something value.

And metals have a special kind of value, called intrinsic value. It means the value isn't there by decree - nobody decided and demanded they have a certain value. Instead, the value is contained physically within the metal. The metal gives the metal value, not any central authority! Silver and gold are useful and scarce, giving them a value which is contained within them. That's sound - real - money!

So whether precious metals simply continue to grind higher and hold their value through the decades, or finally break free of the banker control and revalue to some lofty new point, I believe it's important to understand them and consider including them in your savings.

Silver

Silver generally overreacts - it goes down too low in a bear market, and up too high in a bull market. Also, silver usually legs behind gold in monetary moves.

Right now, silver is still at the tail end of its bear market. It hasn't budged, and is nowhere near all-time highs in any currency. Silver is still a MASSIVE bargain.

Currently the Gold:Silver ratio is a colossal 98:1! I expect to see this move down toward 20:1 or lower as this bull run continues, which means gold is going up, and silver is going, well, TO THE MOON.

That's not financial advice, because I don't own a fancy piece of paper saying I went to 18 months of brainless economics classes, but there's a very good chance I'll be linking back to this post in a new article before too long.

Gold (and silver) bullion is incredibly undervalued at current prices. At some point, not even a wheelbarrow full of cash (or a zillion digital fiat units) will be accepted for physical gold. You currently live in a world where thin-air-nonsense can be converted into pure intrinsic value, for a limited time. Investigate accordingly.

DRutter

Posted via Steemleo

Gold is awesome. But cannabis has many of the properties of sound money! Only problem is, it isn't permanent... either it dries out or somebody smokes it :D

Turns out that gold has been the best investment of this century!

I'm tempted to trade my 1 oz. Gold Maple Leaf for almost 100 silver Maple Leafs.

Posted via Steemleo

If you believe we're heading into a long bull market for metals, that's probably one of the smartest things you could do.

Look at it this way - the opposite way.

In 2011, at the TOP of the precious metals bull market, I was sitting in front of 30 Silver Maples and wondering if I should trade them in for 1oz of gold. I decided that silver was going to continue to gain against gold, and that I'd convert to gold much closer to 10:1. Turns out I should have just gone for it. Reason I didn't was that I didn't see that top happening. I thought PMs were going to continue to sail. I thought there was a free market, or that PMs had broken free of manipulation.

So, are we near the bottom for PMs, or are they going to resume their bear market that began in 2011? That's your question.

@drutter the gold market seems to be becoming stronger and also an independent market....and it could be the next safe haven asset..

Posted via Steemleo