Crypto Communities need to provide value to the world

I recently discovered Brett Scott, alias @Suitpossum on Twitter, an independent journalist and author with a passion for exploring the topic of "money" and its frontiers.

I should have discovered him much earlier, as author, in February 2016, of a Working Paper for the United Nations Research Institute for Social Development (UNRISD) titled "How Can Cryptocurrency and Blockchain Technology Play a Role in Building Social and Solidarity Finance?".

That is actually a long time ago, before the launch of Steemit ...

Today, his Twitter feed draws readers toward his blog, brettscott.substack.com, where Brett has lately taken to critically analysing Bitcoin, and exposing what might amount to hypocrisy on the side of its evangelists.

Confusing narratives

In a piece he recently wrote for CoinDesk, 5 years after the UNRISD working paper, he advises other bitcoin critics about How to Win a Bitcoin Street Fight (Without Mortal Combat). In it, he complains that bitcoin evangelists "throw chaff" and "switch arcade games" by using two very different and possibly incompatible stories about Bitcoin:

- Bitcoin is "better money" (non-inflationary), fighting the evil Federal Reserve boss-man (which he dubs "Money Wars")

- Bitcoin is a star investment asset (dubbed "Titans of Trading")

In so doing, they misinform a generation of idealistic young people.

It might be useful to start by (partly) dispelling the confusion: it's not necessarily the same bitcoin enthusiasts peddling the two stories.

While one can still easily find proponents of the first (and original) one that started the whole movement (see for instance an article I wrote 4 years ago, "The Church of Bitcoin" ), I reckon their numbers are dwindling. An indication in support of my statement is provided by a comparison of the market prices of BTC, BCH and BSV, the latter two being the main vehicules for the believers in the "Bitcoin is better money" credo.

I would say that a majority of bitcoin supporters can now be found "playing the Titans of Trading game" and encouraging people to get exposure to a rising star in the investment arena. Among those supporters are such luminaries as Stanley Druckemiller and the analysts of JP Morgan. And against them, Brett has a very weak, rather invalid argument: "Why not just buy shares, which are actually anchored into the real economy?!”

There is of course no dichotomy: one can buy both shares and Bitcoin, in proportions governed by various portfolio allocation strategies. Three to four years ago, those who were looking at Bitcoin as an investable asset were possibly using the "get off zero" strategy. Today, it's more like 1% of the portfolio. If anyone (including Brett) has a problem with that, one can choose a different portfolio allocation, as a vast majority of asset managers, who own no Bitcoin and no cryptocurrency at all, are doing.

It is also worth mentioning that Bitcoin is a (still very small) part of the "real economy" as it underpins large "mining" operations and it's, to a large extent, the main reason why crypto-exchanges such as Coinbase, Binance, Bitstamp, Bittrex, Bitfinex and others exist. These are all legitimate companies from the "real economy", providing services to their customers (even though anyone is free to sniff at those services).

Exploitation

Admittedly, cunning bitcoin supporters and their gaining traction as the price of BTC increases can be somewhat irritating because of dashed hopes. Brett's and many other people's hopes...

Back in 2016 bitcoin, alongside blockchain and cryptocurrencies, were seen as portents of financial liberation and inclusion. Now "big money" seems to have swiftly diverted bitcoin, ethereum and other cryptocurrencies and transformed them into instruments of financial exploitation. By using the above "confusing narrative" and "chaff" of "bitcoin as the weapon to defeat the evil fiat boss-man", they are attracting and disorientating young people.

I agree with Brett Scott here: financial exploitation is what the big capitalist machine is best at, and it attempts to use any opportunity it gets for that, day in, day out. Whether bitcoin or something else, cunning and cowardice will always try to take advantage of each generation of idealistic young people.

Financial speculation versus ...

What is frustrating for many people, is that, as Brett observed back in 2016, blockchain and cryptocurrencies were holding so much hope for a better, more prosperous and more inclusive future!

Back then, many "thought leaders" were imagining ways in which blockchain-based applications would use a dedicated cryptocurrency for social and economic development, financial inclusion and more generally to "do good".

Yet today, as anyone can notice, the only blockchain-based apps that appear to attract interest are "apps for trading cryptocurrencies themselves. What results is an almost hermetically sealed economy, whose currencies exist only to be traded and become derivatives of themselves."

One can argue, as Michael Casey does, that speculation is the basis of American capitalism and it's driving, not hindering, the development of a crypto-based economy. Yet I firmly believe that the current situation should only be the "breeding ground" for a future in which the crypto community opens up and starts providing value to the world at large, not only sucking in financial flows and redistributing them among crypto insiders and early adopters.

Dawn of the crypto-economy

And the reason I returned to write on Steemit.com is that we have here, as well as on the sister Hive blockchain, probably the best example of how today's blockchain applications can support not only "trading crypto" but also the "real economy".

To illustrate my argument, let's look at Brett Scott's very participation in the real economy, through his occupation as author and journalist.

Setting aside his writing for CoinDesk (which, as part of Barry Silbert's DCG, ironically pays Brett with money from Bitcoin gains), Brett is also running a personal blog on Substack, which aims to "make it simple for a writer to start an email newsletter that makes money from subscriptions."

That is an easy to understand, "old world" model where some people choose to pay a certain sum of fiat to Brett (presumably using a credit card) in order to get access to exclusive content. This is a one-to-one relationship, from subscriber to Brett, including Substack as a middleman taking a cut. So far, so ordinary. A variation of this model is the Patreon one, based on voluntary support, not linked to a specific exclusivity.

Another slightly different "old world" model in this area is Medium, which is many-to-many. A subscriber pays a sum of money to the platform itself which then distributes to the authors according to its own algortihms (after taking a cut for itself).

Yet another model is the individual blog, financed through advertising, whether it's third-party ads or the implicit advertising of a sister company.

What kind of innovation can a blockchain-based application bring in this apparently well-served area?

The right stuff

Blockchains come in several flavours and the tag "blockchain" is not a registered trademark. Thus I prefer to be specific: true blockchain systems are for me those which not only "chain blocks" but, more importantly, "enable better organizational paradigms than were socially and economically viable before." , as I was writing back in June 2018.

I first tried to start a blog (on Blogspot) in 2004. Between 2004 and 2016 I managed to write a grand total of ... 7 posts! I simply could not picture anyone coming to read my blog (which, to make things worse, alternated between posts written in English and posts in French).

Yet after discovering Steemit in August 2017, I wrote more than 100 articles in less than four years. I like writing, but I need to feel that I write for a readership. I need a "feedback loop" to not let self-doubt drag me away from writing. This rapid feedback loop I found on Steemit (and now also on Hive): there is a community of readers, some of whom are interested in the topics I like to blog about, and who signal to what extent they appreciated my writing through voting.

Crypto can already pay

It's worth noting that these votes distribute crypto. Although, as an occasional blogger, it's not the reason I'm here, this could offer an alternative model to professional authors and journalists such as Brett Scott. Additionally, this model gives the lie to Brady Dale's observation that Crypto Doesn’t Pay

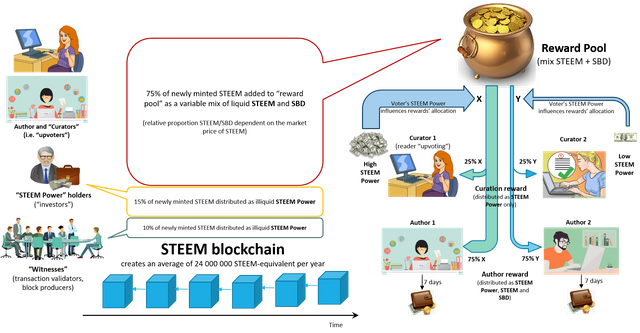

More importantly, unlike platforms like "Cent" (which Brady Dale also mentions in his article), Steem and Hive do not function on the principle of "tips". The crypto which an article receives doesn't come in deduction of what the voters own but instead come from a community budget. That is a fundamental difference: for the crypto to have fiat value, people from the outside world need to acknowledge that the community as a whole provides value (and therefore exchange actual money for steem or hive)

It's natural that unknown bloggers like me would switch from Blogspot to Steemit once they begin to understand the difference. But why would well-known, reputable bloggers genuinely interested in blockchain's potential for good NOT make the switch from Medium, Substack and ad-supported individual blogs to Steemit (or Hive)? I see no good reason and tend to think it's because of inertia but perhaps you should ask Brett Scott.

The sun also rises

To sum it up, I wanted here to engage in debate with both cryptocurrency critics (such as Brett Scott) and pessimists.

Yes, it's still early and most blockchain applications, including bitcoin, are self-referential or have been captured by the capitalists, or both.

Yet hundreds of Venezuelans and Nigerians blog on Steemit and Hive and are able to put bread on the table because, on the other side of the world, South Koreans exchange their fiat KRW for steem and hive.

In the comments section of one of Brett's articles, he hints at what constitutes currency thus: "Nothing gets to be on the FX market unless it is also a unit of account that dominates in a particular region, and the FX market is like an interstitial zone between currency networks." If one looks at steem and hive, blockchain-based currency-like objects, they appear to have managed to sever the link between economic networks and geographical boundaries. They are facilitating economic interactions in an area defined not by geography and physical proximity but rather by attachement to an ad-hoc community (the "steemit community" or the "hive community").

It is also important to note that, designed respectively 7 and 11 years after Bitcoin, steem and hive are far from mimicking their illustrious ancestor. No energy-intensive mining is underlying the above mentioned transfer of wealth. No "cuts" are taken in the process by the blockchain infrastructure as there are by design no transaction fees (albeit the conversion to fiat might incur exchange fees). Steem and Hive are also not deflationary (their supply is not capped) and can be earned by anybody who is willing and able to participate in the respective communities with no condition of prior capital outlay.

We can indeed say that some blockchains have been designed to support financial inclusion, redistribution, social development. And if these blockchains haven't reached their full potential yet, perhaps some of the fault lies with authors and journalists such as Brett Scott who prefer using old world, financially regressive business models instead.