Nutbox Trilogy① | Crowd-Staking as a Bootstrapping Method

The Web is built as a gift for everyone, as its inventor Tim Berners Lee said: “This is for everyone”.

In the Web 3.0 era, in order to allow everyone to retrieve the ownership of the Web, we believe that "DAO is for everyone." Everyone should be able to launch a DAO within a few minutes at a cost close to zero. Nutbox was born out of this vision.

What is Nutbox?

Nutbox is a DAO operating system for Web3.0 and a smart contract platform based on Staking and Content.

Through the Cross-chain Staking Protocol, Public Content Protocol, DAO Services & Plugins, Government Protocol and other components provided by Nutbox, DAO (Decentralized Autonomous Organization) founders can easily create their Crowd-Staking, DAO Services, Governance and other modules, launch the DAO, and let the DAO operate sustainably and economically.

This article will introduce Crowd-Staking as a way of Bootstrapping.

The first problem an economic system faces is launching. Bitcoin solves this problem well, and its success stems from a subtle concept —— Bootstrap.

Bitcoin and Bootstrap

The first goal of the Bitcoin network is to ensure the security of the blockchain and make Bitcoin a viable electronic cash. There is a prerequisite for achieving this goal —— to have a healthy mining ecosystem composed of a group of honest and protocol-compliant nodes, which requires a large number of miners to invest their computing power in the competition of Bitcoin mining.

These miners will only do this when the exchange rate of Bitcoin relative to the U.S. dollar is quite high, because they pay for energy and hardware costs in U.S. dollars and receive Bitcoin as reward. Therefore, the higher Bitcoin's value rises, the greater the incentive for miners, and the fiercer the competition, the safer the Bitcoin network will be.

How can we ensure the high and relatively stable value of Bitcoin? This happens only when users generally trust the security of the blockchain. If they think that the Bitcoin network may be hacked by attackers at any time, then Bitcoin will not have much value as an electronic cash.

Therefore, the security and healthy mining ecology of the blockchain and the exchange rate of Bitcoin have an interdependent relationship.

When Bitcoin was created, these three aspects did not exist. Except for Satoshi Nakamoto, no other miners run mining software, and Bitcoin has no value as a peer-to-peer electronic cash.

However, as people learn more about Bitcoin, they become more interested in mining. The more they are interested in mining, the more people have confidence in the security of the Bitcoin network, because more mining activities are happening now. This in turn promotes the exchange rate of Bitcoin relative to the US dollar, allowing more people to understand Bitcoin.

The PoW consensus (Proof of Work) adopted by Bitcoin in this way encourages miners to participate in the construction of the blockchain, promotes the formation of positive network effects in these three aspects, solves the initial launching problem, and realizes Bootstrapping.

PoS, Liquidity Mining and Bootstrapping

Following the Bitcoin network using PoW consensus, whether it is a blockchain network using PoS or a Protocol Network using Liquidity Mining, the initial launching problem has been solved through a similar Staking method.

The PoS consensus mechanism provides security for the network by replacing the energy-consuming hash calculations in PoW with Staked Assets. This mechanism uses local encrypted assets as collateral to determine whether to participate in the consensus process of the blockchain network.

Like PoW, PoS validators need to lock up the liquidity of Staked Assets, which is consistent with how Bitcoin stipulating validators to "lock up" energy and hardwares.

Liquidity Mining is similar to the PoW consensus mechanism. The Hummingbot team's definition of Liquidity Mining is: We call this matter "Liquidity Mining" because its concept is very similar to PoW mining.

Compared with the use of energy and hardware, liquidity mining uses computational resources and token inventory to run Hummingbot's market-making client. By competing with other participants for promotion incentives, their joint efforts can achieve a common goal: to provide liquidity for specific tokens and exchanges. In return, they will receive compensation commensurate with their work based on the model defined by the algorithm.

In terms of contribution to the network, the core of the PoW and PoS consensus mechanism is to provide security for the network, while Liquidity Mining is to provide liquidity for the project token.

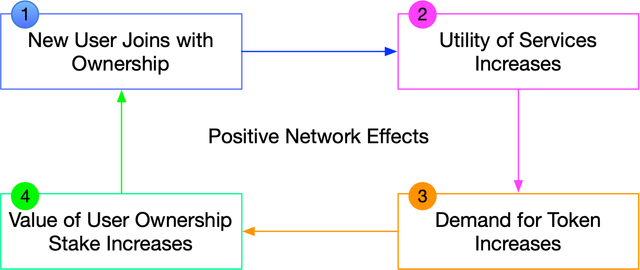

From an economic point of view, PoW, PoS, and Liquidity Mining use the basic economic principle of Staking to enable the system to achieve positive network effect. As new users join, the value of the network (security or liquidity) increases, and the demand for tokens also increases, and the value of tokens held by users will also increase, which will in turn lead to more new users joining, thereby producing a positive network effect and realizing Bootstrapping.

Crowd-Staking as a Better Bootstrapping Launch Method

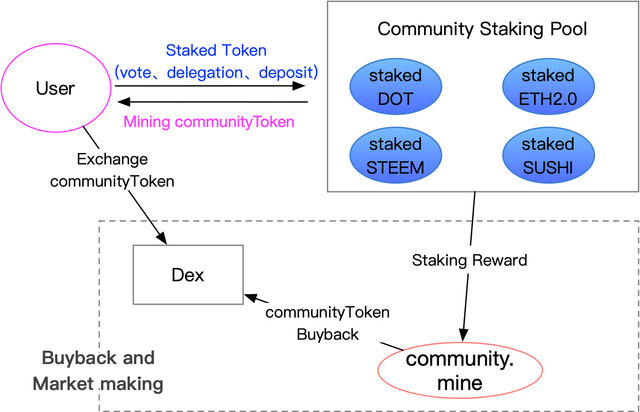

Compared with the PoS mechanism and Liquidity Mining's use of local crypto-assets as collateral, Crowd-Staking transfers the right-of-use, voting rights, and dividend rights of Staked Token (PoS Chain or Protocol Token) to DAO (Decentralized Autonomous Organization) through delegation and voting, etc.

In return, users will receive compensation (token or others) commensurate with their contribution based on the model defined by the algorithm.

As new users join, the value of the network increases (the amount of Staking Rewards increases), the amount of newly generated Community Tokens remains the same, and the value of the Community Tokens held by users will also increase, resulting in a positive network effect.

This method has considerable advantages over Bootstrapping launch methods such as Liquidity Ming and PoS:

Users do not need to purchase local crypto-assets as collateral, but only need to support the DAO by delegating the right-of-use, voting rights, and dividend rights of the Staked Token or voting for them. This avoids the risk of loss due to the purchase of crypto-assets and Staked Token due to bugs or poor development of the DAO.

The user can cancel the delegation or vote at any time, and always retain the ownership of the Staked Token, and can choose to increase or decrease the support for the DAO as the project develops, realizing Vitalik's concept of "DAICO".

Because of 1 and 2, Crowd-Staking greatly reduces the risk of asset loss faced by users, and their psychological burden of supporting DAO is lower, allowing DAO to gain more extensive support.

This method creates a new way to support DAO, enabling DAO to complete an early cold launching and achieve Bootstrapping. Polkadot is also combining its economic model to help parachain complete its launch in a similar way (Crowdloan).

Nutbox Peanut has completed the launch of a Staking DAO in this way, and built a more stable and sustainable network covering Crowd-Staking, DAO Services, and Governance on this basis.