Mini Crypto Program Part 2 || "How Psychology Influences Market Cycles", by @zzzinnn || 10% of the payout to @steem.education

Cover Photo: Edited by myself in Canva

Cover Photo: Edited by myself in Canva

FOMO and FUD are terms used to describe actions in online trading especially in crypto trading that are caused by lack of knowledge and experience of the trade.

In this post I will be digesting the two terms to the best of my understanding.

FOMO

FOMO is a technical term used to mean; Fear Of Missing Out.

The fear of missing out sets in a person when they think they’re loosing, for not being a part of something with great potential. At this moment, a person starts to act in a haste, make uncalculated decisions and mostly end up with their greatest fear, loosing.

There’re some technicalities used to describe individual’s reaction to the behavior of trading charts. They’re called emotional levels. I will try to explore a few of them.

When a chart of a particular token reaches its peak the emotional level used to describe that is called euphoria phase. The reason is because at that particular moment you’re very excited and feeling very proud of yourself for making such a good trade.

When it starts falling too it reaches a point called the panic phase; this is where people have started selling out of the trade and you also feeling like following suit but you’re still having doubts.

FOMO OCCURS HERE

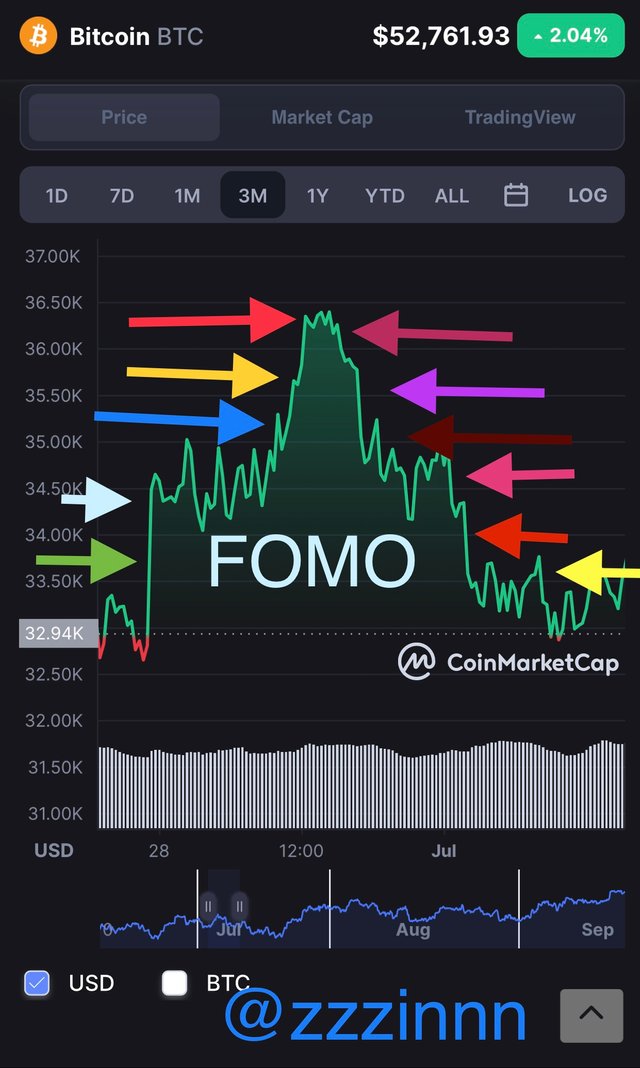

The screenshot below show a classic example of the act of FOMO.

This happened to me just yesterday night actually, I was doing my random checks on some crypto tokens I had flagged because I thought they have a great potential. When I opened the Internet Computer (ICP) token I had found out that it’s value had just moved from $68 to $85 within 1 hour and was still moving up as I was still watching it. So I quickly withdrew funds from one token and bought the ICP token. By the time I was buying it had moved down from $86 to $81 but I still bought anyway, with the hope that it’d move up again with that time period but it didn’t, it kept coming down until $79. I lost a few dollars by the FEAR OF MISSING OUT to the ICP token.

The screenshot below shows an example of FOMO and how it can screw you

Screenshot: Taken from coinmarketcap

Screenshot: Taken from coinmarketcap

FUD

Just another technical expression of the words; fear, uncertainty, doubt.

It is advised that, before you go into putting your money into trading, especially crypto or online trading, you should have the fundamental knowledge about the particular kind of trade you’re about to do. Otherwise you’re doing so at your own risk.

Fear, uncertainty, and doubt should be the least of your driving factors for trading.

- Don’t put your money somewhere because you fear the risk of loosing it where it already is.

- Always make sure you are confident enough about the particular trade you’re about to make and about the amount of money you’re risking to lose, wether you can actually afford to loose it.

- Clear all your reservations by learning about the trade and studying those tricks such as, patterns, indicators, charts, etc.

FUD OCCURS HERE

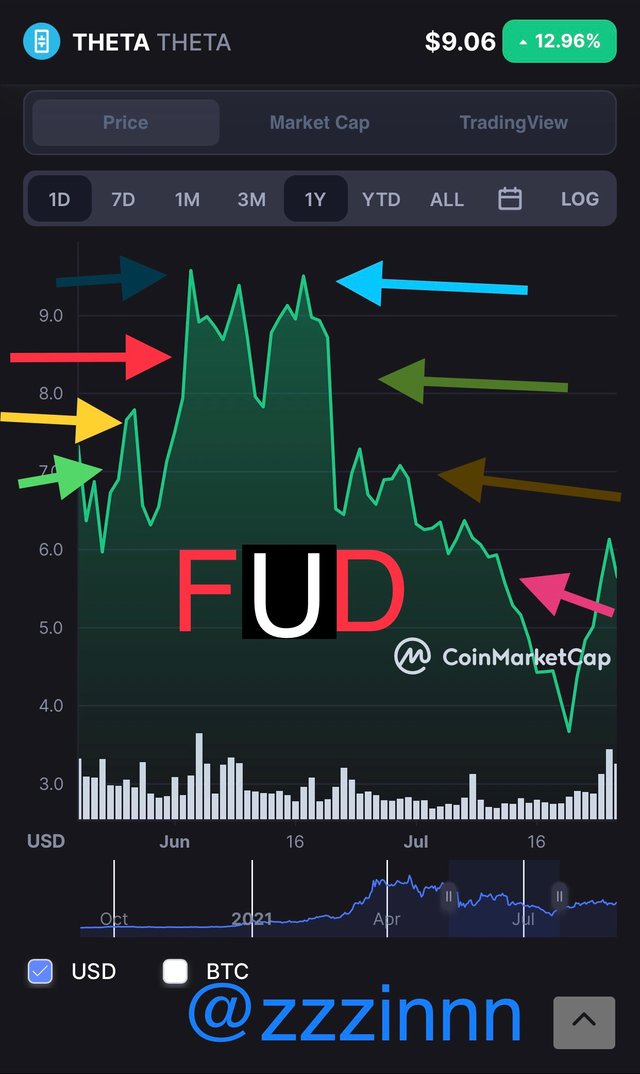

In the screenshot below, anyone who knows about trading, i.e any experienced trader, will know not to still be in the trade after the first dip(complacency phase). At least by the second phase of the fall in the market, a good trader will get the indication to close the trade. The anxiety phase.

It is only FUD that’ll make anyone to still be in the trade after the second dip. After the second dip the next emotional level is the denial phase emotional level.

When you go into a trade with fear, uncertainty , and doubt, you’re most likely to come out of the trade with disappointment because you were already basing your trade on luck. Well the bad news is that, it doesn’t work like that over here. If you’re coming in, come prepared, otherwise you’ll always come out of the trade not happy.

Screenshot: Taken from coinmarketcap

Screenshot: Taken from coinmarketcap

BTC

The different color arrows show the different emotional phases/levels.

As the graph is ascending to reach the peak your emotions too start to rise. Then FOMO sets in. What if I don’t buy now and if continues to rise ? You’re in this mental dilemma until it reaches the left yellow arrow then you now buy. But then it’s already too late, it’s just about to start to fall.

Here your fear of missing out has caused you to hesitate in buying and then ended up buying at a bad time.

Screenshot: Taken from coinmarketcap

Screenshot: Taken from coinmarketcap

THETA

This example seeks to show how you can actually miss out on a good deal because of your doubt and fear. By the left red arrow you had a good indication to buy but because of your doubt and uncertainty you failed to buy. It then went all the way to the peak and almost stayed there for a while but fear and doubt and end up buying at the peak, but then it was just about to fall but you didn’t realize that because you didn’t pay attention to the indicators and the emotional phases you were going through.

You end up buying at the wrong time and loosing because of your fears, doubts and uncertainty.

The different color arrows describe the different emotional phases, some of which are described above.

Screenshot: Taken from coinmarketcap

Screenshot: Taken from coinmarketcap

Conclusion

This shows the importance of emotional intelligence especially in trading crypto. The most important thing is to learn and understand that it is not a good trading habit to trade with your emotions or how you feel about a particular trend or based on luck.

Always make sure you have studied and understood the facts about the particular token you want to trade as far as the indicators are concerned. And learn to control your emotions when you trade.

Do not trade with money you can not afford to lose!

I invite @five5, @soweto, & @sammypoet to participate in this program.

10% of the payout to @steem.education

Thank you

CC: @liasteem

Dear @zzzinnn ,

Thank you for participating in this Mini Crypto program, I really appreciate your good intentions and your efforts in understanding our practice this time.

Here is an assessment of your practice;

you have not put FOMO and FUD in which phase

You haven't given me an explanation through your graph where FOMO and FUD occur, I see a lot of the phases you show, but where do the actual FOMO and FUD phases occur?

Choose the currency that is commonly used in trading, it will be easy for you to better understand the market cycle.

You explained the theory well, but again, from the graphic screenshots you took, you still don't understand where and when FOMO and FUD occur.

Thank you very much, we will waiting for your next exercise, and we will waiting you at the season 4 of Crypto Academy. 👍💪

Has been assessed by;

@liasteem

@steem.education

Very well

Thank you

I’ll study the graphs more

👍👍👍

Thanks Bro

Excellent information. Many times price manipulation is done by the Token developers.

The worst thing to happen is when they withdrew all liquidity and run. Uniswap tokens are great but easily shaken by concocted FUDs

Nice bro, you rock it🤘🤘

Thank you