Book review of Rich Dad poor dad by Robert Kiyosaki||

There is a saying, that he who reads owns the world. Ignorance thrives where the love for knowledge is amiss.

These sayings and a genuine desire to leave my current level of knowledge drove me to seeking out knowledge beyond my reach. My dad had a stash of books worthy of instilling jealousy in the heart of any book lover. It also instilled in me the desire to read at an early age. Whenever I got a little time to spare or steal away from my daily chores, you'd find me pooring over a book or another.

Did I understand what I read at such an early age??. Probably not, but I noticed I began to grow wiser beyond my years ajd my peers so I continued. The first financial book I ever read was "THE RICHEST MAN IN BABYLON" by George S Clarson.

From this book I learnt the first principle of savings I ever knew .. the 70/ 30 principle. This revolutionised my way of thinking as a growing teen, so while my mates would run off to shops to buy sweets and chocolates with money uncles or aunties gave them, I'd run up to my saving box and insert the money inside. This continued for a while, until my savings box was broken and my money stolen. The pain was too hard to bear for a young 15year old.😂😂 But the lessons I had learnt about savings could not be taken away from me.

I resolved to find better ways of savings and then convert them to investments.

But enough about me... What does the book review of today say?? Let's find out.

The first lesson I picked up from this book is;

Humans never come to the point where we are needless. Be it for money, joy, fulfillments and so on. Even when one needs is met another series up it's head like a roaring lion. Because of the human insatiable desires and needs, new ways of solving problems need to be invented or sought out.

The need to satisfy our insatiable desires will bring us to the point of knowledge which of course takes time.

Everything you ever need is a feet or two feet above you and to reach it, you need to acquire a new kind of knowledge. Not new in the sense that it doesn't exist or hasn't existed before, but new in the sense that you never had it or knew about it.

The next lesson I got from this book is that

So what have I been doing all these while working 9-5 ??.

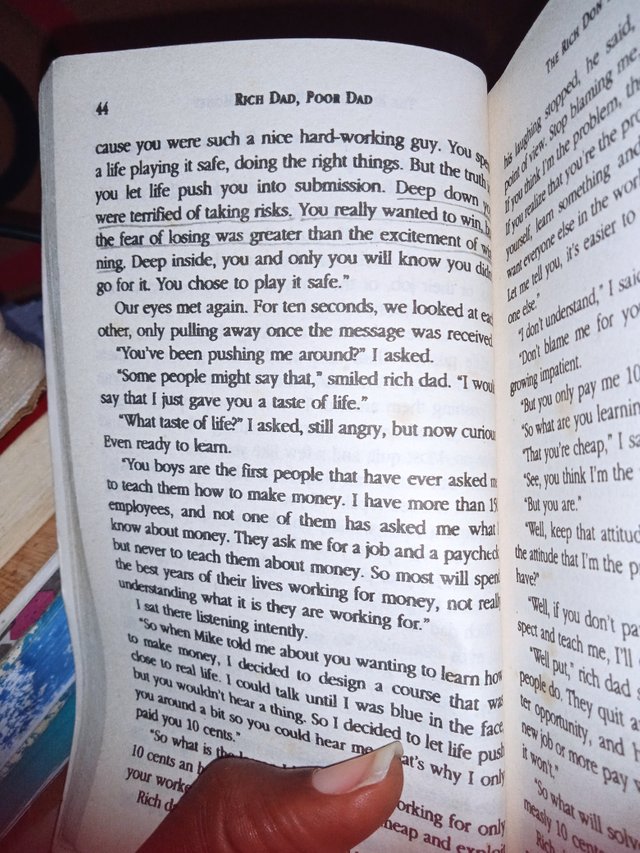

At this point I knew I had to have a mental shift if I really want to practice these principles and see them work for me, but in the meantime, what does he mean by the RICH DON'T WORK FOR MONEY??

- How exactly do they earn money if they don't work for it?

Well, the answer came simpler than I expected. What intensifies fear and desire is IGNORANCE!!

The rich don't work for their money, rather they have their money work for them by way of investments. Not just any kind of investments now, high paying investments they have studied and can bet a good ratio of its returns.

So the rich actually sit down and embark on deep researches??. I asked myself.

What a silly question, but hey, my mind was shifting and i was beginning to think deeper than surface level.

I learnt that a job is a short term solution to a long term problem. What could the problem be then? I asked myself!!.

The problem I found out to be THE FEAR OF LACK!!.

oh my!!. At this point I had to drop the book for a few hours so my brain could adequately process these information. I then began to take a trip back memory lane to see that I didn't always go to work because I necessarily love the job, but because i had this nagging feeling of lack

- What if my money finishes, where will I get another??

- What if I had a financial emergency, where will I get the funds from?? etc.

These thoughts had kept my back up 7 times a week going to a job I didn't like, not becaue i couldn't quit, but because of the fear of lack. Wow!!! What a mind shift.

The next question that came into my mind was WHAT DO I DO??

- Should I quit my job??.

The simple answer was NO!!. Work, get paid a salary, save some of that money, and then invest. Get your money to do the work for you until you attain financial independence!!.

Well then, pick up the book and dive in with me.

Have you read this book before?? and have you been motivated to read it from the review I dropped??. Drop your thoughts in the comments.

All pictures taken with my phone except where otherwise stated.

Thank you @steemcurator07 I appreciate it