Cryptocurrency tax rules in Indonesia

Dear Steemians…

For owners of digital assets in Indonesia, the decision taken by the Minister of Finance Sri Mulyani as stated in PMK number 68/PMK.03/2022 concerning VAT and PPh on Crypto asset trading transactions and effective 1 May 2022 is really unexpected news.

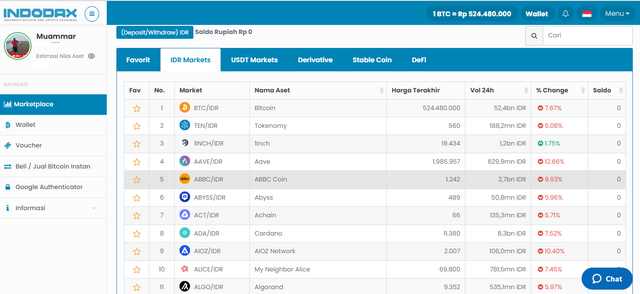

Actually, what is Cryptocurrency, simply Cryptocurrency is a digital currency that can be used as an online transaction tool. The uniqueness of this currency is that it does not exist in physical form but has value. One of the platforms that is recognized in Indonesia as a place for exchanging Cryptocurrencies in Indonesia is Indodax

The breakthrough made by the Minister of Finance is considered a way to make the legal umbrella for Cryptocurrency in Indonesia run. Because so far the legal umbrella regarding Cryptocurrencies is still lacking so that this gap is used by investors to maintain their presence in a country

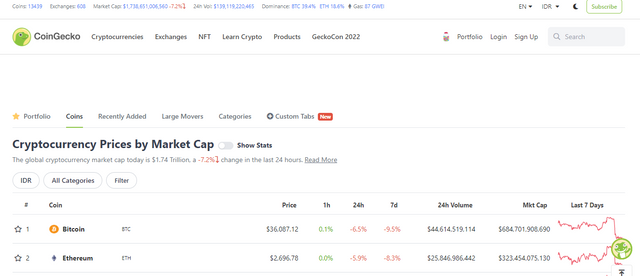

Some countries still consider this cryptocurrency illegal even though several other countries have acknowledged its presence. Countries that have legalized cryptocurrencies are preparing legal and technological umbrellas and tax regulations so that they become one of the tools to become state revenue

The presence of PMK 68 has various responses from people who have digital assets. Personally, I appreciate what the government has done. With the PMK, Indonesia makes progress and can follow other countries that have implemented digital transaction taxes

The PMK provides Indonesia with legal certainty and tax certainty so that investors will feel comfortable and safe investing in Indonesia.

But what is legalized by the government is used as a commodity and not as a means of payment. For example, when having coffee and the owner has a wallet account and we pay with Bitcoin, it is not justified and prohibited, meaning that investing in digital currency is legal but using it as a means of payment is illegal and can be subject to punishment.

As a commodity, Crypto assets are considered a trading commodity, so they are referred to as VAT objects. Because it is an object of VAT, so VAT is charged at the time of delivery by the service seller for Crypto buying and selling transactions and also Crypto buying and selling Transaction Verification services.

VAT is also charged when submitting Crypto assets by sellers in the Customs area or buyers of Crypto assets in the customs area. And buyers of goods and services using Crypto assets, such as NFT.

The Indonesian Crypto Asset Traders Association in their release said that it is necessary to involve many crypto asset business actors who are involved and develop crypto asset tax rules. The hope is that the existence of this legal umbrella can encourage innovation and competitiveness of Cryptocurrencies in Indonesia

Who collects the tax. trade providers through an electronic system (PMSE) and e-wallet services that will collect, deposit and report Crypto transactions

Not only VAT, income from Crypto assets is also subject to income tax or income tax. Value Added Tax payable as referred to in Article 2 letter a is collected and deposited at a certain amount. The specified quantities are as follows:

- 1% of the VAT rate multiplied by the transaction value of crypto assets, if the PMSE operator is a physical trader of crypto assets

- 2% of the VAT rate multiplied by the transaction value of crypto assets, if the PMSE organizer is not a physical trader of crypto assets

This means that the amount of VAT collected and deposited is 1% of the general VAT rate or 0.11%. If trading is not carried out by physical traders of crypto assets, the amount of VAT collected is 0.22%

But calm down. When we still have Crypto assets and just keep them, they are not taxed. Later we will not need to calculate how much tax is imposed on each of our transactions because PMSE calculates and pays the tax. The report will be attached when we report the annual tax return

With the enactment of PKM 68, it indicates the seriousness of the Jokowi government and the recognition of Cryptocurrencies circulating in Indonesia, then the tax imposed is actually very simple and final and we must be careful in conducting Cryptocurrency transactions because it will be subject to VAT and PPh taxes at the same time so knowledge and information are needed. which is more against the tax rules

Bayu, May 6, 2022

@muammar607

Bereh Mar. ka aktif lom

hahaha

beuretus tulisan kali nyoe.....

hahaha di bantu kuh hamba laeh nyoeh