MINI CRYTO PROGRAM,PART2 || "HOW PSYCHOLOGY INFLUENCE MARKET CYCLE"|| BY @JEBOBLI

Hello to everyone, a special thank you to @liasteem and @steemeducation for giving me this great opportunity to learn more on crypto and to be able to share the little I have learned. 10% of payout goes to @steemeducation.

I am here today to share with you on what I have learned on the following topics:

- Visit the website CoinMarket and explain what FOMO is?

- Explain what is FUD?

- Explain where FOMO occurs!

- Explain where FUD occurs!

- Choose two cryptocurrencies and use their graph to explain where FOMO and FUD occurs!

Now let us get into the details in learning something exciting and very useful.

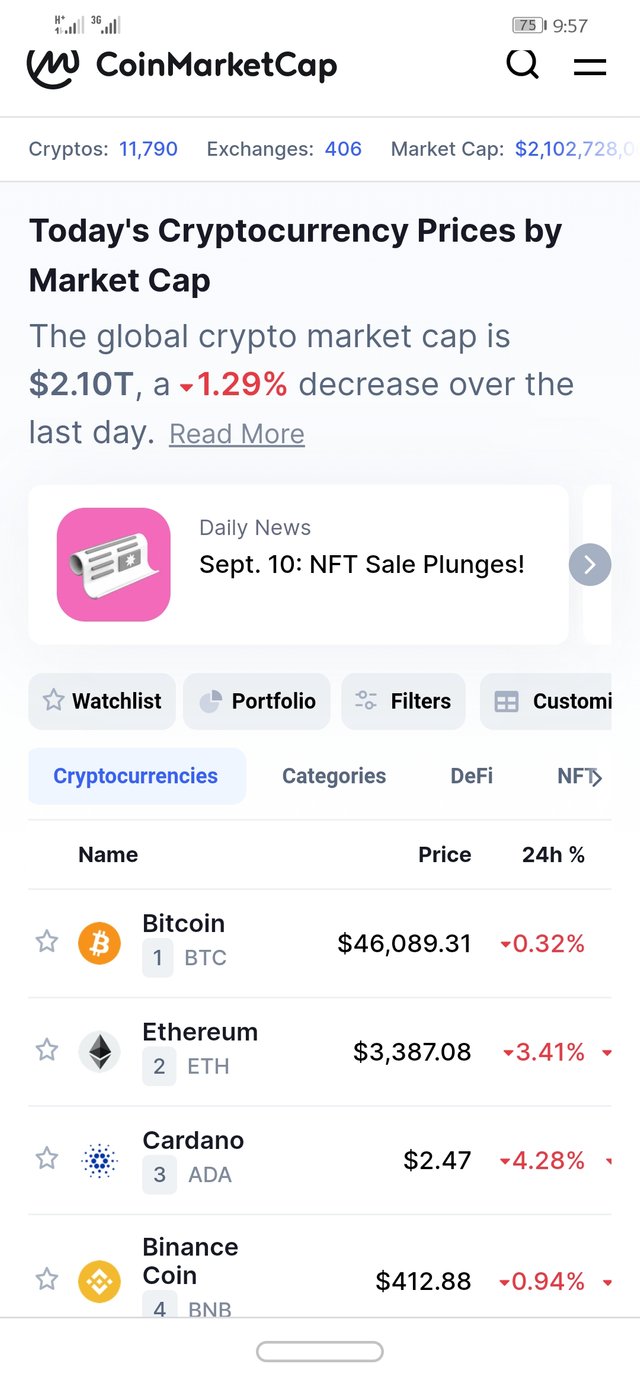

A visit to the website of CoinMarket gave a home screen as shown bellow.

Home screen of CoinMarket

EXPLAINATION TO FOMO

FOMO is an acronym for "Fear Of Missing Out". This has to do with the psychological fear the individual has towards someone or something. They may have a fear of being left out or missing chances on something very beneficial that others have gained from. This also happens in crypto currency, where an individual may envy someone who has gain huge profits from crypto currency and would not want to miss out on the chance of getting same gains.The 'fear of missing out' by an individual may lead to making the individual trade on a particular currency which others are currently enjoying its high profits. Someone who trades based on 'fear of missing out' my lead to the individual loosing all their investments with no profits. This is because, they make irrational decisions based on their 'fear of missing out' profits others are enjoying.

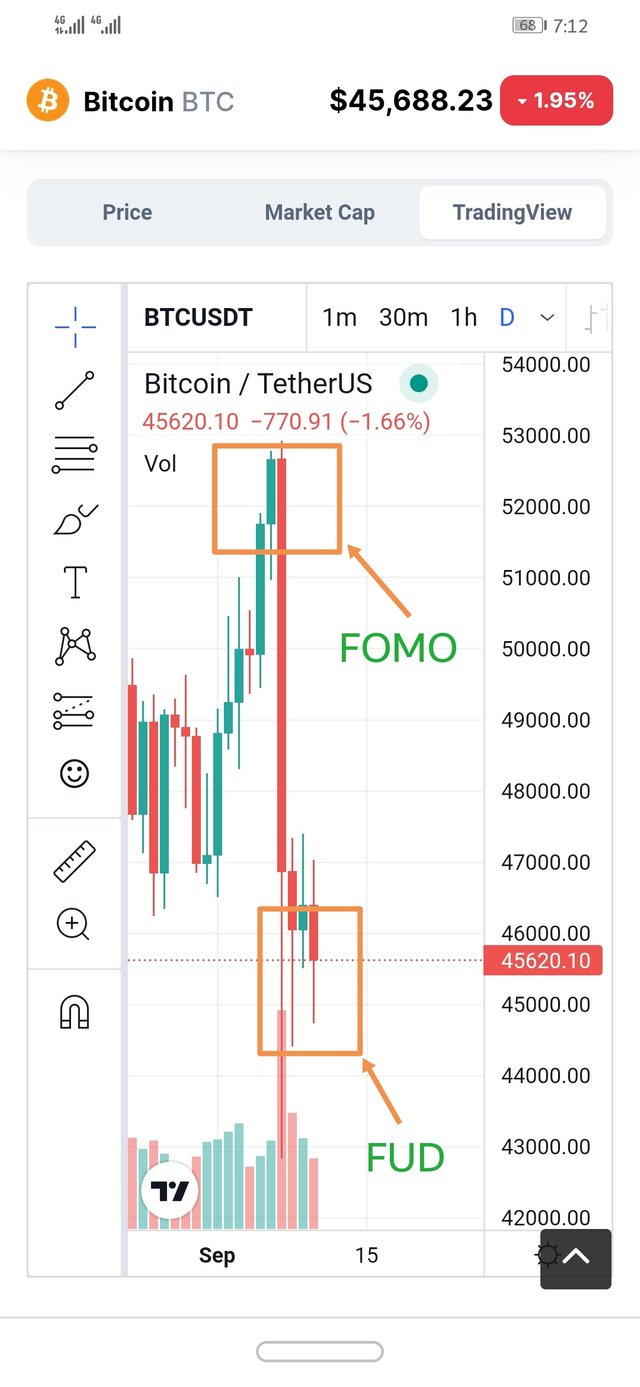

Image of Bitcoin graph

- Explain what is FUD!

This is an also an acronym, which means Fear, Uncertainty and Doubt. This is a situation when an investor is in fear or not sure if the market price of an asset will rise when it has depreciated over a particular time period. The investor sell all their assets to prevent them losing all their investments not knowing when it will rise. Let's take a look at chart bellow.

source

source

Bitcoin chart

The chart clearly shows that, the price of Bitcoin at had dropped down and this may create fear or uncertainty in the mind of the investor that prices of their assets may continue to drop and for fear of losing all their assets, not knowing when it will rise again. The investor will resort to selling all their assets.

- Explain where FOMO occurs!

source

source

FOMO occurs

The above diagram is an XRP currency chart which indicates where FOMO occurs. The highest peak of the bullish candlesticks is where the maximum profits are made and an individual who is not enjoying the profits of traders with the currency may be influenced by 'fear of missing out' (FOMO). An individual who buys when bullish candlesticks are at its highest peak to make double profits in attempt to enjoy the profits others are enjoying, the investor is likely lose to their assets when the market falls down due to their 'fear of missing out'. At this point,an investor is buying assets when they are at their highest price and is likely lose them when it falls.FOMO is usually caused by anxiety and boredom. The individual who feels FOMO should try and understand how things work rather than having the Fear of missing Out.

- Explain where FUD occurs!

Let's take a look at the chart bellow to help us explain where FUD occurs.

source

source

Litecoin chart

It can be seen clearly from highlighted part of the chat that, at the bottom of the Bearish Candlestick is where FUD occurs. From the graph it can be seen that, the price of Litecoin has fallen. This creates Fear or Uncertainty in the mind of the investor as to when the price of the asset will rise again. The investor resort to selling all their assets in fear of continuous fall in the asset they have invested in.

LTC(LITECOIN)

source

source

Litecoin chart

The Litecoin chart above with highlights shows where FOMO and FUD is likely to occur. The highlighted portion with FOMO written shows that asset is at highest price at that particular time. The investor may have the feel of FOMO without prior knowledge or understanding of the whole concept but due to FOMO. The individual who invest at this time risk loosing all their investments wihout getting doubled the profit they hoped-for in a short period ot time. It can also be observed from the chart where the highlight marks FUD, fear or doubt sets in the mind of the investor. Fear or doubt creates an impression of continuous decline in the asset and the individual resort to selling all their investments with fear or doubt of loosing all their investment since he/she is not certain when the asset will rise.

BTC(BITCOIN)

source

source

Bitcoin chart

The Bitcoin chart above also shows clearly where FOMO and FUD may occur. The portion of the chart highlighted and written FOMO can be seen that it occur where the Bullish Candlestick are at their highest. An investor with littled or no knowledge about the asset may be encouraged by FOMO due the profits other investors are making may want to also gain double profits on a short period of time with the feeling of FOMO in them. The investor influenced by FOMO invest and end up loosing all their investments when the prices decline. Likewise on the other hand, where we have the chart highlighted and FUD written attached is where FUD occurs. The decline in the price of the asset shown by Bearish Candlestick may create fear or doubt in the investor, creating an impression that, it may continue to decline and with the fear of missing out on their investments. The investor resort to selling all their investments in other not to lose everything.

Conclusion

In conclusion, I encourage other beginners like myself and everyone here to understand things clearly before venturing into investments others are enjoying to avoid FOMO and FUD since it may lead to depression and loosing out on their investments. I hope the little I have learned and shared will be beneficial to others. Thank you @steemeducation and @liasteem for the opportunity to learn and prepare us for crypto currency next season. I also wish to encourage @atakura, @mrabdul and @dipaa to join this exciting and educational experience.

Dear @jebobli ,

Thank you for participating in this Mini Crypto program, I really appreciate your good intentions and your efforts in understanding our practice this time.

Here is an assessment of your practice;

FOMO and FUD are not always above the trend line or below the trend line. FOMO and FUD happened because of several things before it.

FOMO and FUD cross each other but they have a negative value and can affect market trends.

use the simplest markdownstyle if you are very young to know markdownstyle.

In graphic shooting, you can use the desktop screen.

Thank you very much, we will waiting for your next exercise, and we will waiting you at the season 4 of Crypto Academy. 👍💪

Has been assessed by;

@liasteem

@steem.education

Thank you very much. I will surely correct my mistakes. I will keep learning to improve