Is it worth to invest a volatile ERC20 token to borrow a ERC20 stablecoin?

DeFi

This has been a really hot topic for many people including my #teammalaysia friends who have been investing heavily on crypto of late.

But for testing purposes, do you think whether it is a good thing to actually borrow money to make money? Well at least for some who has ton of money set aside doing nothing, perhaps.

Do you think this is only for players who are wealthy?

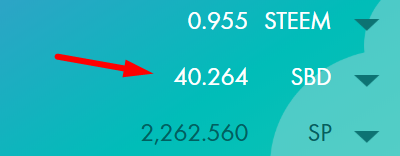

For instance, I want to make good use for the SBD that I have, besides investing into SP to continuously supporting the STEEM community, I want to expand my earnings to roll further, and perhaps, dump it back into SP again.

I once remembered, never invest all the eggs into one basket; and so far I have managed to move some of my other SBD into Nexo after converting to USDT stable coin to generate 8% interest in Nexo.io; but to own DAI is really expensive but my #teammalaysia family @khimgoh mentioned to use whatever that is sitting and doing nothing, roll it to something.

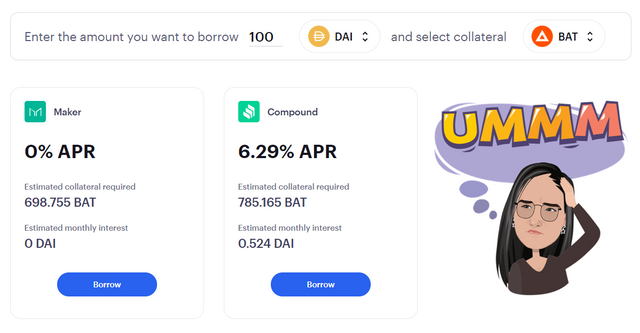

With MakerDAO it is currently offering ZERO % interest to borrow DAI, even as little as 100 DAI just to test it out while paying back the interest little by little later, would it worth?

However, because of publish0x previous postings (yes you earn by receiving tips, check out my tiny blog there on some of my gaming reviews and occasionally cooking journey there) I actually got some really decent BAT to test this out, but I am short a tiny bit more to test whether it is worth it or not on the long run for small time earners.

Cost:

$9 USD worth of ETH to establish a proxy

700 BAT used for collateral.

Worth my time?

Definitely open for discussion while I gather my eggs together to top this up....

haha, not even trying that yet and it has already boom so much

Yes and having DeFi booming so much so that it is congesting the network pretty badly.

[WhereIn Android] (http://www.wherein.io)