"Selling pressure keeps Bitcoin waiting for a signal to sell"

"Selling pressure keeps Bitcoin waiting for a signal to sell"

Hello, good morning everyone, welcome once again to the analysis of the cryptocurrency market and today we are going to comment on a couple of things that may be putting selling pressure on bitcoin but it is a Temporary selling pressure and then we are going to comment on a key psychological aspect .

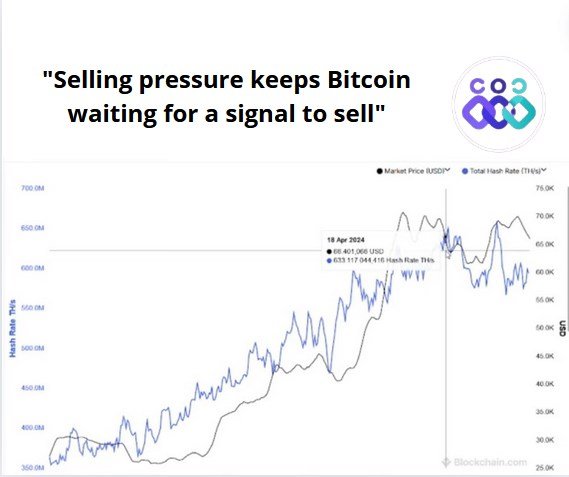

Where are we? No, the possible selling pressures on bitcoin come above all. I think that the miners, the reserves of the miners, tell us here this news that has come out more recently, which is at a 14-year low, that is, the miners are selling. part of the bitcoin that they have Because of course with Halvin we already know the costs increase so they need to continue paying those costs and the income is not as much as what they had before Halvin also lately there is not much volume being made on the network as This at 017 bitcoin 027 0109 015 022 is enough to sustain the network in the long term but it is not enough to make the Hash rate continue to grow.

For that, the price has to be raised to higher levels than we are or the commissions that are generated in each block have to be raised, but not at the moment because the network is holding up quite well with a fairly high Hash rate but not enough to that miners stop selling bitcoins, not those they have in their portfolio.

This is to cover costs while the price does not rebound, so while we are in this situation there will be selling pressure from the miners that at some point will obviously end up in another place where some selling pressure may also come, although not more so. for what it implies no for no for the amount of bitcoin that they have sold it is because of the German government that has moved 6500 bitcoin on the 19th and this has caused there to be rumors on the internet that it has been selling those bitcoin no they are not many for influence the price 6500 but you know, people are always afraid that if they sell everything because they reach 50,000.

Well, that could be a significant pressure then. Those sales from those who are afraid that the German government could sell those bitcoins and force the price. Not because they are not those 6,500 that you sell but the same other 10,000 or 12,000 that people sell thinking that the German government can sell, no, so that pressure is on the price in recent days, it is not in the psychological aspect that I was going to tell you right now, it gives the feeling that bitcoin cannot go up, it can only go down, everyone is pessimistic, everyone is pessimistic. The world is seeing that we have lost that trend line that we have been going down since the last few days.

Hey, when it seems like there is no chance of it going up, that's when there are more chances of it going up.

People are already bored with this lateral movement, people are oh no.

They were just bored, they were bored until a couple of weeks ago. Now they are worse than bored because with this latest fall, they are afraid that it will fall better. That feeling is what I am perceiving from the market. And when you think that the market cannot go up at all way it's probably when it's about to go up, it's just the opposite. It also happens when you think it can't go down in any way, well it doesn't go down.

So when we were there about to break the highs it seemed like it was not going to go down because we have had this correction and now I think it seems the opposite, it does not seem that it is impossible that it will return to 70,000 soon and it is most likely what do precisely for that because it is what that most people are not expecting in the short term, that's not also true, alcoins continue to perform well against bitcoin.

As we persuaded, most are rising, not all but:

AB rises 18 4%

Cardano 150%

Algoran 8%

In general, the majority are in the green against bitcoin. That means that the pressure is only on bitcoin, that is, for specific reasons for bitcoin, which could be the ones we have commented on, about everything about the miners, not that in other altcoins, because you are not seeing that pressure and how the market is not bad in general because we are having more or less stable stock markets.

Although they are correcting, but they are minimal corrections, 0.19 for the future of the sp500, 0.32 for the dax after having risen almost 1% yesterday and the Dow Jones also barely corrects the future, so that there are no big movements in the future. any. the stock market for there to be so much selling pressure.

So it's a selling pressure on bitcoin in particular that will end at some point. Right now we don't get the impression that it can go up, but that is precisely what usually happens before it goes up, which doesn't give us the impression that it can go up. So at any moment we are going to have a recovery, the first resistance level is 65139 and the next good one, 66643, which yesterday we almost touched that level, so we are not that far away either. What happened is that yesterday everything was lost in the end. victorious.

Analysis of Bitcoin market pressures

- The factors contributing to Bitcoin selling pressure, focusing on miner behavior and government actions. Additionally, a psychological perspective on market sentiment is analyzed.

Factors that contribute to sales pressure

Miners are selling Bitcoin at their lowest level in 14 years due to rising costs after the halving, affecting network sustainability and hash rate growth.

Despite a high hash rate, miners continue to sell to cover costs until prices rise, indicating continued selling pressure on bitcoin.

Government influence and psychological feeling?

The sale of 6,500 Bitcoins by the German government sparked many rumors and fear among traders, affecting market sentiment despite the relatively small volume sold.

Market sentiment reflects pessimism with doubts about Bitcoin's bullish potential, highlighting a common belief that when it seems impossible for Bitcoin to rise, it often does.

Market Dynamics and Altcoin Performance?

Altcoins show strength against Bitcoin as most are in the green, suggesting specific pressures on Bitcoin rather than the entire cryptocurrency market.

Minimal corrections in traditional markets indicate that selling pressure is primarily directed at Bitcoin specifically and not a broader market trend.

Conclusion.

Bitcoin price analysis and future prospects?

- Current Bitcoin price levels and speculate on possible future movements based on resistance levels and market dynamics.

Price levels and resistance points

Current resistance levels are at 65139 followed by 66643; Recent fluctuations suggest proximity to important price points.

Despite recent setbacks in price growth, optimism persists regarding possible recoveries based on historical patterns of unexpected price increases.

Thank you for reading me grateful.....

Let's remember to comment on my publication, I will gladly answer you.

This article is written by @OscarDavid79 free of copyright

X PROMOTION

https://x.com/oscardavidd79/status/1804254101531959635

Upvoted! Thank you for supporting witness @jswit.

Thank you for supporting

Note:-@oscardavid79, your article quality is poor, needs improvement in writing.

Regards,

@theentertainer