An Introduction to Maximal Extractable Value (MEV)

|

|---|

Friends, let's discuss EMV which stands for maximal extractable value for today which is an interesting topic that deals with how miners get profited from mining cryptocurrency.

| Maximal Extractable Value (MEV) |

|---|

Whether you are a crypto miner, block producer, validator, or witness there is always a maximum block that you can get by reordering or excluding transactions anytime you are creating a new block through a process known as "Maximal Extractable Value".

|

|---|

Simply put, MEV is a strategy that is used by miners, validators, or block producers to improve their profits when creating new blocks which are intentionally done either by changing the order of transactions, omitting, or including blocks to optimize profits. It is just like a tax that is invisible to taxpayers which in the case of a blockchain is done by extracting transaction fees and block rewards which works perfectly on a proof of work network.

| How Maximal Extractable Value Works |

|---|

|

|---|

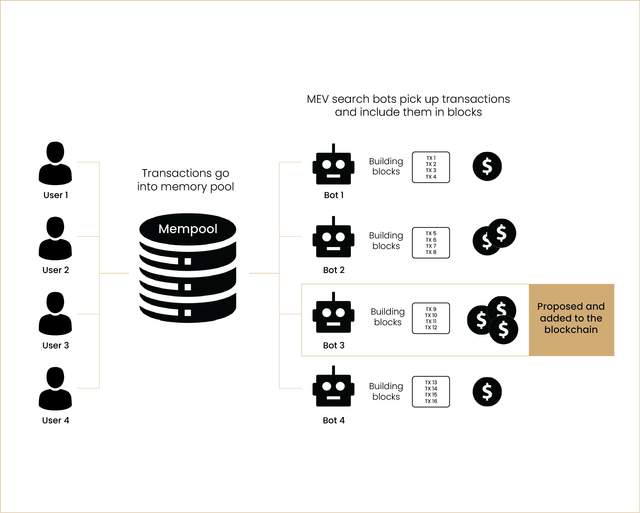

On a blockchain, a transaction that is submitted by users is passed through the "mempool" of each of the nodes in the blockchain network, which the block producers or miners can choose to do the following

- Include

- Reorder or

- Exclude the transactions to the next block to earn

Having said that, block producers or miners can extract MEV from arranging the transactions within the block with respective fees involved. Doing this results in initiating arbitrage and opportunities that block producers or miners from earning extra profits aside from the transaction fees.

| Types |

|---|

As introduced earlier it is through arbitrage and On-Chain that MEV made profits which constitute the following types.

- BACK RUNNING:

This is the type of trade that happens when a trade is accomplished instantly by an MEV operator. The MEV operator would benefit from the thick-running trade by capturing a large amount of liquidity in decentralized exchange and selling the crypto at a higher price.

- FRONT RUNNING:

This is the type that deals with how researchers and block producers enter a buy order before it is executed. They both profit from the impact a similar trade has on the price of the asset a buy order is open.

- LIQUIDATION:

Decentralized finance protocols depend on MEV to liquidate the position of those who borrow assets on a DEFI collateral must be put in place first if the collateral falls below the agreed amount MEV will be needed before liquidation can occur.

- SANDWICH ATTACK

This is when there is an attack on the transactions of an exchange to execute a buy order before and after a sell order. To this, the participants of the network would then make profits from the slippage of the main transaction (original trade).

Disclaimer

We have learned about MEV which is a means through which miners or block producers earn extra rewards. This post is strictly for educational purposes and not as investment advice.

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

My link.

https://x.com/AkwajiAfen/status/1805499810717241477

Note:- ✅

Regards,

@theentertainer

Thanks for sharing with us on MEV taking step by step to explain. Though I'm not really deep into this. Alot of questions bothering me in this very interesting post... I wish you could find time to answer. However, I will research further on it.

Feel free to ask me your questions sir.