Nested Exchanges and a Review of the Crypto Market

On the crypto space, we have lots of exchanges that operates in a way users can carry out crypto transactions. These popular exchanges are known as centralised and decentralised exchanges. These popular exchanges are used to trade crypto assets like dollars and other assets. Not just transactions but trades are also done in these exchanges. Asides these two popular exchanges of which most of us finds it difficult to know which is which. There's yet another exchange that should be avoided by all cost. Not all exchanges are good for trading. I can remember the experience of a women I was teaching crypto basics.

She told me she was once scammed due to greed on an exchange that barely exists as an app. The exchange is on a site built by one of these scammers used to project their waves. They claimed it's BitGlobal exchange. She hurried in since she heard it was an exchange. That's how she lost $200 funding the exchange to trade.

Nested exchanges belong to the list of exchanges for crypto transactions that operates within another exchange. They are nested as the name implies on larger exchanges and allow traders trade crypto without directly interacting with the main exchange to which it is built on. They leverage on this large exchange for security and liquidity which provides a broader range of trading options without needing to sign up multiple accounts.

The nested exchange operates on a diverse way me mechanism which includes; utilizing the main platform's infrastructure, crested an account on the main exchange before creating on the nested exchange allows for dual benefits of both exchanges.

In as much as this exchange is advantageous in terms of being cost effective, using liquidity to make assets stable, high trading volume etc, it is also disadvantageous. How?

They might not have this clear information about operations and activities carried out therein like gas fees and user data. These are concealed or vague in such a way that users finds it difficult to understand the conditions of trades carried out. This makes them lack transparency which is a serious concern.

Since it's dependent on the main exchange hosting it, it experiences what is experienced in the main exchange. Examples of such Nested includes; binance sub account, kuda sub account, idex etc Now let's take a close look at the crypto market in general.

History Repeating itself - Bull Run |

|---|

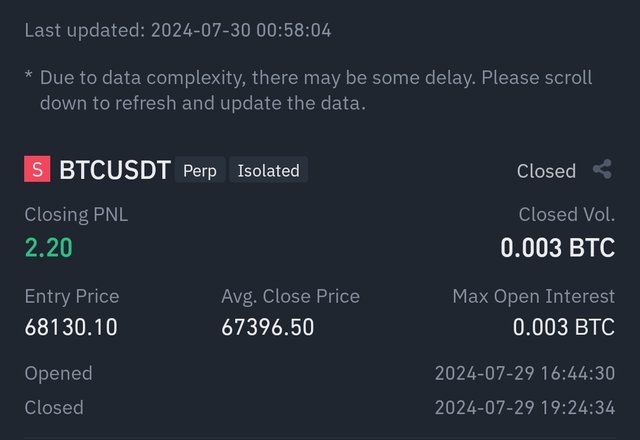

List I've always said, we are trading with trends following past movement of the market last bull run year. The movement that happened in the price of bitcoin, July, 2021 is actually repeating itself and this has actually guided us in making trades decisions. Today, i actually expected a drop in the price of bitcoin and I placed a trade that followed that pattern. It actually happened to show that the market is repeating itself. These are screenshots of yesterday's moves.

|  |

|---|

Let's make some quick analysis on the past movement and now. Earlier this month, there was a pump in the market which made bitcoin rise from $53k to $66k. This happened on July, 2021 where bitcoin moved from $28k to $42k second week of July. There have been slight movements and drop throughout this July. The aim was for bitcoin to reach $52k and the aim this year is for it to reach $75k before it dips.

Now let's take a look at the similarities between these charts of past movements and current market. I'm using these charts to trade futures and it's actually working well for me. I don't doubt the movements of the market in terms of pump and dips because I'm working with history.

These are screenshots of today's movement. This may not be they accurate but it's repeating history. Our next target is for it to hit $71k after this drop of $66k. It won't go down beyond this from my history analysis. What I'm doing is not a trading decision for you to follow but It's one of my trading strategy and has been working well for me using different indicators. Do your own research to avoid risk from losses as the case may be.

All screenshots are from my binance app.

Disclaimer :Any financial and crypto market information provided in this post was written for informational purposes only and does not constitute 100% investment advice. It's just basic knowledge every crypto trader or investor should have

https://x.com/bossj23Mod/status/1818074843490988092?t=5zm_vupNutxKHldMzvRc1g&s=19

Note:- ✅

Regards,

@jueco