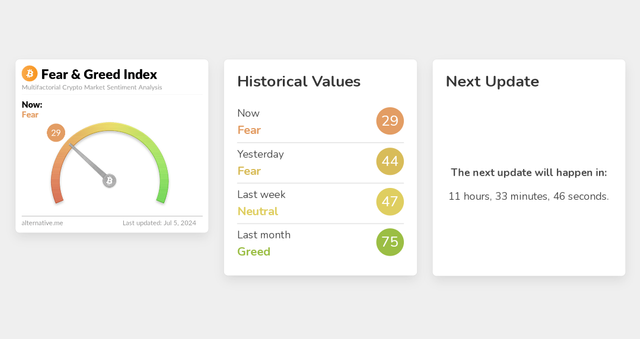

Fear and Greed Index: Measure market emotion to predict potential market movements.

Greetings to everybody . Today one of the favorite tools for most of the market investors is trying to measure the sentiment powering the market.

It's used in forecasting possible market movements and determining how much fear and greed guide market participants.

Canvas source Canvas source |

|---|

In the following post, I'll explain how the fear and greed index works, and the ways you can use it for better investing decisions.

How the Fear and Greed Index Works

The Fear and Greed Index is premised on the logic that very high levels of fear will depress prices at depressed levels, whereas very high levels of greed will inflate them. It thus follows these sentiments to understand the present market sentiment and further helps in anticipating changes. The index goes from 0 to 100—one extreme indicating extreme fear and the other showing extreme greed.

It is calculated or based on factors such as market volatility, stock price momentum, trading volume, put and call options, market breadth, and safe-haven demand. Each of these components gives a view of the general market mood at that time.

For instance, one would point towards fear if there is high volatility and an increased demand for safe-haven securities like gold, with other pointers being strong stock price momentum and high trading volumes.

source source |

|---|

By regularly monitoring the Fear and Greed Index, investors are able to figure out if the market currently has a more favorable opportunity to climb or drop.

If the index signals extreme fear, it may indicate it is a buying opportunity, as prices may be undervalued.

On the other hand, if it signals extreme greed, then it could be a selling opportunity, as prices may have gone up too high.

How to Use the Fear and Greed Index with your Investment Strategy

Using indexes of fear and greed could help in making investment decisions. For example, if the index flashed extreme fear, one will want to buy fundamentally solid stocks that were probably pulled by sentiments. This contrarian approach will identify bargains which allow one to capitalize on rebounds.

On the other hand, if it indicates extreme greed, it might be time to have caution. At that time, prices will be high, and the risk for an adverse correction in the market will be high. You may take out your profits or reduce risky assets. In this regard, you will be protecting your investments against probable downturns.

It is an important point to think about; after all, the Fear and Greed Index is just amongst many tools. It could prove worthwhile for hints on market sentiment, but it is worth not even a dime. Remember to consider other factors, including economic data, company fundamentals, and global events.

Use the Fear and Greed Index to understand market sentiment, predict potential movements, and hence arm you with more informed decisions into your investments for a better chance of success.

Remember, use this in conjunction with other forms of analysis, which may give you a better view of the whole scenario. With the right approach, you can be better placed to navigate financial markets up and down.

Kind Regards

@artist1111

Adieu, folks!

May the winds of fortune

carry you to greatness!

May the winds of fortune

carry you to greatness!

https://twitter.com/HamadkhanMWT/status/1809203341219545186?t=J-8OFjulns-WXZAcUX_GQg&s=19

Note:- ✅

Regards,

@jueco