The future of blockchain marketing

The future of blockchain marketing

Introduction

Blockchain technology, which emerged in 2009 with Bitcoin, has received over years innovations in the form of other currencies and platforms, expanding possibilities of the creation of Satoshi Nakamoto. We realized that other platforms like Ethereum, Steem, SiaCoin, Enjin Coin, which came later, brought in their proposals more than just financial solutions, but added to the blockchain technology features like smart contracts, blogs, files in the cloud, digital games, and showed that the possibilities of applying the technology were vast, and could be adopted not only by individuals, but also corporations and governments.

Another important aspect is the analysis of the current internet. To talk about platforms of blockchain marketing, we need to understand how marketing is constantly bombarding us with advertisements and promotions. Almost every time we grab our smartphone and use it, we have contact with advertisements. Even apps today adopt advertisements for profit, instead of being paid, they are free, and they get revenue through the implementation of advertising spaces within the platform.

Blockchain marketing platforms come to improve marketing on the internet, making processes less bureaucratic, cutting costs and increasing the reliability of system as a whole, from the advertiser to the customer.

We will use Adex as the object of analysis. It was launched in 2017, and is a platform that, for comparison purposes, resembles Google Ads, promoting online ads. It is a mix of new technology and new use of existing technology as it is a synthesis of blockchain with traditional online marketing. It is a disruptive technology, but not necessarily a financial innovation, as it adapts the reality of cryptocurrencies and brings a new functionality for blockchain, a solution to a problem, the reliability that so much remains broken in the current online advertising system, which disrespect the user's privacy when stealing personal information.

Hypecicle analysis

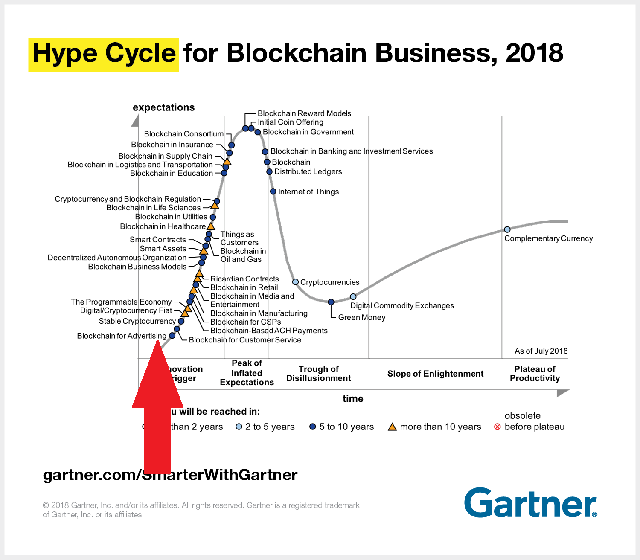

Hype Cicle is a form of analysis where we study the current and further adoption of a technology in relation with the expectations of consumers regarding that technology. Looking on the Gartner website, there is an article about blockchain where we notice, as shown in the graph below, right at the beginning of the cycle, in the trigger stage of innovation, the term “Blockchain for Advertising”, followed by the caption indicating that this technology will reach, according to them, the productivity plateau of 5 to 10 years counted from 2018.

This graph, in addition to showing a variety of technologies, also shows how the time the main factor to be analyzed. Other older blockchain platforms like Ethereum, Ripple and Monero took years to solidify and become establish themselves as market leaders in their respective proposals. Ethereum, Ripple and Monero have proposals that innovate and improve other existing technologies. In the case of Ethereum, its focus is on smart contracts, Ripple is focused on systems for financial institutions and banks and Monero is a private and non-traceable currency. Adex also comes along these lines, entering the growing digital marketing market and solving problems of this area, as others did before it, and managed to consolidate themselves. The biggest example of this is Bitcoin itself, which is already consolidated as currency, being progressively more accepted by large and small companies and governments.

Dow's Theory

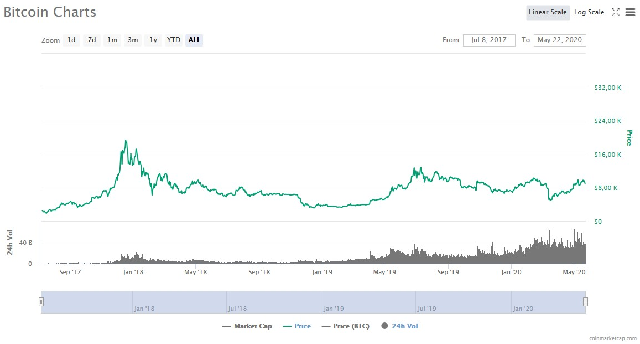

Dow's theory for analyzing this technology can be done by perceiving the graph also from Adex. What makes the analysis more complex is the fact that we have, in the world of cryptocurrencies, a tendency of so-called “altcoins” to follow the flow of Bitcoin prices. Altcoins, as currencies other than Bitcoin are called, have a small market presence, individually, while Bitcoin has dominance 66% of the total market, this total being evaluated, on 22/05/2020, in $168.775.622.766 US dollars.

Below we see a graph of the price of Adex, and then a graph of the price of the Bitcoin, from the same time period. If we take other coins, we will see that the tendency is for all to follow Bitcoin, due to this majority presence of the currency in the market. Other factors, such as the so-called “FOMO” or “Fear of Missing Out” also explain much of the price variation. This is explained as being waves of buying and selling in a short period of time from “bombastic” news, good or bad. Many bad informed traders buy and sell in times of crisis with an euphoric fear of missing an opportunity, giving the appearance of currency instability.

It is noticed that Bitcoin has a primary growth trend and Adex to remain stable. This happened with Bitcoin in its beginning too, taking years until a price increase path was perceived, derived from the increased interest in the currency and the technology. Adex, being a new proposal, as well as was said in the analysis of Hype Cicle, it's understood within this initial adoption window, still not having its potential explored, being able to be classified as being in the Accumulation Phase.

Conclusion

It is noticeable, in the graphs above, the proof of what was said about the trend in price of altcoins to follow the “big brother”, Bitcoin. This does not mean, however, that we can affirm the success or failure of a given technological innovation based only on this price fluctuation. The primary trend of the active crypto market is the rise, as we can learn from the Bitcoin chart. And, as Dow's Theory says, a trend will consolidate until there are signs of reversal. And there isn't, although some smaller waves may eventually give the opposite impression.

Blockchain-based marketing technologies and platforms will be a trend? It is an extremely recent technology and will face many resistance and barriers, mainly from companies already consolidated in the market of digital marketing, but we can say that it is a trend based, mainly, in other successful cases that use blockchain technology. Smart contracts, virtual currency, records of the most diverse documents, whether private or government-related, fundraising campaigns, sale of currencies in ICOs and HTOs, cloud storage, games, blogs and vlogs and even proposals of the so-called “stable coins” with gold or other asset backing them, are all examples, among many others, of how versatile the blockchain is and how bigger is it's potential to technological development than it may initially appear.

Parabéns, seu post foi selecionado pelo projeto Brazilian Power, cuja meta é incentivar a criação de mais conteúdo de qualidade, conectando a comunidade brasileira e melhorando as recompensas no Steemit. Obrigado!