Is SBD back in the Reward System? - Understanding the Determinants

Introduction |

|---|

The return of SBD back in the reward system on Steemit seems to be the freshest news we have seen in recent days on the platform. While existing users are happy about SBD, some new users are curious about what the whole thing is all about.

Free Image from FreePik

But, how did this asset (SBD) make its way back into the rewards? As existing or new users, you deserve to know a little about what's going on such that you equip yourself with the knowledge of how the Steem blockchain works. So, I've got a piece to share with you today.

The Factor behind SBD's Return - The Debt Ratio |

|---|

Steem Backed Dollar (SBD) stopped printing in early May 2022. At that time, many users who joined the platform around 2020 through early 2022 had not experienced such before and that created a lot of confusion as regards the disappearance of SBD in users' rewards.

Basically, the debt ratio at a point would determine how users receive their authors' reward to keep things balanced on the Steem blockchain. Remember, author rewards can be received in STEEM, SBD, or STEEM Power depending on the author's reward setting and the debt ratio at a point in time.

I've got a piece for you as regards the debt ratio if you haven't seen it before, it's an article I created during the heat of the SBD's disappearance in May 2022-

Debt Ratio's Impact on the Authors' Rewards on Steem- Understanding the Current Situation. Now that you have read a little about the debt ratio, let's proceed.

How SBD returned |

|---|

The debt ratio over time largely depends on the market capitalization of STEEM and that of the SBD. We can't talk about market capitalization without the supply and price of an asset because it's a product of both (supply and price).

Many users asked me when SBD would be back and I have always emphasized, price. The price of STEEM has a huge role to play in elevating its market cap and giving it weight to achieve a reduced debt ratio. So, what has happened in the last one and a half years?

SBD stopped printing (limiting its supply during the period).

STEEM continually prints (increased supply).

Increased STEEM's market price.

In fact, the three points above being fulfilled is all the STEEM blockchain needs to achieve a reduced debt ratio and we will use that in our calculation later. Over the period, SBD suffered a decrease in market price.

_1.png)

The SBD/USD chart above shows that SBD touched a low it has previously seen in 2 years (Dec 2020 - Nov 2022). Quite interesting, while many of us weren't paying attention, SBD hit 1.17 USD and was almost back to maintain a 1:1 parity with the USD.

That said, the supply of SBD remained unchanged over the period while STEEM supply and price have expanded. So let's calculate our debt ratio to determine how an author who sets his/her reward to 50%SBD/50%SP receives a post reward at payout.

- Debt Ratio = SBD's Market Capitalization / STEEM's Market Capitalization.

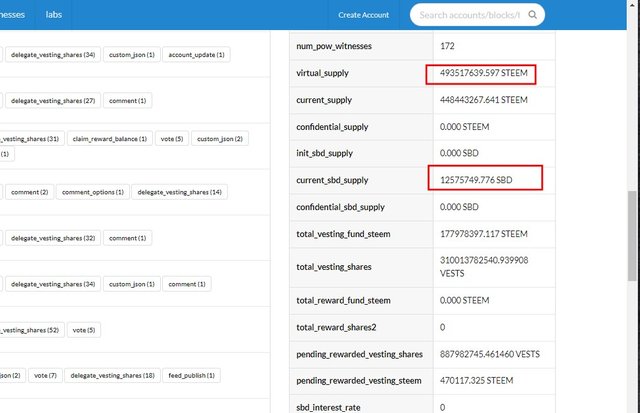

So, we need to know the Virtual supply and Price of STEEM, the product gives us the market cap.

https://steemdb.io/

From the image above, we can see that the virtual supply of STEEM is 493517639.597 and the supply of SBD is 12575749.776. And STEEM was trading at 0.2769 USD at the point I was creating this content.

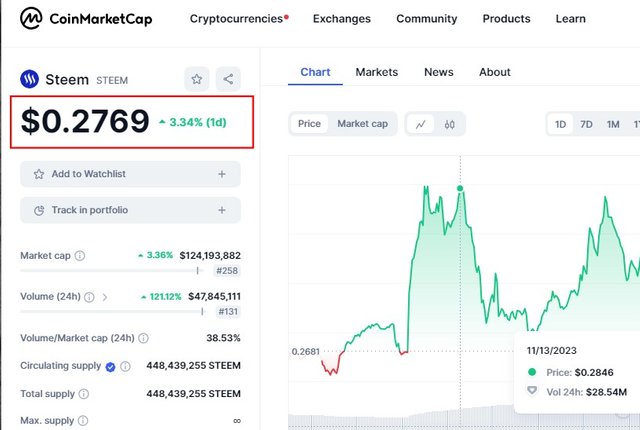

https://coinmarketcap.com/currencies/steem/

Such that,

STEEM market cap = 493517639.597 * $0.2769 = $136655034.40.

SBD market cap = 12575749.776 * $1 = $12575749.776. Note: the STEEM blockchain considers SBD to be $1 at all times because it's a stablecoin pegged to the USD on the ratio of 1:1. We will talk more about the broken peg subsequently.

Now, the debt ratio equals,

Debt ratio = $12575749.776/$493517639.597 = ~0.092 - - - 9.2%.

And to achieve SBD printing again, the debt ratio must be less than 10%. And at <=9% SBD printing is back at 100%. The debt ratio is within 9% - 10% now, which implies author rewards are being received in STEEM, SBD and SP.

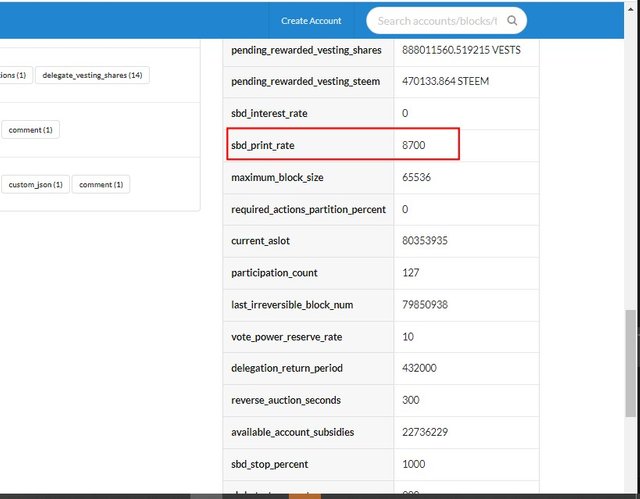

By exploring the Steemdb.io tool, it can be seen that SBD printing rate is at 87%. Reason why you can still see some STEEM on your rewards.

https://steemdb.io/

You can always check the website I included above to see the current SBD printing rate and maybe work things out on your own to get more familiar with the STEEM blockchain. I have written a simple JavaScript function (steemDebtRatio) to calculate the debt ratio at any point in time, you can use your Chrome developer tool to run it whenever you want, although you have to manually input the virtual supply and price of STEEM and the SBD supply, via a prompt.

var x = prompt("Enter the SBD supply");

var y = prompt("Enter the STEEM virtual supply");

var z = prompt("Enter the STEEM market price");

function steemDebtRatio (x,y,z) {

return (x / (y * z) * 100) + "%";

}

steemDebtRatio(x,y,z);

Where are we now? Over the last few days, we have seen a quick switch in the SBD printing rate from attaining 100% and slipping below again. A few things to note:

SBD is printing again which eliminates its stagnation of many months.

The continuous supply of SBD affects the debt ratio if it's assumed that the price of STEEM remains at a level.

To achieve a more stable debt ratio below 9%, STEEM's price is a huge factor. The higher it goes, the more stable the debt ratio is achieved as there is an increased STEEM market cap and a reduction in the printing of STEEM as a reward.

Well, we can't deny the fact that SBD printing for rewards is not satisfying the initial intention of stopping the excess supply of STEEM on the blockchain, because with SBD, excesses of STEEM are still created due to SBD not maintaining its parity to USD. But, SBD tends to benefit authors more as seen over the years, that's crazy, you know?

Conclusion |

|---|

In conclusion, the debt ratio determines how the author reward is paid out on the STEEM blockchain over some time and it is a concept you need to understand such that you don't get confused about the rewards payout subsequently. I hope you have learned something today. Drop a comment about what you have learned from this today. Thanks for reading.

Thank you @fredquantum for publishing this article in the Steem4nigeria community. We have assessed your entry and we present the result of our assessment below.

MODs Comment/Recommendation:

We will love to read more from you. Keep making good quality posts in the Steem4nigeria community And Please remember to always share your post on Twitter and endeavor to join the #Nigeria-trail for more robust support in the community. Click the link Nigeria-trail to join. And if you have difficulties joining, you have a guide to join which can be of help

Thanks for the verification of this article, @manuelhooks.

It's good to read from you, it's been a while.

Thanks once again. Yeah, it's been a long while. Been busy with study and work. You'll see more of me in the coming days. I appreciate the kind gesture.

Thank you for the valuable post. The teaching is worth to be read over and over...

It's a pleasure doing this. Thanks for reading through, boss.

First, thank you for giving an extensive expaknation about SBD. Secondly, are you saying if the SBD price is not maintained, there's a high chance it will be stopoed again?

It's the price of STEEM we are concerned about. SBD still maintains a $1 peg in the heart of the Steem blockchain as such we only care about its supply in the calculation of the debt ratio.

There is a possibility. We have seen the SBD print rate slip forth and back over the last few days which shows how the market price of STEEM has an effect in this context.

For example, two days ago when I first made my calculation, the debt ratio was around 8.8%, bringing it below 9% which enables SBD to print at 100%. At that time, STEEM was trading around $0.29.

If you observed the highlighted period, STEEM wasn't reflecting on pending rewards. STEEM price is slightly lower compared to what it was 2 days ago, the debt ratio is now >9% such that SBD now prints at a percentage while the remaining is paid in STEEM.

This is a reason we have STEEM showing up on rewards as of today. This tells you how the price of STEEM can affect the debt ratio that determines the SBD print rate over time.

Now, imagine STEEM at $0.2. I know you don't wanna imagine that, no one wants to 😂 .

I hope it's clear enough now. Thanks for reading, @yuceetoria.

It's much clearer now, thank you Sir @frequantum.

I'm glad it's simplified now. You are welcome.

This is a manual curation from the @tipu Curation Project.

Also your post was promoted on 🧵"X"🧵 by the account josluds

@tipu curate

Upvoted 👌 (Mana: 6/7) Get profit votes with @tipU :)

Thank you very much for this amazing post. @realitytraend and @chiomi check this and

It's my pleasure

Great piece boss..good to have you back here. I can wait to drink more from your wealth of knowledge.

Thanks, man. How have you been?

Been here boss...trying to stay afloat the steemit ocean. Smiles.