The Risks of EVM Chains in the Crypto Ecosystem

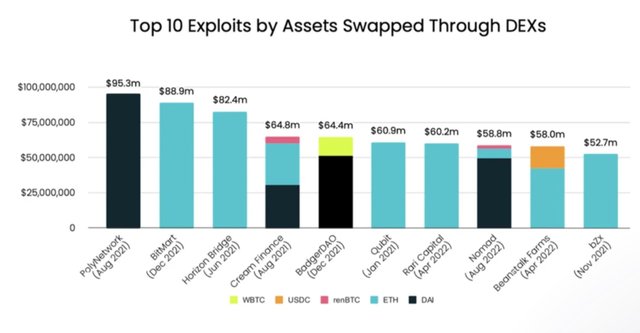

Top 10 Exploits as of June 2022, Source: elliptic

Recent crypto exploits highlight a concerning trend: most hacks, scams, and rug pulls occur on Ethereum Virtual Machine (EVM) chains like Ethereum, Binance Smart Chain (BSC), Arbitrum, Optimism, and Base. These chains have been at the center of high-profile incidents throughout crypto history and continue to dominate the landscape of vulnerabilities.

Are EVM Chains the Problem?

At first glance, the data might suggest avoiding EVM chains altogether. However, this conclusion oversimplifies a complex issue. While it's true that EVM ecosystems can be risky, the reasons behind their vulnerability are worth examining.

The Wild West of BSC

Binance Smart Chain (BSC) has earned a reputation as one of the most chaotic environments in crypto. Scams and fraudulent decentralized exchanges (DEXs) are rampant. New projects often lure inexperienced users with promises of quick profits, only to disappear overnight in so-called "hacks" that are likely self-inflicted exploits. Binance itself has faced criticism for listing tokens from questionable projects and turning a blind eye to these practices.

Ethereum’s Silent Exploits

Ethereum has also seen numerous protocol exploits where users lost funds with little chance of recovery. Despite this, Ethereum's reputation remains largely intact. Why? Centralized exchanges (CEXs) and key opinion leaders (KOLs) often hold significant amounts of ETH, profiting from these incidents while avoiding criticism of the chain itself.

The Role of ETH Maximalists

Ethereum maximalists (ETH Maxis) frequently target emerging chains like Solana, highlighting minor flaws to undermine competition. This behavior stems from concerns over Ethereum’s stagnating development and lack of new revenue streams for holders. By discrediting rivals, ETH Maxis aim to protect Ethereum’s market dominance.

Broader Context: Security Trends

While EVM chains face scrutiny, it’s important to note that DeFi hacks overall declined by 63.7% in 2023 compared to previous years. However, vulnerabilities persist due to inadequate smart contract audits and poor security practices. Both EVM-based chains and other platforms like Solana remain popular targets due to their ability to execute smart contracts.

Key Challenges:

- On-Chain Vulnerabilities: Poorly designed or unaudited smart contracts.

- Off-Chain Risks: Compromised private keys and weak wallet security measures.

Moving Forward

The crypto ecosystem must prioritize robust security measures across all chains. While EVM chains may currently dominate headlines for exploits, no platform is immune. A balanced approach—focusing on education, security audits, and accountability—is essential for fostering trust in blockchain technology.