How To Get A Crypto Loan on TRON - JustLend

Hi all,

in our educational series on the TRON blockchain, we talk about what you can do with the TRX you earn for posting and curating on Steemit.

JustLend

JUST is a leader in the decentralized finance industry. One of their products is Justlend. A decentralized platform where you can supply crypto to earn interest or get a loan on your crypto.

In this post, we explain how to get a loan, how to supply your coins to earn interest, and what you can do with your loan.

JustLend - TRON's decentralized lending platform

Justlend can be accessed via the wallet Tronlink. In this wallet, you have full custody over your coins and it is highly recommended you have one. On the homepage of Justlend you can see all the coins you can supply, or get a loan for. Next to the ticker symbol, you also see in real-time the APY you earn on supply crypto and the borrow APY. Borrow APY is the percentage per year you have to pay if you get a crypto loan.

Supply crypto and earn interest

If you supply tokens, you earn interest in SUN tokens and the supplied asset. This will be automatically distributed to your wallet on regular basis.

Simply explained: You have for example 1000 TRX, you can provide this to the network so other people can borrow it. For doing so, you earn SUN tokens and a small percentage in TRX.

Getting a crypto loan.

When you have supplied your assets to the network, you can opt-in to use your assets (TRX, BTC, etc..) as collateral to borrow against. You can not borrow more than the actual net value of your assets. We call this an undercollateralized loan.

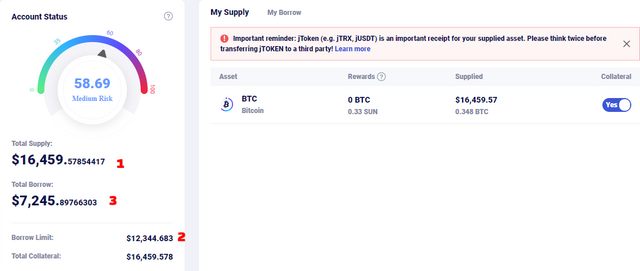

In the example, you see I have supplied 0.356 BTC, worth about $16450. (1) I can borrow a total amount of $12318 (2) and I have borrowed $7000 (3). (I borrowed 7000 USDJ to buy crypto) I do not recommend borrowing the maximum amount because you risk partial liquidation in case the price drops dramatically and below the Safe threshold. The Risk level for my account is 58. This means the price can drop 42% before a liquidation occurs.

In case of liquidation, the contract starts selling portions of your BTC until your Safe threshold is lower than 100. Unless you have paid back the loan or lowered the liquidation threshold. You can do this by paying back the loan partially or in full or supplying more collateral.

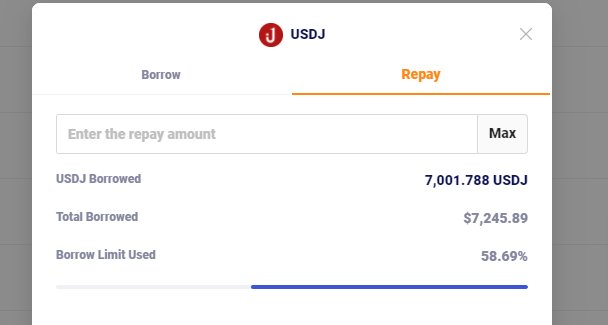

On this image, you see I have borrowed 7000USDJ. The interest I have to pay is in USDJ. So far, I have to pay 1.788 in interest.

Why getting a loan

There several reasons why you should take a loan on your crypto. The main reason is that you have more assets that can appreciate in value. Dollars, or any currency for that matter, become less valuable day by day. Having assets is your hedge against this inflation. So having more of it, makes complete sense.

You need money now. Times are hard, many people struggle these days. Some people might want to get a loan to pay for expenses. You can withdraw a portion of your supplied asset to pay back the loan later. Bitcoin and other assets will likely appreciate, so paying back later is possible with the gains of the supplied asset.

And you?

What would you do with a loan on your crypto? Was this information helpful? Do you have more questions? Do not hesitate to ask!

Useful links:

https://justlend.just.network/#/home

https://www.tronlink.org/

https://just.network/

Thank you for this information that the truth did not even know if this is true, but I love it because there is so much to know about the blockchain, shared.

I would buy a better car (secondhand) for my family as our old car isn't going to last much longer.

Thanks for sharing this post! I learnt something new today which is always a bonus.

DC 🙏 🎼

Muchas gracias por esta informacion, me parece interesante y tal vez la utilice muy pronto

very nice post

Congratulations

Muy buena información. Es bueno tenerlo presente

for those who want to explore DeFi I would say Justlend is a good starting point

Thanks for these interesting info.