Common misconception about crypto market✍️

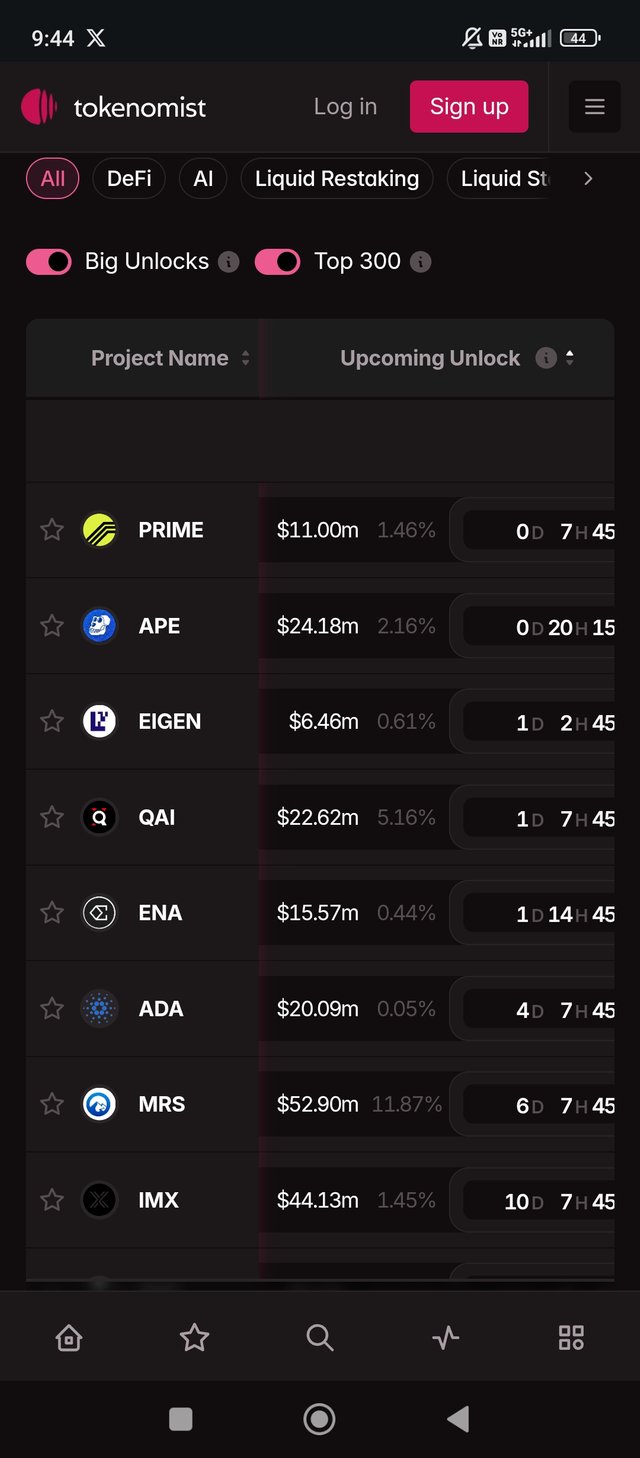

Good evening to all my friends. I hope you all are doing well. I am having a fantastic day. Bitcoin made new all time high today and niw trading above $106k which is huge. Today i am going to discuss about common misconception that makes investors exit their positions, especially during a bull market. This misconception is about dilution, which occurs when tokens are unlocked. In a bear market, when liquidity is low, unlocked tokens are often sold by investors, leading to a price drop. In contrast, during a bull market, investors usually prefer holding onto their tokens rather than selling them, so the price doesn't always fall despite token unlocking.

Many investors mistakenly sell their positions in a bull market, expecting a price dump after unlocking. However, this doesn't always happen because investors hold their tokens instead of selling. For example, the TIA project saw no price drop despite major unlocks because holders kept their tokens. In a bull market, token unlocking doesn’t necessarily lead to a price drop, and holding tokens helps maintain or even raise the price. In a bear market, however, selling unlocked tokens is usually beneficial to avoid further dilution. I hope you understood what i was trying to say. That's it for today. Thanks & have a good day!!