SLC-S21W5: How to Handle Amazon Taxes

Hello Friends,

Hey there! I’m Muhammad Ahmad from Pakistan, and I’m super excited to join the Engagement Challenge Contest hosted by @hamzayousafzai. I feel really lucky to be a part of this, as I’m eager to learn how to handle my Amazon taxes. Let’s jump

Find out the tax rates for self-employment income in your country. |

|---|

Step: 1 Finding Self-Employment Rates

I am from Pakistan and thus I have to find the Tax rates for self-employment, I am talking about the recent 2023 to 2024 tax rates. Listen If my income on Amazon is 400,000 then there is no Tax on me but if this amount increases like if my income is 400.001 then a specific amount of Tax will be applied to me which is 2.5%. But if my income is 600,001 then 12.5% of the tax will be applied to me. We have to clear all the taxes because it is very important because of the Taxable Earnings as discussed by our instructor too. Being an E-commerce like Amazon it is crucial to declare our income with Federal Board Revenue FBR.

Discuss whether Amazon Affiliate income qualifies for any deduction. |

|---|

Step: 2 Qualifying For Any Deduction

As we know Amazon-Affiliate income is taxable so it means that it qualifies for the Deduction. But a Question arises how will it or on what basis it would be deducted?

If you are generating traffic for your Amazon products through any website or Blog (Blogger) then the costs of the Website domain and maintenance etc would be deducted.

If you are advertising your Amazon Products on Google ads or any social Media Platforms then it would be deducted as Business Expenses.

It would be also deducted because there would be some consultants, and accountants to manage your Amazon Business Account.

Some of the parts of your electricity, rent, etc would also be deducted if you use your Amazon account from home. Etc

Describe the process of submitting a W-9 or W-8BEN form (based on your residency). |

|---|

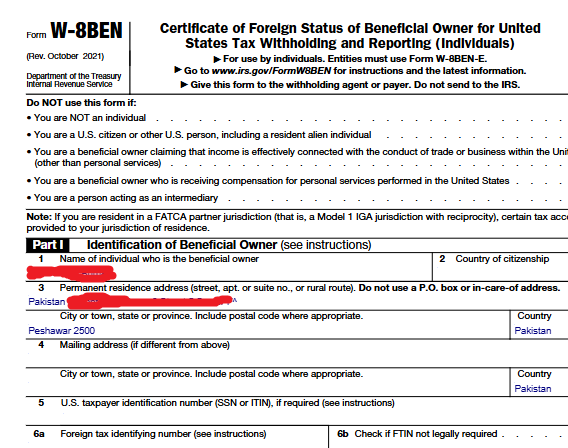

Step: 3 Submitting a W-8BEN Form

First of all, you have to download the W-8BEN Form from the official IRS website and then you should open it. It is a one-page form and you can even open it in your browser. Then after opening, you have to add your details.

- Full legal name.

- Your country.

- Add your complete and accurate address.

- Mention in which country you are.

- Sign and write a date and then once again check all the details.

- Now Submit your form.

Explain the process of filing taxes in your country using online portals if available. |

|---|

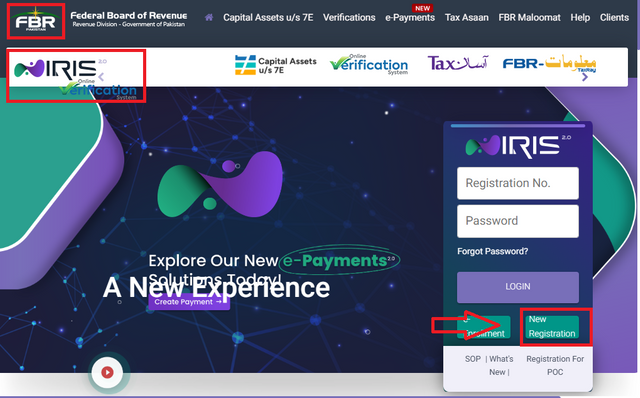

Step: 4 Tax Filling Method in Pakistan

For this, first of all, you have to visit the FBR official website. Now here you have to register yourself by adding your CNIC number and after the registration process. Shortly, you will receive a confirmation email.

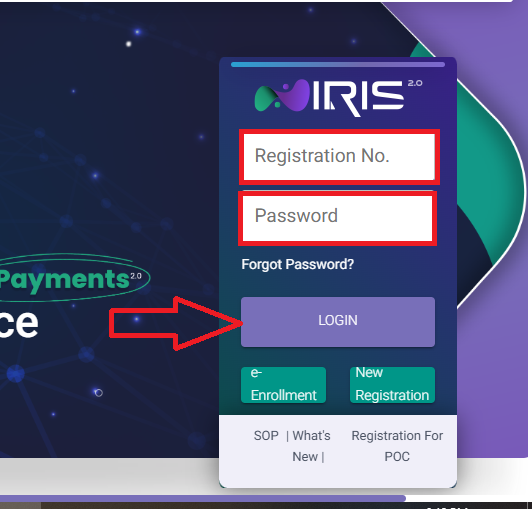

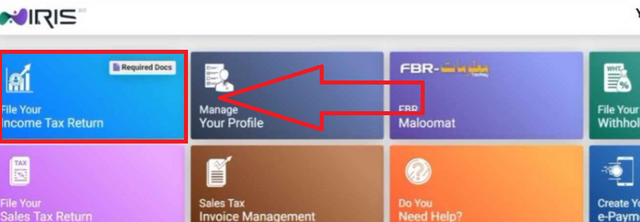

Step: 5 Login to IRIS Account

Now you have to log in to your IRIS account by simply entering your Registration number and password and then simply click on the Login and then you will be logged in to your account. Now you have to go to the Tax Section.

Step: 6 Filling Tax Form

Now we have to fill out the Tax form and here you have to provide the details of your income, deductions, etc. Also, use the FBR Tax Calculator and generate your Tax liability. Also, you have to add some more information.

Step: 7 Submitting Form

When you are done with the completion of the form, you have to check it again if there are any mistakes then fix them. Then submit this application. After submission, you will receive a receipt in your IRIS account.

Why is it important to manage taxes properly for online earnings? |

|---|

Step: 8 Importance of Tax management

◉ Managing the tax properly for online earnings is very important because it is very crucial to connect yourself with the law and avoid any kind of fines etc. When you earn online money then you have to comply with the tax rules and regulations. Paying taxes simply allows you to make deductions from Internet bills, electricity, and much more. Also by paying taxes, you can get loans or any kind of investment easily. Also on the international level by paying taxes you simply contribute to Hospitals, lifecares, ambulances, and much more. Also, you will be secured by paying taxes on time. This is all the importance according to me but the importance doesn't stop here.

Step: 9 What have I learned from This

◉ Honestly, I have learned a lot of things that can't be described in words I didn't know about taxes before but after this lecture, I acknowledged a lot of things about taxes. Like how to be registered with FBR and much more. I also came to know about the percentage of how much would be deducted from my income even though I did not know about this before. Now I have come to know that there is a tax on online money too which we earn and that tax goes from us in the form of money to the Government and they give this money to Hospitals and welfare for the betterment of the country.

✦ I am going to invite dear @chant @ruthjoe and @irawandedy to participate in this amazing Challenge. I hope that you all will participate in it.

Thank you very much for sharing your assignment task with us! We truly appreciate the time, effort, and creativity you have put into completing this assignment. Your dedication to following the guidelines and your commitment to learning are evident, and it’s a pleasure to see your progress.

Below are the evaluation results, highlighting the strengths of your post and any areas of focus for improvement:

Teacher Recommendation and Feedback!

Total | 8/10

1.45 SBD,

3.15 STEEM,

7.87 SP

Thank you for your review Sir. I will address your feedback and avoid mistakes in the next challenge. Kind regards.

0.01 SBD,

0.01 STEEM,

0.03 SP

You deserve my little thumbs up for taking your time in describing and explaining about tax in Amazon product. Though I don't know much about Amazon but from your description, it make me eager and curious to know more about about it. Talking about tax, I think as a citizen of a country we're expected to pay our tax before this small tokens are what the government use in provision the necessity to the people. Thank you for sharing.

Thank you so much brother that you have likely post and even tough you don't know much about tax.But after reading my post you get to know somewhat about Tax. Thank you so much brother.Best Regards