The POS Micro Fintech business in AkwaIbom State

pixelLab

pixelLab

POS: the Mini Bank Business

Looking back to the time before the year 2012 when the POS had not yet been introduced in Nigeria, a lot of Nigerians were still struggling to use their ATM cards on the Automated teller machine, the the struggling is still not over for some but a smart few who had this problems have left the ATM resulting in very few people in and around the banks.

Based on my observation, the bank staff with the highest load of work this days are those working as customer care attending to clients with challenges. Dispensing of cash was in the bank was drastically reduced with the introduction of automated teller machine though very few ATM could collect cash so we still had a less concentrated queue of people on the banks. The queue almost completely disappeared after 2012.

pixelLab

pixelLab

POS everywhere you are

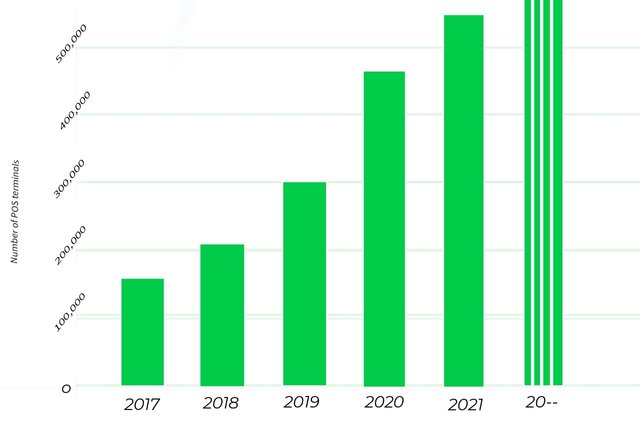

Why pay your way to the bank when you could have your money at a POS near you. Though introduced in the year 2012, the number of POS Business went up in 2017 according to a publication in Statista, by Doris Dokua Sasu a Research Expert who noted that the year "2017 had around 150 thousand POS terminals, while as of April 2021, the figure jumped to 542 thousand. And in recent years, the volume transactions conducted through the POS in Nigeria have experienced a great increase." Statista

Created with pixelLab with data from statista

Created with pixelLab with data from statista

Services Provided By POS

Locally, a POS is a small kiosk by the side of the road that provides financial services like

- Balance Enquiry.

The client want to know how much they currently have in their account regardless of the bank. - Cash deposit

The client here wants to pay some money into his bank account or that of someone else. This involves giving the POS operator the physical money then he will transfer its equivalent from his wallet to the specified account. - Cash Transfer

The client here wants to move Funds from their account to another account with no physical cash involved in the transaction - Cash withdrawal

The client here wants to move money electronically into the POS account and be given the equivalent amount in cash.

The ATM Business

What it Takes To Start

- To get this business started, you will have to conceive the idea and dwell on its potentials to succeed.

- Consider Identify a high foot traffic and a dense population away from ATM machines to site the POS kiosk.

- Make yourself available to manage the POS business or employ someone

- An arrangement with a POS supplier like opay or any bank

- You will also need the following

| Particular | Naira | Steem |

|---|---|---|

| A POS device | 30000 | 230.77 |

| Credit POS wallet | 30000 | 230.77 |

| Get POS Thermal Paper | 6000 | 46.15 |

| Build POS kiosk | 40000 | 307.69 |

| Logistics | 10000 | 76.92 |

| Total Amount | 116000 | 892.30 |

At the time of writing, Steem price was 130 Naira per Steem

Assuming we make a budget of 1000 Steem for this venture. taking into consideration the intense competition and risk involved. Just note this amount as required capital.

A simple Income Analysis

The POS sharge the following fees

| Amount Range | % Charge | income |

|---|---|---|

| 1 - 7.69 | 5% | 0.3845 |

| 8.46 - 15.38 | 10% | 0.77 |

| Per 76.92 | 10% | 0.77 |

This covers both deposit and withdrawal, in the case of a transfer the charge is multiplied by 2 and Ballance enquiry is free.

Let's say in a day we have a transaction of 5 thousend naira (38.46 Steem) across all the services once

| Transaction | Amount | POS Charge |

|---|---|---|

| 1 Balance enquiry | 38.46 | 0 |

| 1 Withdrawal | 38.46 | 3.85 |

| 1 Deposit | 38.46 | 3.85 |

| 1 Cash transfer | 38.46 | 7.7 |

| Toral | 15.4 |

15.4 which is very poor in a day multiplied by 25 days in a month will give us 385 Steem

In a three month of bad business we will have 385 x 3 = 1155 Steem

Meaning the budget capital of 1000 Steem can be recovered comfortably in 6 starting months with intence competition. Going by very rough estimation we should make 2310 Steems in 6 Months

Advantage

- The queue in the banks are taken away for clients

- The POS kiosk is still open by 8pm local time which favours both operator and clients

- They are all over the place which is good for the clints

- in the case of a failed or dishonest transaction, the transactions are well documented which is good for both client and operator.

- some banks do not charge for the day's first transaction. Which favours the POS operator

Challenges

- The Minimum requirement for starting

- They are constantly at risk of being Attack by robbers

- Operators are attacked by policies

- They are given huge taxes from revenue office

- we also have Fraudulent individual who often prey on the systems vulnerabilities

Conclusion

The POS business is here to stay providing valuable services to the public and income to the operators. Solving the problem of youth unimployment and poverty. It is a venture worth trying.

Fintech fbcrypto club57 steemexclusive nigeria finance

hello @bobwalter thank you for sharing your post in the steem entrepreneur community, have a nice day, friends.

Team verification results :

Note: You must enter the tag #fintech among the first 4 tags for your post to be reviewed.