PERCENTAGE RETURNS ASSOCIATED WITH APY AND STAKING IN CRYPTOASSETS

Author: @madridbg, through Power Point 2010, using public domain images. robiniaswap

Greetings and welcome dear readers to another installment associated with the world of cryptocurrencies and the performance that we can extract from these through staking and the mechanisms of the DeFi world. In this sense, in this opportunity we will focus our attention on the conceptual approach of some projects that have been managed and that present a high percentage of profitability, which assures us passive income over time.

The idea of writing about it, responds to certain questions that I have been raised on the subject of staking and as is well known this type of investment is considered a technique that consists of placing money in a fixed term and receive percentage returns according to the invested capital.

The capital we wish to invest, we place it in an exchange which will block the assets for a certain period of time, as we are referring to cryptoassets, our capital must be represented in the form of tokens or cryptocurrencies, which will ensure us returns on the investment made.

It is necessary to highlight that some Exchange establish time ranging from 15 days onwards, which implies that during this type we will not be able to withdraw our investment, so the returns will be received in the form of a conceptual approach called Annual percentage yield (APY), which represents the annual interest that we will receive for our contribution or investment.

Another aspect that every investor should be aware of is that APY levels are changeable so that they are directly proportional to the investment made and the number of days provided by the investment.

Among the elements that we must know and evaluate to develop this economic activity stand out:

* Identify the currencies or tokens in which we are willing to invest.

* Establish a time period for the investment, thinking about the return generated.

* Evaluate the levels or percentages of returns, the higher the better, although this is directly related to the acceptance of the project.

The volatility of the currency we will receive as a return is crucial and understanding it will allow us to assume the risk of the investment, so that if the price goes up or down it will have a positive or negative impact directly on the return we will receive.

Based on the above, currently currencies such as Polkadot (APY 18.34%), ARK (APY 5.19%) and XTZ (APY 9.15%) with some investment benchmarks from the Binance exchange that we can use to generate passive returns on investment.

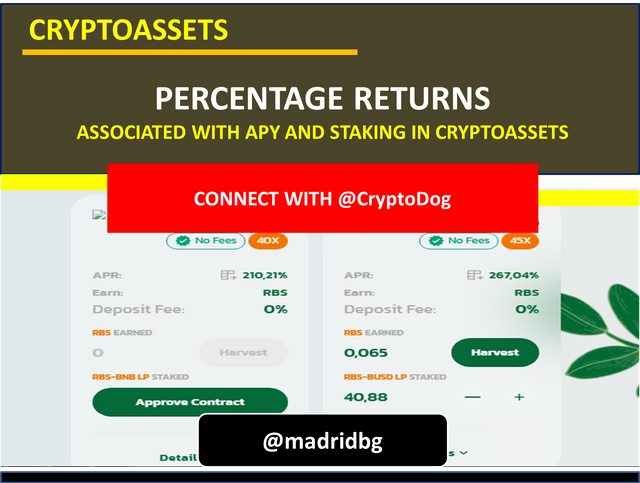

Now there are other possibilities to achieve this task, among these are the investments that can be carried out from the Robinia Swap Exchange where we can make token bets that exceed 200% APR or annual percentage return.

Among the Robinia investments that stand out the most are RBS (APR of 100%), MOON (APR of 234%), these related to liquidity pools. In relation to the FARM we can find interactions between the pairs RBS-BNB LP (APR of 209%), RBS-BUSD LP (APR of 267%), as well as MOON-BNB LP (APR of 378%).

As you can see we can find several ways to invest our capital and take advantage of our investments in the form of passive income, at this point I invite you to review the projects and make the choice that best suits what you are looking for.

OF INTEREST

•