Steemit Crypto Academy - Season II Week I by @kouba01|Cryptocurrency Contracts For Difference (CFDs) Trading

What is cryptocurrency CFD?

First of all I want to explain what CFD is. Contract for Difference (CFD). CFDs are platforms that enable the buying and selling of price expectations over the opening and closing prices of assets such as stocks, stock indices, commodities, FX contracts. There is no actual ownership of assets on these platforms. For example, you don't buy gold and resell it. You make a contract with the broker at the opening and closing price of the gold price. If the price is in the direction of your expectation, you will gain, if the price is out of your expectation, you will lose.

SourceSource Source: https://laptrinhx.com/news/the-smart-way-of-earning-money-from-bitcoin-without-buying-it-w1qZ4Qb/

Source: https://laptrinhx.com/news/the-smart-way-of-earning-money-from-bitcoin-without-buying-it-w1qZ4Qb/

Cryptocurrencies have become very popular after 2017. Most of the people living in the world know what cryptocurrencies are. Difference contracts platforms have included cryptocurrencies in their portfolios after cryptocurrencies became popular. It is the purchase and sale of crypto currencies on the difference agreement platforms at the opening and closing price without actually owning the crypto money.

In order to make a profit from a crypto currency in traditional crypto money exchanges, the price of the crypto money must increase. In crypto currency CFDs, you can make a profit without increasing the crypto currency price. As with leveraged trades, you can make two-way moves. You can choose for the rise and fall of crypto money.

How do I know if cryptocurrency CFDs are suitable for my trading strategy?

Cryptocurrency CFDs do not appeal to every trader. Inexperienced traders can make a profit by buying and selling on the spot sections of the exchanges during bull periods. Bearish periods are quite challenging for an inexperienced trader. Cryptocurrency CFDs are challenging in both bullish and bearish periods. You can earn a few times. Then you can lose all your winnings in one go.

* You should not open a trade with all your money to avoid losing all your earnings / money. It is ideal to open transactions with 10% of your money.

* Since the general trend is in a downward direction in bear periods, it is generally necessary to open a short position. There are sometimes strong rises during the bear periods. It is necessary to be able to estimate those times.

* Since the general trend is upward in bull periods, it is generally necessary to open a long position. There are sometimes sharp dips during bullish periods. In order not to lose your winnings, you should close your position after you have reached sufficient earnings.

* Before opening a position, it is necessary to closely follow all developments related to crypto money and all crypto money sector.

* It is sometimes very difficult to buy and secure crypto money on traditional exchanges. It may be necessary to go through various stages. You can make your transactions in crypto currency CFDs without owning crypto money.

* It is necessary to open a trade for short-term targets. Because you can lose more while waiting for more gains.

Are CFDs risky financial products?

Cryptocurrency CFDs are very risky. Reducing or increasing the risk is partly dependent on the users. Crypto currency CFDs are leveraged products. Opening high leverage will cause you to lose all your money. A small rise or fall in high leverage destroys your entire asset.

It is very difficult to predict crypto currency prices. It is an industry where there are many variables and where bear and bull supporters are in dispute. Even if you make good moves, you will suffer a hard aftermarket loss.

In crypto currency CDFs, transactions are usually made with popular cryptocurrencies. We should not open transactions on less popular cryptocurrencies, as prices of less popular cryptocurrencies are more easily manipulated.

Do all brokers offer cryptocurrency CFDs?

Cryptocurrency CDFs are not yet very advanced. It is difficult to find cryptocurrency difference contract platforms related to the unpopular cryptocurrencies. Popular cryptocurrency difference contract platforms are.

eToro: The most advanced in cryptocurrency difference contracts is eToro. eToro immediately stands out in this industry. It is one of the crypto money CFD platforms with its headquarters in Cyprus. You can trade with popular cryptocurrencies such as BTC, ETH, BCH, XRP, DASH, LTC, ADA, ETC, MIOTA.

Easymarkets: Its headquarters are in Cyprus. Crypto currency is one of the CFD platforms. We can make transactions with cryptocurrencies such as BTC, XRP, ETH, LTC, BCH, XLM.

Cmcmarkets: It serves cryptocurrencies such as Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Dash, Eos, Monero, Stellar. Trading hours on this platform are between 23:00 on Sunday and 21:00 on Friday.

Fpmarkets: We can transact with cryptocurrencies such as Bitcoin, Ethereum, XRP (Ripple), Bitcoin Cash and Litecoin. As with other platforms, it is not necessary to have a cryptocurrency wallet to make transactions.

Explain how you can trade with cryptocurrency CFDs on one of the brokers (Using a demo account).

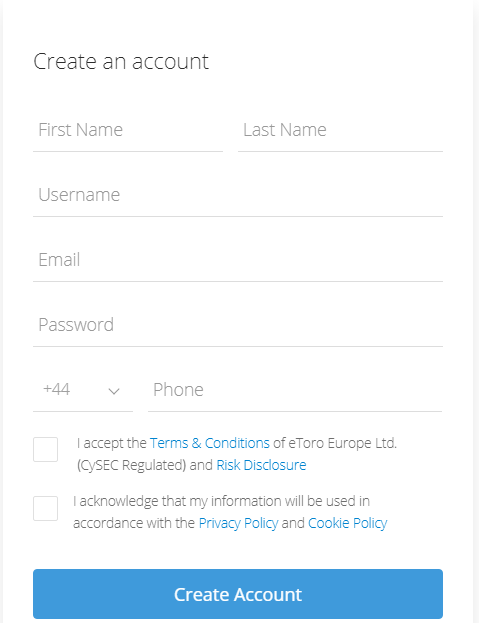

I will answer this question on the etoro platform. Having a demo account in crypto currency CFDs is an advantage for us. First to gain practicality.

Let's log in to etoro.com.

Click on Join now.

Let's write our name and surname.

Let's set a username

Let's write an e-mail address

Let's create a password

Let's write our phone number.

Let's accept the terms of the contract

After these transactions, we now have an account. If we are going to use our account in real terms, we must complete our profile information completely.

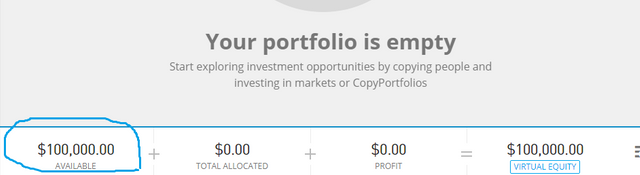

Currently our account is a real account. To switch to the demo account, we need to click on the place where it says REAL and change it with a virtual account. It is necessary to click on the warning that appears.

100,000 dollars for us to use initially. is given.

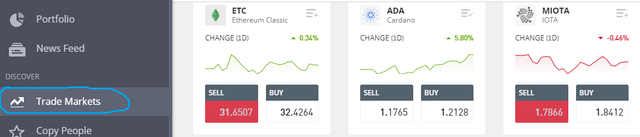

Click on Trade Markets to trade contracts for difference. If we click on the crypto section, we will switch to the crypto currency CDF transactions section.

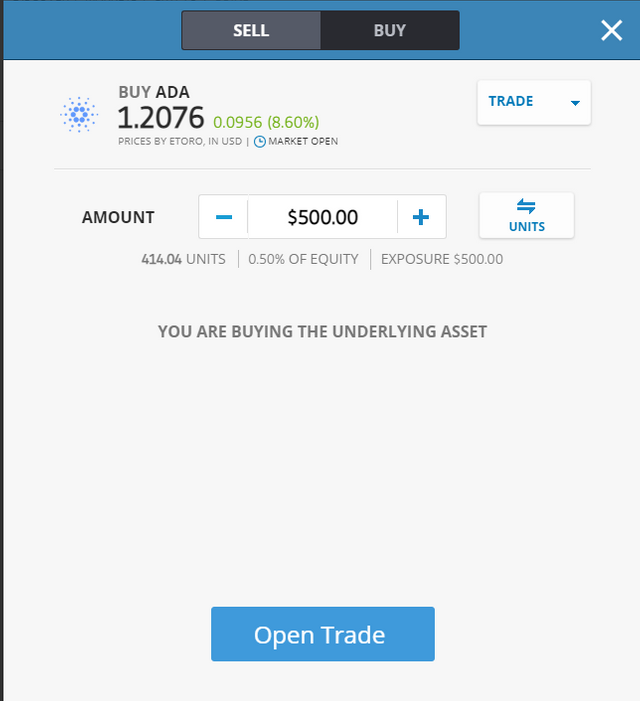

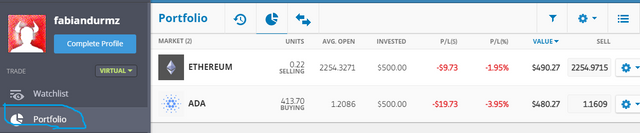

I took action towards the increase of ADA. The transaction amount is $ 500. If the ADA price rises, I make a profit, if the ADA price decreases, I lose. I click OPEN TRADE to confirm the transaction.

I am doing the same for ETH but this time for a sell position. The amount is again $ 500.

You need to click on the PORTFOLIO section to access the account statements. Details of transactions related to ADA and ETH are available. There are instant changes, instant profit and loss situation. After reaching sufficient profit, we must immediately close our position.

Hi @zonkork

Thanks for your participation in the Steemit Crypto Academy

Feedback

Good work. Well done with your research on CFDs

Homework task

7